A Deere World: Incentivizing Sustainability in Agriculture

With the agriculture community facing numerous conflicting threats, John Deere is positioned to offer integrated solutions that financially incentivizes environmentally-friendly agricultural practices.

Ag-gregating Challenges

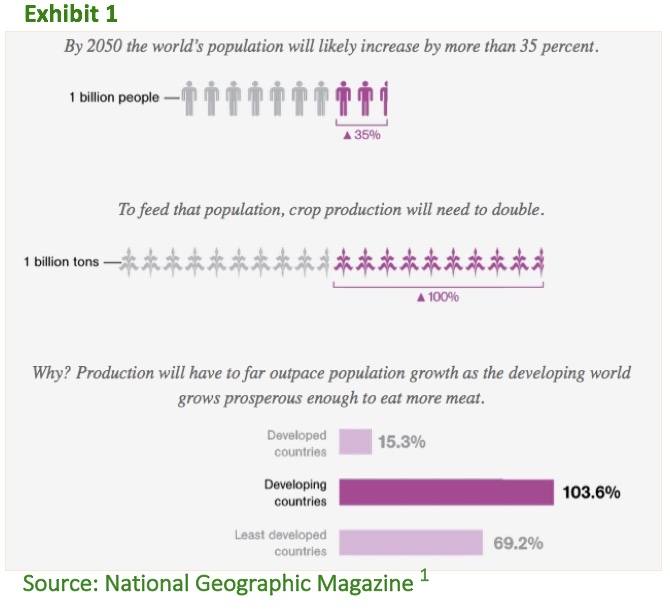

With the world’s population burgeoning to 9.8 billion by 2050 and the Earth experiencing unprecedented global warming, the agricultural sector is tasked with doubling food production, while reducing the use of emission generating chemicals that fuel crop productivity.1, 2 Though improvements in crop yields are widely viewed as the most attainable way to fulfill this increased food demand, climate change and the dilapidated state of arable lands have begun to challenge agricultural yields.2 According to a study by the Food and Agriculture Organization, a quarter of the world’s farmland is currently highly degraded from soil erosion, biodiversity loss, and water degradation due to current land management practices.3 Furthermore, the National Academy of Sciences estimates that each increase in the mean global temperature of 1˚ Celsius results in yield reductions of 7.4% for corn, 3.1% for soybeans, 3.2% for rice, and 6% for wheat—the four crops that collectively account for two-thirds of caloric intake.4 For the agricultural community to solve these conflicting obligations of needing to increase output while using less of the inputs required to do so, leadership in promoting environmentally friendly innovation will be required.

With the world’s population burgeoning to 9.8 billion by 2050 and the Earth experiencing unprecedented global warming, the agricultural sector is tasked with doubling food production, while reducing the use of emission generating chemicals that fuel crop productivity.1, 2 Though improvements in crop yields are widely viewed as the most attainable way to fulfill this increased food demand, climate change and the dilapidated state of arable lands have begun to challenge agricultural yields.2 According to a study by the Food and Agriculture Organization, a quarter of the world’s farmland is currently highly degraded from soil erosion, biodiversity loss, and water degradation due to current land management practices.3 Furthermore, the National Academy of Sciences estimates that each increase in the mean global temperature of 1˚ Celsius results in yield reductions of 7.4% for corn, 3.1% for soybeans, 3.2% for rice, and 6% for wheat—the four crops that collectively account for two-thirds of caloric intake.4 For the agricultural community to solve these conflicting obligations of needing to increase output while using less of the inputs required to do so, leadership in promoting environmentally friendly innovation will be required.

Farm Equipment… with a side of Environmental Leadership

Understanding the gravity of the challenges facing the agriculture sector, John Deere, the world’s largest manufacturer of agricultural equipment, has sought to become a leader in environmental stewardship. Focusing initially on its own operations, John Deere is in the midst of a 7-year project to achieve 15% reductions in greenhouse gas emissions, energy consumption, and water usage by 2018.5 While these initiatives are admirable progress, John Deere has also realized the opportunity that it has to make a much larger impact through offering environmentally friendly and innovative products to its worldwide customer base of farmers. Emphasizing sustainability during the development phase, John Deere is currently testing prototypes for the first zero-emission electric tractor, while also introducing smart tractor systems that accumulate data ranging from watering quantities to wind patterns.5,6 John Deere has helped usher in the era of big data in farming, and it will need to continue to play an active role as farmer-partners seek to synthesize and apply this new information into their decision-making processes.7

Understanding the gravity of the challenges facing the agriculture sector, John Deere, the world’s largest manufacturer of agricultural equipment, has sought to become a leader in environmental stewardship. Focusing initially on its own operations, John Deere is in the midst of a 7-year project to achieve 15% reductions in greenhouse gas emissions, energy consumption, and water usage by 2018.5 While these initiatives are admirable progress, John Deere has also realized the opportunity that it has to make a much larger impact through offering environmentally friendly and innovative products to its worldwide customer base of farmers. Emphasizing sustainability during the development phase, John Deere is currently testing prototypes for the first zero-emission electric tractor, while also introducing smart tractor systems that accumulate data ranging from watering quantities to wind patterns.5,6 John Deere has helped usher in the era of big data in farming, and it will need to continue to play an active role as farmer-partners seek to synthesize and apply this new information into their decision-making processes.7

Longer Term: A River of Opportunity

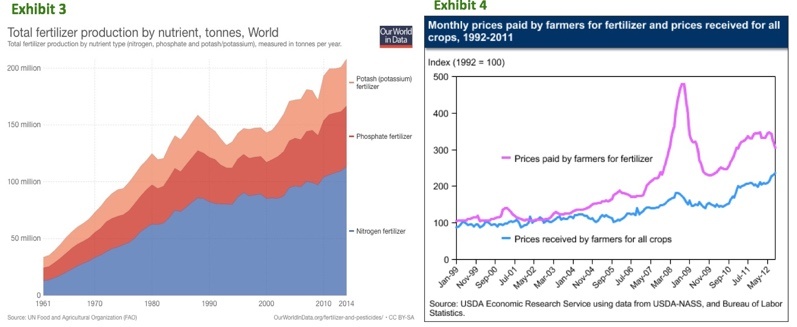

Entrenching itself further into the world of precision agriculture and eco-friendly innovation, John Deere’s recent purchase of Blue River Technology highlights a new area of opportunity for a large environmental and economic impact. Under current practices, agriculture accounts for 90% of total ground and surface water usage in the Western United States.8 In addition, fertilizer production has increased by over 400% since 1961, which has contributed to agriculture currently producing one-fifth of total global greenhouse gas emissions.9,10

In an era in which water supplies have become increasingly limited and costly and chemical price growth has outpaced crop prices (exhibit 4), John Deere has a unique opportunity to align long term environmental concerns with the short-term profit-maximizing motives of farmers.10 Acquired for $305 million in September of 2017, Blue River Technology utilizes machine learning and computer visioning attached to tractors and drones to manage crops at the individual plant level.11 Though its applications are currently limited to weed control in lettuce and cotton fields, Blue River has been able to reduce the usage of herbicides by 90% by targeting and dosing each plant rather than inefficiently spraying entire fields.11 Looking forward, John Deere should invest heavily to continue to expand this “See & Spray” technology into water and other chemical applications for a wider range of crops. Though farmers are notoriously slow to incorporate new technology, John Deere has the potential to encourage widespread adoption of environmentally friendly practices by helping farmers need less of the water and chemical inputs that drive up their costs.

Questions Crop Up

Facing daunting challenges in agriculture, John Deere appears to be uniquely positioned to develop integrated solutions that improve crop yields, reduce the need for water and chemicals, and reduce input cost for farmers. To do this, John Deere will need to partner with farmers to help them integrate new data from smart tractors into their decision making, while also committing to expand applications for precision ag technologies. As we sit at a critical moment, will John Deere will be able to successfully introduce “See and Spray” technologies into additional crops to reduce the need for chemicals on a larger scale? As a public company responsible to shareholders’ demands, will John Deere be able to adequately invest in innovations that could financially incentivize farmers to adopt more environmentally-friendly practices. Time will tell, but the future of agriculture may depend on its willingness to go John Deere Green.

Facing daunting challenges in agriculture, John Deere appears to be uniquely positioned to develop integrated solutions that improve crop yields, reduce the need for water and chemicals, and reduce input cost for farmers. To do this, John Deere will need to partner with farmers to help them integrate new data from smart tractors into their decision making, while also committing to expand applications for precision ag technologies. As we sit at a critical moment, will John Deere will be able to successfully introduce “See and Spray” technologies into additional crops to reduce the need for chemicals on a larger scale? As a public company responsible to shareholders’ demands, will John Deere be able to adequately invest in innovations that could financially incentivize farmers to adopt more environmentally-friendly practices. Time will tell, but the future of agriculture may depend on its willingness to go John Deere Green.

Words: 776

Bibliography

- Foley, J., Treat, J., & Mason, V. (2014, May 21). Feeding 9 Billion. National Geographic Magazine.

- How to Feed the World 2050. (October 2009). Food and Agriculture Organization of the United Nations: High Level Expert Forum. Retrieved from http://www.fao.org/fileadmin/templates/wsfs/docs/Issues_papers/HLEF2050_Global_Agriculture.pdf

- Diouf, J. (Ed.). (2011). The State of the World’s Land and Water Resources for Food and Agriculture. Food and Agriculture Organization of the United Nations. Retrieved from http://www.fao.org/docrep/017/i1688e/i1688e.pdf

- Temperature increase reduces global yields of major crops in four independent estimates

- Deere & Company. (2017). Environmental Stewardship[Press release]. Retrieved November 5, 2017, from https://www.deere.com/en/our-company/citizenship-and-sustainability/environmental-stewardship/

- Lambert, F. (2016, December 5). John Deere Unveils Latest All-Electric Prototype for Zero-Emission Agriculture. Retrieved from https://electrek.co/2016/12/05/john-deere-electric-tractor-prototype/

- Wolfert, S., Ge, L., Verdouw, C., & Bogaardt, M. (2017). Big Data in Smart Farming. Elsevier: Agricultural Systems,153, 69-80.

- Schaible, G., & Aillery, M. (2017). Irrigation & Water Use. United States Department of Agriculture: Economic Research Service. Retrieved from https://www.ers.usda.gov/topics/farm-practices-management/irrigation-water-use/background/.

- Max Roser and Hannah Ritchie (2017) – ‘Fertilizer and Pesticides’. Published online at OurWorldInData.org.Retrieved from: https://ourworldindata.org/fertilizer-and-pesticides/ [Online Resource]

- http://www.fao.org/3/a-i6132e.pdf

- Blue River Technology. (2017). Smart Machines [Press release]. Retrieved November 5, 2017, from http://www.bluerivertechnology.com

Bruce highlights some critically important issues in the links between precision agriculture and sustainability. The opportunity within the US to reduce agricultural waste and inefficiencies is huge, and there appears to be low hanging fruit as many practices have not evolved significantly with the times.

Having lived in California for much of the past decade, an area that is near and dear to me is water usage. In the US, most crops are watered through flood irrigation – the name says it all in terms of how efficient this method is for water consumption. Israel has pioneered drip irrigation, a significantly more efficient use of water in an extremely cost effective way (the technology is essentially holes drilled into PVC piping that is buried underground), but it remains largely out of use in the US [1]. A significant driver of this is farmers’ unwillingness to spend upfront capital on technology, despite demonstrated savings down the road. My question is, while Deere is developing sustainable products, how can we incentivize farmers to change their ways and implement solutions that are likely more expensive upfront?

1. Roth Schuster, “The Secret of Israel’s Water Miracle and How It Can Help a Thirsty World”, Haaretz, accessed November 2017, https://www.haaretz.com/israel-news/science/1.698275

This post paints a clear picture of the many challenges today’s agriculture industry must grapple with. These issues will continue to escalate with inaction as climate change drives down yields and arable land becomes more scarce.

As Bruce clearly articulates, John Deere is in a unique position to act and tangibly transform the industry. The development of precision agriculture technologies (even those that go beyond the tractor) are an excellent first step. [1] I presume they have an exceptionally broad network of relationships across the supply chain, and broad commercialization of technologies like what Blue River has to offer is extremely difficult without access to such networks and without the existing relationships and credibitliy that John Deere has to offer.

I think they can take this farther. To address Patrick’s critical question – how can we reduce the barrier to change for farmers – I believe John Deere could identify creative value-sharing arrangements that leverage their extensive capital (which farmers generally lack) to cover upfront capex of new technologies. The excess payoffs in 1) efficiency of resource usage and 2) increased yields could be shared between both parties.

To take it a step farther, John Deere could consider setting up an internal VC fund or new ventures group, as they are uniquely positioned to identify and act on key opportunity areas in agricultural technology. They have access to industry-wide data through Blue River that could be consolidated and analyzed to determine areas for cost reduction / efficiency improvement or identify trends in effectiveness of certain techniques based on geography, crop type, and more. By positioning themselves as a holistic solution-provider for farmers to cut costs and improve efficiency, they can both improve their own bottom line and enable broad-scale adoption of sustainable farming practices.

[1] https://www.forbes.com/sites/johncarpenter1/2017/03/13/the-old-john-deere-makes-way-for-new-tech-with-precision-farming-platforms/#326262d04bdb

Great article, Bruce! I completely agree that precision agriculture technologies will play a big part in reducing the environmental impact of agriculture and improving operations/profitability for growers.

A few years back, I worked with one of John Deere’s competitors on the issue of increasing adoption of precision agriculture. While adoption continues to rise, it remains below 25% for most technologies in most applications. Adoption rates vary widely by farm size, crop, and region. There are several reasons for slow adoption of technology that is—at least theoretically—positive NPV in the near term. Some of the reasons, of course, pertain to growers themselves. Surprisingly, the fragmented network of ag equipment dealers is, to some extent, restricting the adoption of equipment as well. Dealers often play a consultative and trusted role in helping growers navigate capital-intensive purchases and evaluate ever-changing technology.

For dealers, a recent survey shows the top three reasons for not selling precision ag equipment are [1]:

-Precision equipment changes too quickly and increases cost

-The fees charged for precision aren’t high enough

-Demonstrating value to growers is a problem

For growers, the top three reasons for non-adoption are [1]:

-Farm income pressure limits use of precision services

-Cost of precision services to customers greater than benefits

-Lack confidence in site-specific recommendations

Conversion will not be simple. John Deere must need a robust marketing plan to address concerns and painpoints across the supply chain. This may include communication and promotion, grower/dealer financing programs, long-term profitability analysis, grower/dealer training programs, etc. In the end, growers may be hesitant to adopt such technologies until they are in the midst of skyrocketing input costs—we are not quite there yet.

Also, it’s worth noting that John Deere won’t be alone in the fight to convert growers into precision agriculture customers—the competition will be steep. AGCO, DuPont, Syngenta, and others are racing to snap up agtech start-ups [2].

1. “Precision Farming Adoption Trends and Analysis.” CLIMMAR Congress. Purdue Agriculture. October 2016. Accessed November 2017. https://www.climmar.com/bestanden/artikelen/5/79_PRECISION_AGRICULTURAL_SERVICES_DEALERSHIP_SURVEY.pdf?1477120972

2. Johnson, Ben. “Is the Agtech Startup Boom Over?” PrecisionAg. November 13, 2017. Accessed November 29, 2017. http://www.precisionag.com/service-providers/is-the-agtech-startup-boom-over/

Thanks for the thoughts Bruce – it’s great to see what John Deere is doing to combat some important issues in agriculture. I wanted to expand on two important issues you raise: (1) that farmers are slow to change and (2) whether John Deere will be able to invest in innovations that financially incentivize farmers to adopt these new tools. As some of the (amazing) comments above have stated, it will be important to help farmers afford these new tools. Right now, per Grant’s comments, it doesn’t seem like there is enough incentive to switch out existing equipment beyond the moral/environmental argument, which does not seem to be working effectively. Wall Street will also likely have a tough time accepting any profitability losses that John Deere might take on in extending cheaper financing on these types of products than more traditional ones. The question then remains, how do we get farmers to adopt these innovative new products? Is there a player within Big Ag that is more suited to make these investments and upgrade farm equipment than the farmers themselves? Someone a la Ikea that is large and has a vested interest in making the supply chain more sustainable? I do not frankly understand Big Agriculture business well enough to know the answers to these questions, but it seems like we could include a more well-capitalized intermediary in this process to aid in making change.