6% of the world’s GDP under a survival of the fittest environment

The insurance industry is changing more drastically that perhaps ever before; insurance companies need to embrace digitalization in order to survive in this new brave world.

Need to digitize, fast!

During the 20th century many industries were forced to transform the way they served their customers (e.g. telecommunications, manufacturing). It had not been the case, until now, for the insurance industry which, arguably, has not changed its ethos since 1,000 BC.

Internal and external pressures have built in past years, obliging each company of this traditional brokered industry to reinvent the way they integrate their partners, information and resources to remain profitable. Since US$4.5Tn are at stake[1] (global GDP is US$75Tn), everyone is fiercely competing to adapt in this highly changing marketplace – and be able to survive. Nimble is and will be the new normal, and embracing and dominating the digitalization wave will be the only way to stay ‘normal’.

AXA, the French-based and 3rd largest insurer company in the world[2], has so far faced and understood the challenge. They know that if not prepared accordingly, the digital age will sweep them as the wave did with music, travel and publishing, and it is currently doing in banking.

Leveraging the ecosystem

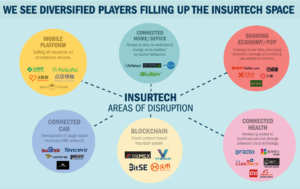

Anticipating this new brave world, AXA has built a strong innovative platform, to foster and boost potential opportunities for the business through Insurance-Tech startups: InsurTechs. The objective is to collaborate with them at every stage of their development, from scouting ideas to investing, and finally by building partnerships. AXA has made 37 partnerships and 24 investments around the world so far[3].

AXA

AXA

In just a few years, InsurTechs have disrupted the insurance ecosystem with innovation and new trends. For example, on-demand and micro-insurance, previously unthinkable due to the lack of information and difficulty in verifying insured assets, are now feasible. Customers now insure their bikes or cameras for particular periods of time (i.e. hours) through their smartphones. Some call it the Uber-ization of insurance, and AXA has partnered with Trōv, the first to launch it, to develop and enable this product in a global scale[4].

The (correct) use of information will be critical to increase the industry’s portfolio and adjust to its customer needs. For example, AXA has augmented its car products to leverage the use of information: pay-as-you-drive policies now satisfy infrequent drivers, and pay-how-you-drive policies help AXA improve margins on both low- and high-risk customers. AXA is also preparing to deal with the complexities and opportunities driven by Internet of Things (IoT). Connected devices will aid with the risk prevention initiatives of the company: e.g. alerting customers in their smartphones when there’s smoke in their kitchen. Partnerships with Phillips, Nest and Orange have driven these opportunities[5].

Complexity will keep increasing

If keeping up with the latter current trends is not sufficient, AXA will still be forced to face new challenges in the midterm. Embracing technologies such as Blockchain and Artificial Intelligence (AI), or even the continuous development of IoT, will be crucial to avoid falling from the digitalization wave.

IoT will further help insurers gain and process data from customers to prevent risks: wearables will anticipate customer’s health complications. Blockchain will change the way the industry operates by enabling to be more efficient, it will for example help verifying the client’s and asset’s data (e.g. health conditions, ownership history of a house). Additionally, among the changes AI will bring, it will facilitate the claims management processes, ending with customer’s frustration and improving the company’s margins[6].

Relentlessness is key

In the meantime, AXA should continue keeping up with, or even lead, the pace of the digital disruption in the industry. Besides innovating in new products, it should also foster innovations to cut its operating costs. During 2017, in average an insurer will incur in US$1.06 in cost for every US$1.00 in revenue during 2017[7], a margin that will only worsen as unpredictability and intensity in climate continues worsening. McKinsey estimates that automation can reduce the cost of a claims journey up to 30%[8].

To reduce costs, many insurers have focused on risk mitigation and claims management initiatives. For example, Munich Re (a reinsurer) has been using drones in affected areas to scout and assess damage and be able to offer real-time aid to people in need[9]. Furthermore, many InsurTechs are working in developing spare auto parts through 3D printing in order to reduce their sourcing cost significantly.

Digitization in insurance is an arms race. Companies that don’t find the correct set of partners in their supply chain, will be doomed to be obsolete.

The Digital Insurer

The Digital Insurer

A new Netflix vs. Blockbuster story?

This essay discussed how insurers are striving to jump in the digitization era. However, what if the wave kicks them away? Will some highly funded InsurTechs be able to overthrow the traditional insurers from their reign? After all, who will need a traditional car insurance policy in the era of driverless-cars…

BrainJet.com

BrainJet.com

(793 words)

Sources:

[1] EY, “Global Insurance Trends Analysis 2016”, published May, 2017, http://www.ey.com/Publication/vwLUAssets/ey-global-insurance-trends-analysis-2016/$File/ey-global-insurance-trends-analysis-2016.pdf

[2] Forbes, “2017 Global 2000: The World’s Largest Insurers”, published May 2017, https://www.forbes.com/sites/ashleaebeling/2017/05/24/2017-global-2000-the-worlds-largest-insurers/#7756dab44ec4

[3] https://group.axa.com/en/about-us/stories-innovation, accessed November 2017

[4] Business Insider, “AXA partners with Silicon Valley startup Trov to launch insurance ‘as simple as Tinder’ for British millennials”, published November 2016, http://www.businessinsider.com/axa-insurance-startup-trov-uk-millennials-insurtech-tinder-airbnb-2016-11, accessed November 2017

[5] https://group.axa.com/en/spotlight/story/home-insurance-of-the-future, accessed November 2017

[6] Forbes, “How Artificial Intelligence Will Impact The Insurance Industry”, published July 2017, https://www.forbes.com/sites/blakemorgan/2017/07/25/how-artificial-intelligence-will-impact-the-insurance-industry/#2dce32ff6531, accessed November 2017

[7] Fortune, “From Monte Carlo, Insurers’ View of the Impact of Irma and Harvey Is Surprisingly Rosy”, published September 2017, http://fortune.com/2017/09/11/from-monte-carlo-insurers-view-of-the-impact-of-irma-and-harvey-is-surprisingly-rosy, accessed November 2017

[8] McKinsey, “Digital disruption in insurance: Cutting through the noise”, published March 2017, https://www.mckinsey.com/~/media/McKinsey/Industries/Financial%20Services/Our%20Insights/Time%20for%20insurance%20companies%20to%20face%20digital%20reality/Digital-disruption-in-Insurance.ashx

[9] Institute of International Finance (IIF), “Innovation in Insurance: How the Technolosgy is Changing the Industry”, published September 2016, https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=0ahUKEwjT0JTQ9MHXAhVJ9IMKHb7ZC1cQFggrMAA&url=https%3A%2F%2Fwww.iif.com%2Fsystem%2Ffiles%2F32370132_insurance_innovation_report_2016.pdf&usg=AOvVaw2uUCkJrNf1U0_TFrnuxRsn

Thanks so much for the article! I had not previously thought about digitization in the insurance industry or InsurTech, so I appreciate the new perspective on how digitization can be applied to personal finance. One very interesting example of the rise of microinsurance you mention is being done by a Swedish-founded company called BIMA, which is looking to expand microinsurance to the developing market. BIMA allows low-income customers in developing markets to transmit very small payments through their mobile phones in exchange for life insurance [1]. This capability has unlocked an entire new segment in the insurance market that had previously been excluded due to low incomes and lack of accessibility [1].

I am curious what other changes we will see to the insurance landscape as a result of digitization. Based on your article and the information I found about BIMA, it seems like the barrier to consumer entry into insurance has been lowered, and I wonder how that will affect the insurance landscape, particularly for the large players that currently dominate the market.

[1] Williams-Grut, Oscar. “This Swedish Startup Brings Insurance to 24 Million People in the Developing World through Their Mobiles.” Business Insider. Business Insider, 22 Oct. 2016. Web. 01 Dec. 2017. .

Fascinating article covering a topic that we don’t normally see in the context of digital revolutions.

I think a critical dimension of your question is just how far the digital transformation will reach into insurance companies. Can blockchain and its guarantees of property or transaction history eliminate or substantially reduce the underwriting effort required for an average policy? If so, then I think you are correct: the insurance tech startups are likely to claim an ever larger part of the market given their highly democratized usage and low cost structure. If not, it’s anyone’s game.

I further suspect that the future also depends heavily on the type of insurance a company sells. My impression is that consumer insurance (eg health, auto, etc.) is becoming commoditized, especially in the post-GEICO insurance world. A standard-ish contract should be sufficient for nearly any customer, meaning that digital could conceivably cut out the agents, brokers, and underwriters. Medium, large, and enterprise business accounts, however, likely require a degree of specialization and human review that a computer cannot perform–assessing complex risk models, estimating fair values, etc. Thus I suspect that the business and premium ends of the insurance market will not die, as it would be difficult for a machine to make those assessments or arbitrate more complex claims.

Either way, I think we can agree that brokers and agents are exiting quickly as the internet levels the information field. Thank you for the insight into how this industry is changing!