Developing a Strategy for Women’s Health Ambulatory Practices while facing the Threat of a Private Equity Company

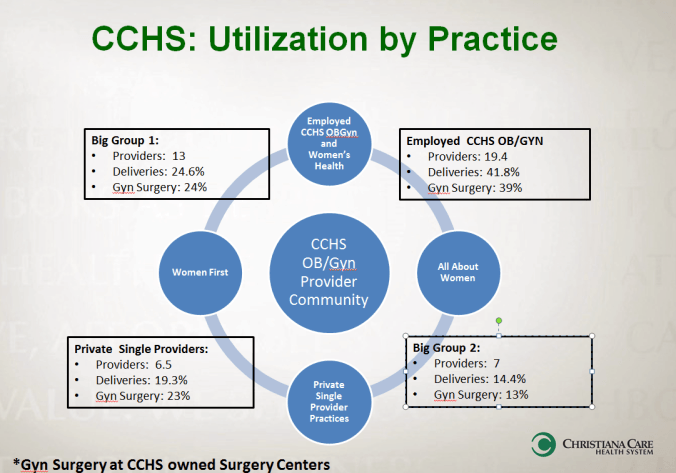

Distribution of ob/gyn volumes by provider groups

Background: Recently I have become the clinical lead of 8 existing employed women’s health practices under a broader medical group as part of my health system. These practices include both general women’s health care and subspecialty care (e.g. urogynecology, minimally invasive surgery, etc). The challenges of this role have piqued due to planned acquisitions of 3 private practices and negotiations are ongoing with several other private single providers. The acquisition of these practices is integral to retain the patient base that is served by our hospital. This spate of activity is the direct result of the challenges of private practice, an aging workforce and the recent threat of a large private equity corporation seeking to purchase private practices. The financial interest of the private equity corporation is to obtain scale, negotiate with insurers and take the profitable outpatient surgicenter/lab/imaging referrals to an owned consortium. Currently this private equity company is negotiating with the two largest provider groups that represent 39% of deliveries and 37% of surgical care. Some independent providers remain. Finally, we will complete an 8 story maternity tower in 2020. Though our only regional competition is a small independent hospital that delivers a 10th of the number of babies that our system does, we recognize that to support this facility in an era of declining births, we need to provide access to women’s healthcare in what have traditionally been secondary markets.

The currently owned practices are diverse in both what they do and the populations serve. Philosophically the medical group system is committed to serving all of our neighbors. Prior oversight of the employed practices has largely consisted of managing Joint Commission regulations and human resource management of staff. Medical leadership has largely been absent and operational philosophy/efficiency and monitoring of financial performance has been ignored. In contrast, the integrating private practices are largely marked by strong clinical leaders, whose salaries were contingent upon maximal efficiency and were based on a volume model of care. Compounding the issue is negotiating models of care that are built on outcomes and not volume beginning with shared savings programs and bundles of care.

Statement of Questions: To address these complex circumstances the following questions emerge about what our ambulatory strategy should be:

- Should we look to organize and grow existing practices that have historically been underperforming by developing key drivers and incentives? If so how do we deal with the complexities of serving diverse consumers? What would you view to be the key drivers in this group to be?

- How should one approach integrating private providers with a very different care model?

- Should we look to competitively acquire practices as they may not be a fit in the current model?

- Should we concentrate on developing new practices in secondary markets?

- Do we counter the private equities offer to Big Group 1& 2-knowing they may not be a philosophical fit with the organization or the concept of bundled care?Business by groups