A healthy use of data, or an unhealthy breach of privacy?

Health insurance plans meet user data – but is such use of our data a healthy development for society?

Link to article

What is Vitality?

Vitality Health is a data-driven health insurance service that adjusts health insurance premiums based on members opting into using health monitoring technology (such as wearables), which tracks and monitors them against their health goals. By collecting user data from wearable technology (such as Fitbits), Vitality Health is one of the first insurance companies to reward people for adopting healthier living habits. In this blog post, I discuss the potential merits of the service, as well as why Vitality may require us to pause and consider causes for concern.

How does it work?

Vitality Health monitors members’ lifestyle behaviors, such as smoking, alcohol consumption, and eating habits, which is informed by regular syncing of biometric readings (which includes weight, blood pressure, and cholesterol levels). This data is then translated into a “Vitality Age” (in the US, 79% of people surveyed have a higher Vitality Age than their actual age).

After one’s starting “Vitality Age” is calculated, Vitality will create “Personal Pathway Plans” to improve users’ scores. Vitality not only provides resources and information for members to improve their lifestyles, but also partners with gyms and health clubs to help members progress and improve their scores.

Business model and design features

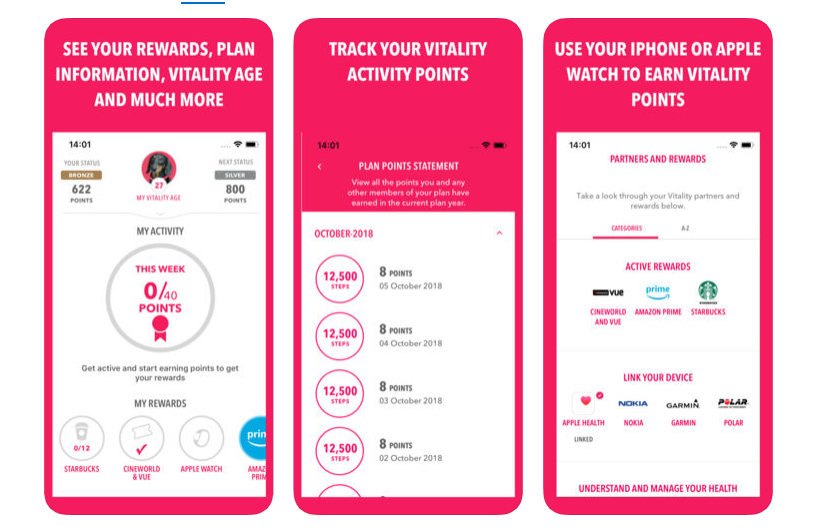

Today, the Vitality Activity Rewards system is used by 5 million people globally. The gamified user experience, with built-in “micro goals” and associated rewards, motivates users to maintain and improve healthy behaviors and lifestyles. The company claims this has led to a reduced hospital admission costs as well as shorter hospital stays.

Vitality gamifies the health insurance by offering “Vitality Points” for healthier behavior. Go to a Vitality partner gym and work out – you’ve just earned Vitality Points. These points can then be redeemed for gift certificates from Vitality’s Partners, which provide offerings such as deliveries of healthy food. Vitality informs such design features through the company’s research in behavioral economics to provide its members with a “gamified approach” to keep them motivated. To users, Vitality positions its service as a “personalized wellness journey” that rewards engagement and “creates long-term behavior change”.

In additional to individual users, Vitality markets its solutions to employers looking to improve the health of their employees, and also markets its program as a more custom-tailored, cost-effective health insurance plan. Vitality also draws retail partner into its orbit by cross-promoting their offerings to improve members’ “Vitality Age”.

Disrupting a classic market of information asymmetry and moral hazard

The insurance provider market has always been the classic case of asymmetric information and moral hazard; insurance companies have traditionally had difficultly pricing insurance premiums appropriately since they had imperfect information on individuals’ health. But with the steady progress of health monitoring technology, companies such as Vitality are making inroads in offering UBI (user-based insurance), which can not only microsegment insurance premiums at the individual-level, but also dynamically adjust insurance premiums based on a daily feed of health tracking data.

Privacy concerns and personal views

In principle, this could be a win-win; users could be getting better premiums for their health insurance, Vitality can price more appropriately, healthier lifestyles can be encouraged, and aggregate societal medical expenses may be reduced. But what are we giving up in return? To reap the benefits, users must give up their most intimate data – i.e. their health data.

How should we feel about companies monetizing our data in this way? While the evidence certainly seems to suggest that Vitality is helping its users achieve healthier lifestyles, my personal view is that we need to exercise caution with respect to the data we allow companies to monetize; it is not difficult to imagine the potential repercussions of a data breach that compromises millions of users’ health data. Even in the absence of a data breach, at a more fundamental level I find unsettling the proposition of health data being monetized to feed Vitality’s ecosystem of retail partners. What’s your view?

Sources

[1] “This Health Insurance Company Tracks Customers’ Exercise And Eating Habits Using Big Data And IoT”, https://www.forbes.com/sites/bernardmarr/2019/05/27/this-health-insurance-company-tracks-customers-exercise-and-eating-habits-using-big-data-and-iot/#6a4dd32d6ef3. Accessed April 13, 2020.

[2] “Why Vitality?” https://www.vitalitygroup.com/whyvitality/ Accessed April 13, 2020.

[3] “Vitality – Insights” https://www.vitalitygroup.com/insights/ Accessed April 13, 2020.

Thanks for sharing this company – we talk a lot about how wearables could slot into health insurance, but this is my first time seeing this company!

I share your concerns about privacy and data monetization, but even if Vitality could provide a perfect solution to these concerns, I still wouldn’t be sold on the concept. To implement, one of two things has to happen: 1) employers (who are the insurance gatekeepers in the U.S.) would have to require utilization, which is an egregious breach of personal freedoms that is neither legal in the U.S. nor ethical; or 2) employers would allow employees to opt in or out, and eventually the employees who decide to opt out for one reason or another will face artificially-inflated premiums since they will become the “market for lemons” and their insurance could become unaffordable.

A very interesting company! I have studied usage-based insurance in the context of auto insurance before, but I didn’t know that it was already coming to health care.

My question is: To what extent does the general public understand the way in which “Vitality Age” is calculated?

For Vitality to achieve mass-market adoption in the United States, I think most Americans would need to believe that their “Vitality Age” is legitimate. If they aren’t confident in its accuracy, then they will just discount the score, which could lead to one of two bad (for the company) outcomes: (1) they refuse to start using Vitality’s insurance in the first place, or (2) they engage in less healthy behavior. (If you don’t really buy the score you’ve been given, why not eat that extra doughnut?)

Of course, we’ve talked in class about the challenge of attempting to explain calculations to non-experts. I wonder how Vitality approaches this challenge.

Interesting model. I’ve always wondered though if this approach runs the risk of fundamentally breaking the core principles behind insurance. By rewarding super users who are already motivated and able to improve their fitness with lower health premiums (even through non-cash rebates), you are in principle increasing costs for individuals who may have pre-existing health conditions that prevent them from being fully healthy.

I wrestle with this one personally, especially given that over the course of my life I’ve been in both camps, a healthy and fitness-motivated potential super user and an individual afflicted by a chronic pre-existing health condition