Coin: Secure Mobile and Online Payments for Small and Medium Enterprises on the Blockchain

Secure Mobile and Online Payments for Small and Medium Enterprises on the Blockchain

With the digital divide continuing to grow many minority-owned small and medium enterprises (SMEs) are missing out on major technical developments that could help their businesses grow. This is especially true in the financial technology (FinTech) space. Many minority-owned SMEs could benefit from recent technologies such as cashless payments and blockchain technology but it appears that not many of the technology companies focus on marketing to or solving the problems of minority-owned SME. As a solution we propose a decentralized payment solution that will benefit minority SMEs and their communities by providing a way for them to accept both mobile and online payments from smartphone, tablet or desktop devices. This payment system will consist of stablecoin (C-coin) that will be used as a store of value, a private blockchain network and distributed ledger (Coin Network) used to verify and settle transactions and a mobile wallet that can accept and receive payments (Coin Pay) over the distributed network.

The Problem Coin Attempts to Solve

Mainly small SMEs do not accept credit and debit cards for payment because it is too expensive to do so. The current payment ecosystem consisting of banks, payment processors and credit card companies often choose not to focus on this demographic since it does not represent a significant portion of its bottom line. Even newer entrants to the space, like Square, tend to focus their advertising, sales and product developments efforts on SMEs that aren’t operated by minority owners or are in minority neighborhoods. Many minority-owned SMEs are traditionally cash-based businesses and the owners may not see the need to process payments electronically since their cash-based system has been working for so long.

However, during a survey conducted by Coin, once informed about the benefits of a low cost electronic payment system merchants expressed an interest in signing for a platform such as coin if it would help them gain more customers and sell goods and services online if the cost was low. A major selling point of the platform as the ability to sell online with little to no effort. Many SMEs do not have an online presence and miss on potential sales as a result. Coin attempts to address this issue by allowing merchants to place their goods and services online so that they can be purchased by their customers online. We believe that by providing a robust payment system that is meant to address the challenges with running a minority-owned small business will help these businesses transition to a digital payments system at low cost and with low risk.

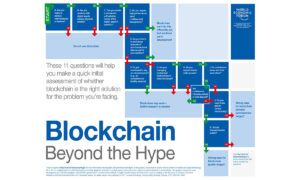

A Brief Introduction to Bitcoin for Decentralized Payments

In 2009 Satoshi Nakamoto released a white paper about a radical new way to transfer funds by using a cryptocurrency called Bitcoin. Bitcoin was described as a digital asset that had no backing, no intrinsic value and no centralized issuer or authority. Payments using Bitcoin are made between two parties without the need of a third-party by using a technology called the blockchain, which can be thought of as an immutable ledger that contains payment transactions.

The blockchain leverages a network of connected computers that maintain a local copy of it and its transactions. When a new transaction occurs or is changed at least half of the computers on the network have to verify it otherwise it would be rejected. In order for new transactions to be recorded, a new block must be created to store them. Blocks become available when computers on the network use their computing power to solve a complex cryptographic problem in an activity referred to as mining. If a computer solves the problem it is awarded a payment in Bitcoin and more Bitcoin is created. The system increases or decreases the difficulty of the problem to keep the average time of creating a new block to roughly ten minutes. Blocks of transactions are chained together in the order they are created, hence the name blockchain.

Cryptocurrencies such as Bitcoin appreciate in value as the underlying platform achieves critical mass (i.e. more users making payments with Bitcoin and more developers developing its technology). This value is correlated with the direct network effects (users using Bitcoin to pay for goods and services) and indirect network effects (users benefiting from the amount of developers developing for the Bitcoin ecosystem) present on the platform.

Ethereum and Smart Contracts

In 2013 a new blockchain-based technology emerged when Russian-Canadian programmer, Vitalik Buterin, released a white paper describing a new blockchain-powered platform called Ethereum [4]. Ethereum differed from Bitcoin in that anyone could create their own contracts to govern how transactions occur on its blockchain. These “smart contracts” could be programmed using a programming language called Solidity and could be deployed to and enforced on any Ethereum network. This allows its blockchain technology to be applied to virtually any problem that a developer can write a smart contract for. Ethereum also differs from Bitcoin in that it uses a different algorithm for creating blocks to store transactions. Its cryptocurrency is called Ether.

The Ethereum Ecosystem

The ecosystem that drives blockchain technologies usually consists of users and developers. In the spirit of decentralization most development is open source and the source code of popular blockchain technologies, including Etehereum, are freely available to view and download online. The success of a blockchain-based platform is dependent on the number of users that are willing to use the technology as well as the number of developers that are developing technology for the platform and its ecosystem. Incentives are distributed to participants via tokens, which are cryptocurrencies that represent the value of the underlying blockchain technology. As a blockchain technology becomes more popular the value of its token is expected to increase.

Although Ethereum presents a viable framework to build blockchain-powered software it is not without its flaws. For example, Ethereum is known to be vulnerable to security threats introduced by its Solidity programming language. However, companies such as OpenZepplin have emerged in the ecosystem to provide secure, production-ready and easily extensible smart contracts for popular use cases such as making and receiving payments.

The Coin Network

The Coin Network is an Ethereum Blockchain based system that uses custom smart contracts and the Quorum consensus model to settle and verify transactions. Nodes on the network are the computers and mobile devices that merchants and customers use to buy and sell goods and services. When a transaction is made it is written to the Coin general ledger after it has been verified by a majority of nodes on the network. This works very much like the Ethereum mainnet with the difference between being that most participants have to be invited to join the Coin network. This is the case for merchants, who must be vetted by the Coin platform while customers can freely sign up but can only transact with merchants (i.e. customers cannot sell goods and services to each other). Payments are made with a stablecoin (C-Coin), which can be used to pay for goods and services, gifted to other users or exchanged for U.S. dollars. C-coin and its benefits are briefly described in the next section.

C-Coin

The primary store of value within the Coin Network is C-Coin, which is Coin’s proprietary ERC20 token that is pegged to the value of the US Dollar. In other words, one unit of coin will always be exchanged 1-for-1 with the dollar in all cases. This makes C-Coin a stable coin that is used primarily for storing value for the purposes of validating transactions. The aim is for C-Coin to act as a prepaid debit card or giftcard that can be loaded with funds from the users’ wallets and used to pay for goods and services provided by a network of merchants on the platform. Users of the platform will receive rewards and benefits as an extra incentive to use and promote the platform.

Coin Pay Wallet

A token and decentralized payment network are as strong as the wallet that is provided to perform and manage transactions. Within the Coin ecosystem the Coin Pay Wallet fills this void. It is a native application that can be downloaded to a merchant or customer’s mobile device or loaded in a webpage and used to pay for goods and services. Each merchant has the ability to display its goods and services in the mobile app or on a web page that is powered by the Coin Network. A customer can make a purchase by simply logging into his or her device and checking out on the Coin Pay Wallet on his or her mobile device or from a web browser. This will allow customers that wish to support their local businesses during the Covid pandemic to do so remotely.

In order for a merchant to sign up for a merchant account it must provide its EIN number, which must be verified by Coin. This allows Coin to know its customers and prevent the likelihood of bad actors joining the platform. Users of the platform can sign up freely by providing whatever information they choose from a list of optional fields that Coin uses to train its fraud detection models. However, since users are prevented from exchanging C-coin with each other and can only use Coin to purchase goods and services from merchants, the amount of bad actors on the consumer side is also reduced.

Privacy

Privacy is at the forefront of the Coin Pay Wallet. Coin Pay is unique in that users on both the merchant and customer ends can view their payment transactions and metadata associated with the transaction but personal details (on the customer side) are obscured. The merchants payment history will detail metadata such as the time, amount, items or services purchased and whatever additional information provided by the customer but no personal details (name, address, age, phone number) are ever given to the merchant. Privacy is baked into the platform from the start and users have full control over the data that is shared with the default options sharing the least amount of information with Coin and merchants on the platform.

Security

For any payments solution security is of the utmost importance. The Coin system addresses this in several ways. 1) The blockchain provides a level of security in that transactions are private and cannot be traced back to a user, 2) smart contracts enforce the rules associated with how payments are verified and cleared, 3) sensitive user information stored in the cloud is encrypted 4) state-of-the-art machine learning algorithms are used to help detect fraudulent transactions in real-time during the time of the transaction, 5) there is a limit to how much a user can have in his or Coin wallet at any given time. This system provides five layers of defense outside against fraud in the system.

Inherent Security from the BlockChain and Smart Contracts

Transactions can only happen between two parties, who know nothing about each other’s identities on the chain. In order for a transaction to clear a hashed token, which only lives the participants devices must be provided. This token does not live in the cloud and is unknown to Coin. The rules of the transaction are enforced by smart contracts, which cannot be changed once deployed the the Coin Network.

Encrypted Data in the Cloud

Coin does store some information about its users on its servers, which includes highly obscured information that is anonymized and used for data analytics. This information consists of the type of merchant, the city it operates in, how long it has been in existence, transaction volume and other payment related information. For customers we track information such as the sex of the customer, age range, zipcode, transaction volume and shopping preferecnes. This information is used to drive forecasts and power the Coin recommendations and promotions engines. If an attacker were to gain access to the system it would be very difficult to trace individual transactions back to individual users since all sensitive data that is stored is encrypted.

Using Machine Learning to Detect Fraud

Coin plans to use autoencoders and other state of the art machine learning techniques to detect fraudulent transactions at transaction time. These models are trained offline and the updates are pushed to each user’s device removing the need for users to update their apps when a new version of the model is ready. The model is used in real-time to analyze the current transaction against the users historical purchase history and that of similar users and merchants.

Limitations on Wallet Amounts

During our research we also learned that most payments tend to fall under $25 for the SMEs we plan to target. This makes the Coin Wallet almost act as a prepaid debit card or replenishable gift card. As a result we have decided to cap the maximum amount that users can add to a card at a time to be one-hundred dollars. Users’ credit cards and bank account information is never stored on Coin servers and only lives on the users device as part of the wallet software. An attacker or malicious actor would have to gain access to both the merchants and customers devices in order to steal funds or gain access to credit card information.

A Case for Mass Adoption of the Coin Payment System

To promote Coin and sign up its first customers effort has been made to survey minority owned SMEs in the Harlem neighborhood of New York City. During this survey phase we found that businesses currently accept credit card payments and in some instances Square, were typically restaurants or retail shops that sold clothing and apparel. However, we did tend to see that service based businesses such as barber shops, beauty salons and nail salons tended to operate on a cash only basis. We also learned that merchants that currently accept credit payments were interested in switching to or adding a new payment method if it was cheaper than their current solutions and customers were willing to pay using this new method of payment.

By first signing up merchants in minority neighborhoods in New York City, beginning with Harlem, we expect customers to sign up after being informed about Coin and its benefits. Harlem is unique in that although it is traditionally a predominantly African-American neighborhood it has become more diverse and is home to students that attend nearby Columbia University and City College. The neighborhood is also home to several sections that have large Latino populations. The Latino demographic is interesting as it serves a potential bridge to international payments for members of these communities that wish to send funds to families in their home countries. Nearby neighborhoods in the Bronx and Queens also play host to many immigrant families that frequently send funds to their home countries. C-Coin could be gifted to family members that could then convince merchants in their countries to become part of the Coin Network. This bakes international virality into the platform from the start.

Another benefit of launching in Harlem is that it is in New York City, which can be argued to be the financial capital of the world. If this experience works here it will surely gain the attention of bankers and other major players on Wall Street. There also exist vibrant tech, venture capital and FinTech communities that can serve as a pipeline for talent and idea sharing. New York City is also home to several major universities such as New York University, Columbia University, Fordham University and Cornell Tech that can also contribute to this effect. By being a live experiment that spans across several disciplines we are confident that Coin will gain the attention of thought leaders in these spaces.

We envision Coin growing organically as more merchants and consumers learn about its benefits and ease of use. We view the platform becoming popular in smaller neighborhoods and quickly expanding and spawning additional spheres of influence as more users adopt the system. Soon this local viral growth will spread online as we expect more merchants to adopt the system due to the ease and affordability of accepting online and mobile payments that it provides. Since the network will grow with merchants acting as the hubs for growth Coin will become a new mode of commerce for minority owned businesses and the communities they serve.

Ran out of time and forgot to post the link to the Coin site. More information about the platform value capture strategy and selling points for merchants can be found here. -> http://getcoinpayments.com

And the link to the deck used in the pitch competition. -> https://d3.harvard.edu/platform-hbappitch/submission/coin-secure-payments-and-business-analytics-for-small-and-medium-sized-businesses/