ROI for Department of Strategy, Business Development & Outreach

Roswell Park Cancer Institute (RPCI) in Buffalo, NY is America’s first cancer center founded in 1898 by Dr. Roswell Park. It is the only upstate New York facility to hold the National Cancer Institute (NCI) designation of “comprehensive cancer center”. RPCI became a Public Benefit Corporation (PBC) pursuant to legislation in 1999. Prior to that, RPCI was part of the New York State Department of Health (NYSDOH). Becoming a PBC has provided the benefit of administrative autonomy while maintaining substantial financial support from New York State.

In the past four years, RPCI has undergone major growth, including the creation of a new department entitled Strategy, Business Development and Outreach. This department has increased RPCI’s presence through practice acquisitions, both local and international joint venture opportunities and strategic partnerships with other local hospital systems. How does the business development office best measure or demonstrate the return on investment to the Senior Leadership team of the hospital?

He Sunita,

Interesting case! My first question would be if when starting the department there is kind of a strategy (|even mission/vision) document being set up by involved stakeholders. Normally this would include the ‘desired’ and ‘shared’ ambition from stakeholders? I can imagine that one of the aims is more and better strategic partnership leading to financial an qualitative improvement?

Derived form this shared ambition, together you would be able to define a few ‘themes/areas’ where improved performance is expected and in those theme’s together with your shareholders you could qualify and quantify KPI’s. And after regularly measure, share and manage ofcourse. Areas that could apply to a strategy and bizz development team could be (a bit Balanced Scorecard inspired:):

– financial improvements (KPI’s like revenues, subsidiaries/sponsorships?),

– market and/or client improvements (visibility, market share, PR/better customer and stakeholders feeling with your company, …),

– employers improvements (stronger brand, more possibilities for working on cross boundary projects, education etc)

– innovation (new technologys entrance by partnerships, etc)

– quality of products/services (…)

During the first 2 to 3 years of a new department which is not in core business from company but facilitates the company to perform better, my experience is that KPI’s are kind of qualitative and work very well if put together with stakeholders. ROI then is hard to quantify, but after a few years, performance improvement due to the acquisitions and collaborations should be measurable? it will be easer to quantify them?

Hi Sunita,

I’d like to add a (very) practical point of view to Jen’s comprehensive, undeniable and only right answer.

Can you ask with every new acquisition, partnership, etc, to make an estimate of all the kinds of benefit from RPCI’s point of view ? For example in terms of the dimensions that Jen suggested earlier. And then validate / measure it after 12 months and then file it and make it a part of a yearly report.

Or make a (semi-)standardised quaestionnaire to inventory the opinion of the most important stakeholders about the benefits of acquisitions, joint ventures and partnerships

It is not very sophisticated, but it is easy to implement and gives at least something whereas now, as I understand, there is nothing.

Hi Sunita,

In my experience working for private equity in the Dutch healthcare sector we have similar challenges participating in acquistions, strategic partnerships etc. For matters of governance and span of control and consolidation we always aim for a majority stake in new or acquired ventures. we started off some years ago we had quite the learning curve. In the acquistion projects we go through a pretty standard M&A process. However, we collaborate with our board early in the process and have a very transparant process. With this we construct 3 business cases; conservative, management & best case. In the conservative case we do not include any synergies in the numbers (upswing in turnover, cost savings etc.). As you describe, RoI in JV’s, acquisitions usually goes beyond the numbers so we would explain ‘soft’ RoI’s like ‘strategic knowledge’, ‘market power’ etc. in our rational memo’s. When going through our internal approval processes we include the conservative case and our soft rational and discuss it with our board. One of things we learned is not to incorporate synergies in the business case as projected true benefits. This makes for a rather conservative positive Business case, but if the numbers are right in these scenario’s, the rest is the upswing. When we incooperate business we review the original business case to challenge the assumptions we made prior to engaging in these projects, this creates much of our learning curve. i’d be happy to talk some more on this topic during next module.

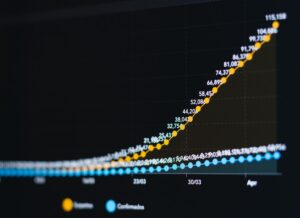

Great question. We are also growing very rapidly and have a very aggressive business development and partnership growth strategy. We measure the value of the work in a variety of ways – at the system level we look at margin growth from partnerships, growth in patient base, $ generated from solutions provided to partners, etc.

However, evaluating partnerships at the system level does not give you the full picture of the VALUE of each partnership so we have created a partnership value dashboard. This dashboard include almost 100 metrics for each facility that role up into what we call our TOP 20 value metrics. These are a combination of quality, operational, financial and synergy metrics. In the dashboard we measure the value of the partnership for both organizations compared to benchmark and combine it for a shared Value. Value indicators include core quality measures like RAMI, ECRI & HCAPs , physicians recruited to the market, discharges, visits, surgeries, % change in transfers to and from both facilities, gains/losses in operating income, service line consolidation synergies and synergy savings in areas like supply chain, IS, rev cycle, EMR. Quantifying the value at this level is critical to the long-term sustainability of the partnership as all parties want to know what they are getting out of it.

Metric Benchmark

1 RAMI ≤ 0.70

2 ECRI ≤ 0.65

3 HCAHPS Overall Rating %ile 65th

4 New MDs Recruited to Market 12% growth YOY

7 Discharges 4% growth YOY

8 Visits 6% growth YOY

9 IP and OP Surgeries 7% growth YOY

10 Transfers from Partner to OHS 10% growth YOY

11 % Total Transfers to OHS Facility YOY Improvement

12 Telemed Consults YOY Improvement

13 Total JOA Income YOY Improvement

14 OHS JOA IS Impact YOY Improvement

15 Partner JOA IS Impact YOY Improvement

16 Productive FTEs per AOB varies

17 Supply Cost per Adj. Discharge varies

18 Total Value to Partner YOY Improvement

19 Total Value to OHS YOY Improvement

20 Total Value of Partnership YOY Improvement

I think the maths should be fairly straight forward for RPCI.

Simply look at the present value of discounted cash flows of the RPCI for 10 years (without the new businesses added, local and international joint ventures, and strategic partnerships) – i.e had the department not existed, and then compare that with the current i.e with all the new ventures bolted on. The difference is the incremental value created by the team !

From the incremental value if you reduce the opex cost of the department, that should simply tell you how valuable the function is.

Or simply incremental revenue X gross margins attributable to the new ventures (less Opex cost of the department) should be good enough.

it is important that these numbers are regularly compiled and reported otherwise the value of such functions go unnoticed !