D-Risking Capital Projects through Machine Learning

Our Vision – To transform oil, gas and energy projects through the power of digitization and data analytics

Our Goal

To optimize energy project outcomes by identifying and prioritizing factors that reduce complexity and uncertainty through digitization, data analytics, and consolidation of industry best practices.

Business Context

Managing large-scale projects predictably and consistently has always been a major challenge. In today’s world of enhanced data access, and digital transformation, competition among firms has drastically increased while barriers to entry have been significantly lowered across multiple industries.

Major oil & gas capital projects are subject to this phenomenon and it is clear that traditional oil and gas companies must modify perspectives and methods of providing energy to the world. Companies that do not heed this trend seem less likely to survive looming financial and reputational consequences. With this in mind, a number of International Oil Companies (IOCs) have already begun the energy transition and those that haven’t, are strategizing about how best to meet the Paris Accord, at least partially. A key driver of this movement is a growing shareholder demand for reduced environmental impact associated with energy generation, particularly given evident changes in climate and weather patterns.

This context sets a scene of increased competition across existing medium and large energy producers where organizations like Amazon, Microsoft, and Google have already initiated their energy divisions. High Volatility, Uncertainty, Complexity, and Ambiguity (VUCA) projects have become ‘The New Normal’ and organizations that do not capitalize on digitalization, data management, and analytics to augment their processes removing human bottlenecks, are likely to fall behind.

This context sets a scene of increased competition across existing medium and large energy producers where organizations like Amazon, Microsoft, and Google have already initiated their energy divisions. High Volatility, Uncertainty, Complexity, and Ambiguity (VUCA) projects have become ‘The New Normal’ and organizations that do not capitalize on digitalization, data management, and analytics to augment their processes removing human bottlenecks, are likely to fall behind.

Crimson Data Analytics can grab market share by leveraging subject matter expertise, digitization, and data analytics to build predictive models that enhance the probability of successful outcomes on VUCA projects across the energy industry.

The Problem

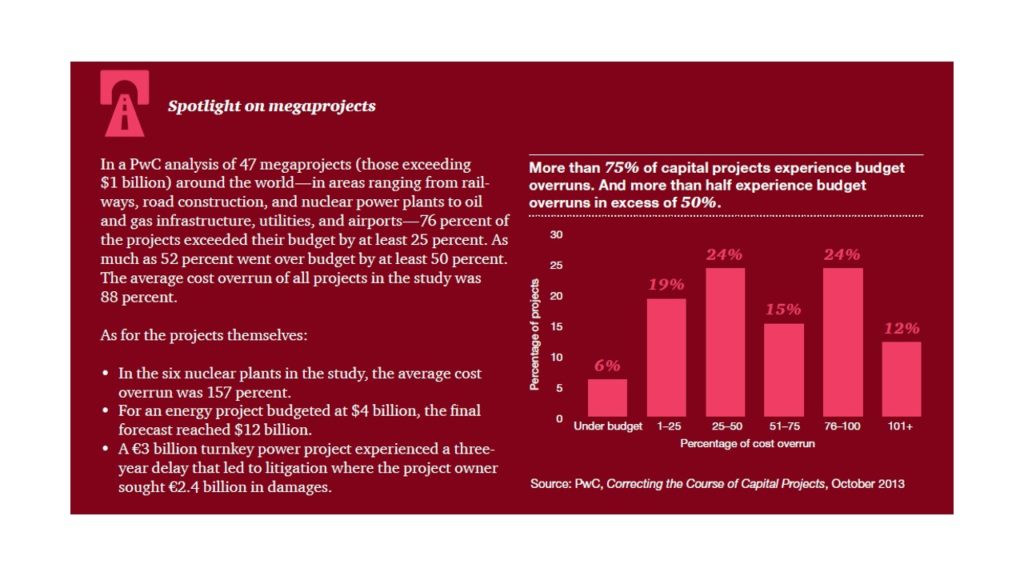

Major oil and gas projects generally possess high volatility due to geopolitical, environmental, and other commercial-impacting factors that do not precisely and predictably present themselves. PriceWaterhouseCoopers (PwC) conducted an analysis of major projects (2013) in Oil & Gas and concluded that more than 75% of capital projects experience significant budget overruns.  Like many of the problems being solved in online retail and healthcare through machine learning, digitalization and analytics present a clear and present opportunity to enhance risk assessment and predictive analysis techniques used in the Oil & Gas industry.

Like many of the problems being solved in online retail and healthcare through machine learning, digitalization and analytics present a clear and present opportunity to enhance risk assessment and predictive analysis techniques used in the Oil & Gas industry.

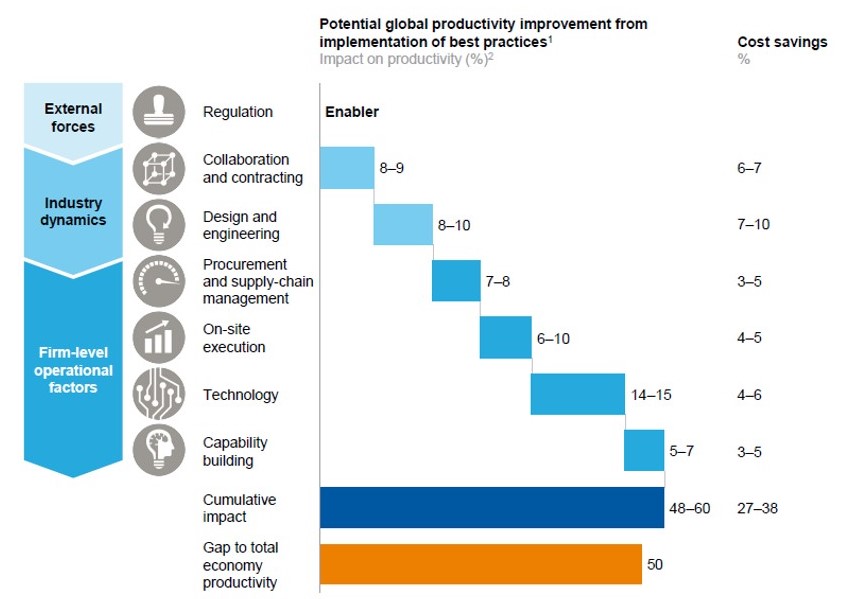

A McKinsey Global Institute analysis indicates that the construction industry, as a whole, has not universally applied basic efficiency-enhancing approaches including technology application. McKinsey calculates potential productivity gains through the implementation of digital solutions and agile, best practices at 48% to 60% with cost savings of 27% to 38%.

Our Solution

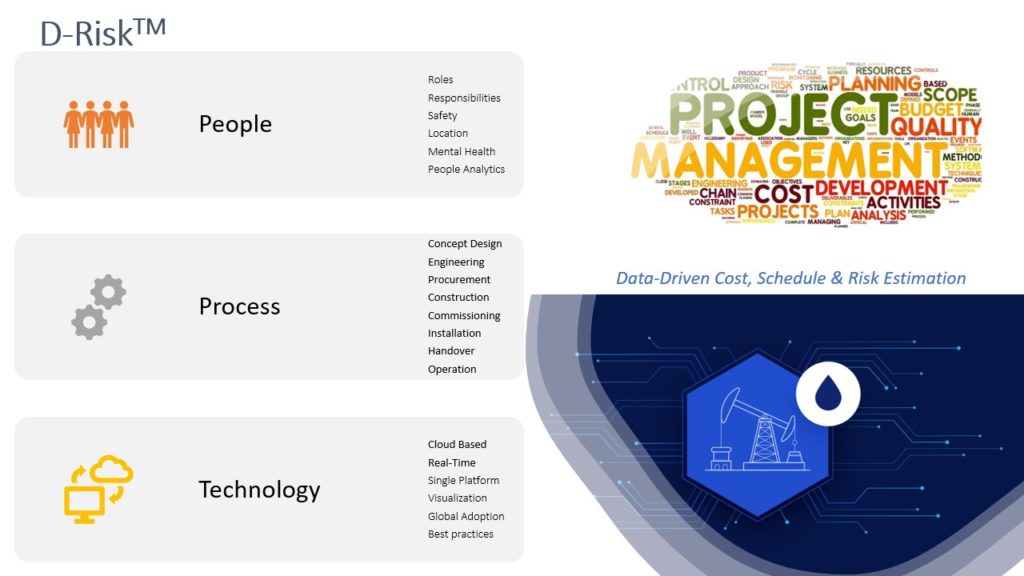

D-Risk ™ is a cloud-based, software tool intended to drive the digital transformation of the oil and gas industry driving data-driven identification and prioritization of factors impacting project success. Through data analysis, modeling, and implementation of machine learning, the product is expected to highlight negatively impacting factors especially those that have been overlooked by common analysis. Digitization, data analytics, and machine learning applied across this industry will create and capture value that leads to reduced cost overruns.

The product will focus on the digitalization, analysis, and visualization of data related to People, Processes, and Technology using agile best practices that are fit-for-purpose and promote successful project delivery.

People

D-Risk ™ uniquely provides a combined technical and management transformation solution to teams working remotely. With real-time visualization of personnel location, for example, safety through geo-location and other people analytics tools, provide a more connected and proactive view to physical safety and mental health. Because activity can be matched to personnel through known roles and responsibilities, risk exposure periods can be clearly visualized by management and colleagues creating transparent methods of monitoring fatigue levels, and overall safety particularly prior to and during the high-risk activity potentially avoiding near-misses and accidents.

Process

D-Risk ™ focuses on the project lifecycle from Concept Design through to handover and Operation. Each of these project stages possesses traditional methods that, digitized, will bring greater transparency, efficiency, agility, and risk reduction. Analysis of each stage can create a data storyboard that helps decipher risk factors and optimize processes to mitigate negative outcomes realization.

Technology

Digital is being tested by oil and gas operators based on the successes of companies like Amazon, Google, and even Walmart. While the industry is not known as a fast mover in the IT space, the time has come to capture business value at scale through strategic prioritization of digitization and data analytics. Traditional project management techniques, especially in this technical space, design and develop paper/chalkboard solutions with the wisdom and guidance of the most experienced person in the room. Our plan is to create value through the sorting and analysis of relevant data to create a step-change in available and usable data. D-Risk ™ is being developed with automation and algorithms that eliminate efficiency blockers as primary objectives of a single platform where project solutions simultaneously meet industry needs and society’s environmental expectations.

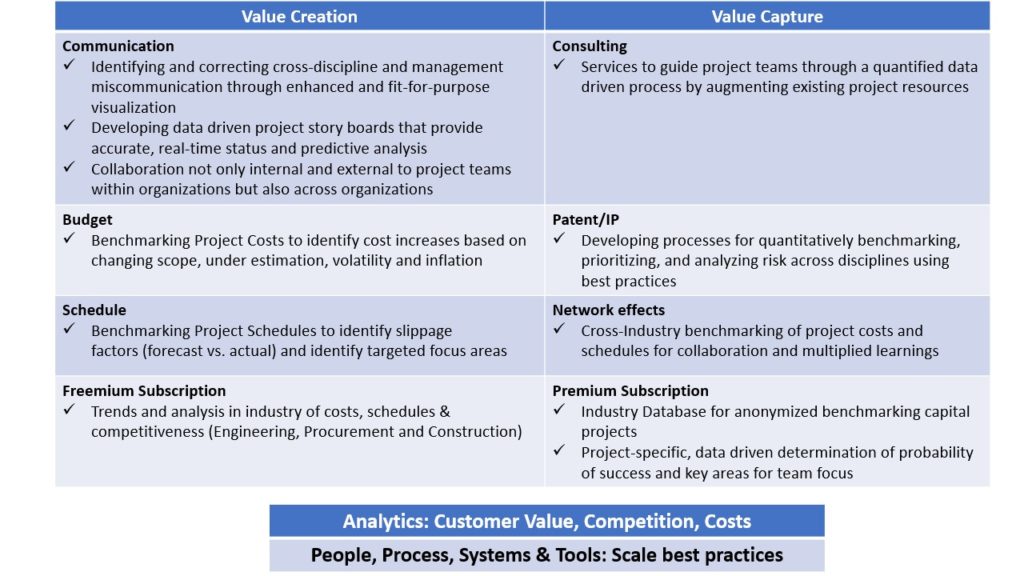

Business Model

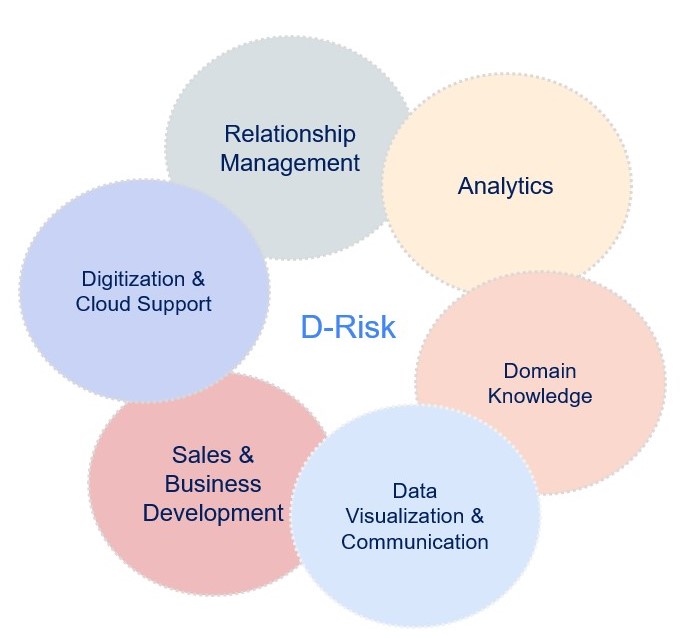

Our objectives are clear – we will work with subject matter experts, project organizations, technical groups, and project teams to develop a cloud-based product that enables collaboration, agility, and accurate predictive models. D-Risk ™ will enhance all areas of the project lifecycle applying best practices that tackle the root cause of observed inefficiencies. Our expectation is to build a collaborative team in each of these areas to build our product to meet our client, partner, and industry expectations.

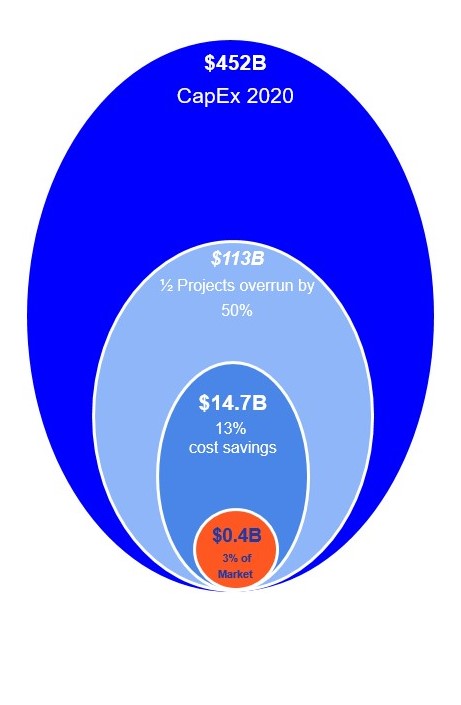

Extensive research and a focus on bringing innovation, technology, and consistent implementation of best practices to the industry, indicate that targets of a 24% increase on productivity and project performance and a 13% average cost savings on major projects using our product versus  traditional estimating and risk management methods are attainable. The figure above illustrates the expected 2020 capital expenditure, based on reported sanction projects across the industry ($452B) and a conservative estimate using PwC’s analysis of at least half of major projects are overrun by 50% or more, the expected over-runs for 2020 projects is in the range of $113B. With our targeted cost reduction of about 13%, D-Risk has the potential to minimize 2020 losses by about $14.7B and if our solution were to gain 3% of this market share over the average project lifecycle time of four years, our potential impact is $0.4B on 2020 major projects alone.

traditional estimating and risk management methods are attainable. The figure above illustrates the expected 2020 capital expenditure, based on reported sanction projects across the industry ($452B) and a conservative estimate using PwC’s analysis of at least half of major projects are overrun by 50% or more, the expected over-runs for 2020 projects is in the range of $113B. With our targeted cost reduction of about 13%, D-Risk has the potential to minimize 2020 losses by about $14.7B and if our solution were to gain 3% of this market share over the average project lifecycle time of four years, our potential impact is $0.4B on 2020 major projects alone.

With respect to potential revenue, a McKinsey article, The New Normal: How disruption is reshaping the world’s largest ecosystem states,

“A $265 billion annual profit pool awaits disrupters. A value chain delivering approximately $11 trillion of global value-added and $1.5 trillion of global profit pools looks set for overhaul. In a scenario based on analysis and expert interviews by asset class, strongly affected segments could have a staggering 40 to 45 percent of incumbent value added at risk, even when the economic fallout from COVID-19 abates”

Our Clients & Partners

Our product’s key value is the compilation of data across disciplines to include smart connectivity across disciplines, functions, and activities effectively displacing siloed organizational architectures. D-Risk ™, therefore, is expected to change the way the industry identifies and applies data needed to assess and mitigate risks particularly those associated with greater volatility, uncertainty, and complexity. Through strategic relationships, our database will bring value through enhanced productivity and reduced costs.

Another targeted leverage point is relationship building with consultancy firms (PwC, McKinsey, WoodMac) that already possess access to major industry players where our services can be provided as an added value to their suite of services.

It should remain clear that D-Risk ™ is not expected to replace subject matter experts and their expertise, but to centralize their knowledge, optimize and augment them. With this in mind, we have already initiated partnerships with subject matter experts for testing model outcomes and feasibility against real-world expectations and experience.

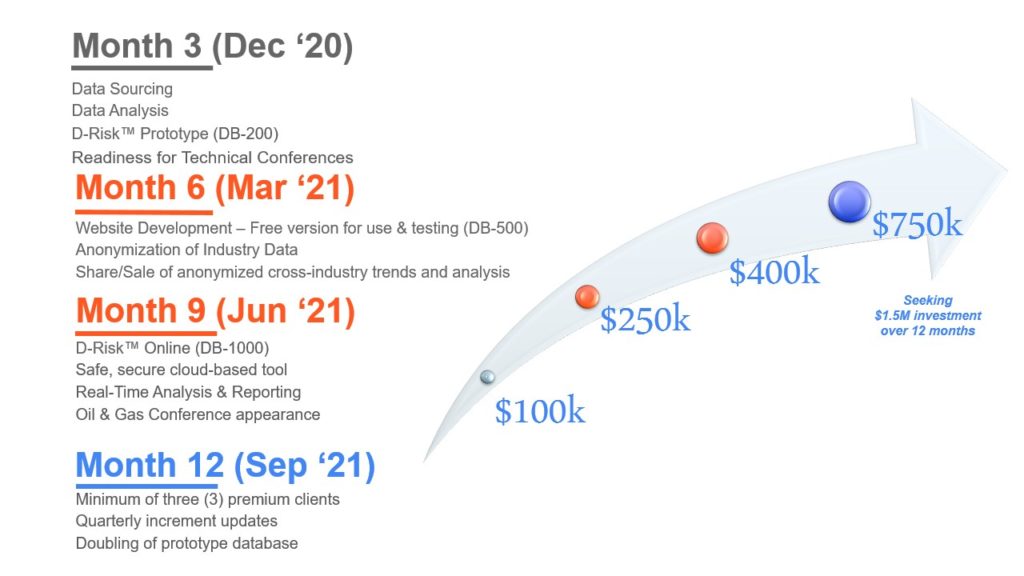

Investment Timeline

To progress D-Risk ™ to the point of client readiness, an investment of $1.5M is required over 12 months with quarterly monetary injections targeted from Q4 2020 into 2021. Database development has already begun, and during Q4 2020, our objective is to build prototype DB-200, a database of 200 industry projects. Our cost estimate for these activities (data scraping, partnership, and prototype development) is $100k.

Website development, beta testing, sharing, and provision of anonymized trends and analyses through a Freemium offering is targeted from Month 6 with the intent building product awareness, and leveraging network effects to obtain feedback on the platform’s robustness.

By Month 9, additional personnel to aid product refinement and architecture as determined during the first two phases of product development. By Month 12, platform ‘go-live’ with a minimum of three client organizations licensed to utilize the platform throughout their project teams and/or organizations is targeted.

Opportunities to Scale

D-Risk ™ possesses strong scaling opportunities since the construction industry, in general, faces a significant productivity problem. Increased project, logistics, and site complexity, along with increasing lack of transparency, siloed operations, ineffective contractual arrangements, and underinvestment in digitalization and innovation are some of the root causes of sub-optimal project delivery. D-Risk ™ aims to address each of these causes. At the activity level, there are many similarities across industries that design and execute major projects. This software product and its platform approach to collaboration and connecting disciplines and promotion of data-driven analysis will readily scale to create and capture value across multiple large industry segments. The primary reason for starting with oil and gas project risk reduction is due to researched and acknowledged under-performance in the segment, our team’s access to subject matter experts, and a well-described digital gap in an industry that drives our society’s way of life. Our team believes that building D-Risk ™ around oil and gas projects as part of our first phase of development will help illustrate the positive impact data analysis and machine learning can have on this industry and build a reputation that allows our team to readily expand into project solutions that benefit other industry sectors and our world.