Walmart – An omni-channel vision with data as its core

Walmart is striving to be the leader of omni-channel strategy in retail. Data is at the center of this vision. Walmart is leveraging both internal data (e.g. in-store data, online data) as well as external data (e.g. social media, weather, Nielsen) to improve the customer experience, enhance decision-making and improve operations.

Many trends have been shaping the retail industry. Those include but are not limited to reduced foot traffic in physical stores, rise in online shopping, changing customer behavior (e.g. rising expectations – focus on ease and convenience, tech-savvy customers) as well as increasing cost pressures.

To stay competitive/afloat in this era, traditional retailers have shifted to an omni-channel strategy and are striving to deliver a seamless customer journey across the physical and digital world. This has led to a proliferation of data. Deemed to be a competitive advantage at first, leveraging data to inform decision-making has become more of a norm nowadays, particularly for big retailers. Retailers are focusing on building a 360-degree view of their customers and leveraging data to improve operations.

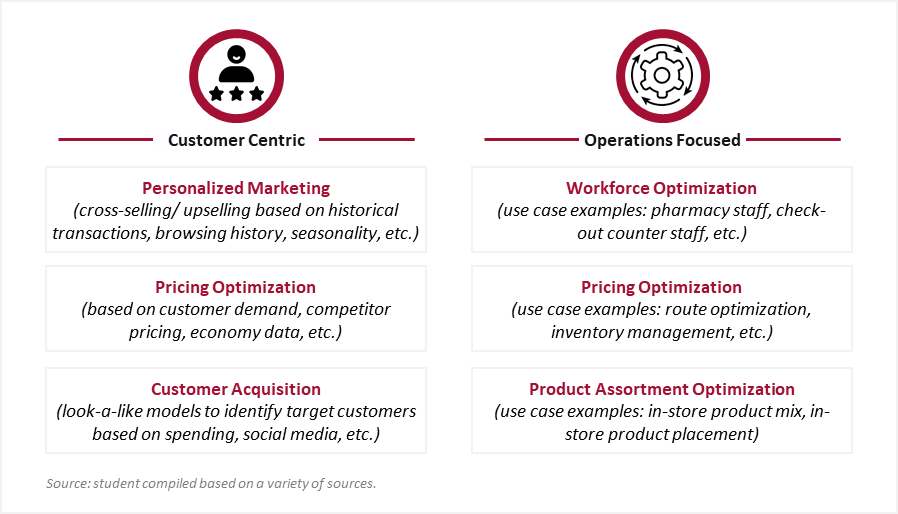

Walmart is a clear example of a retailer that is focusing on harnessing the power of data. Walmart has started leveraging data to execute a variety of use cases, with a varying level of complexity ranging from descriptive to predictive to prescriptive (Exhibit 1).

Exhibit 1: Walmart Use Case Examples1,2,3,4

Walmart is determined to its analytics capabilities. For example, in 2017, it established the Data Café, a state-of-the-art analytics hub which connects to more than 200 datasets, both internal (e.g. transaction data, customer profiles) and external (e.g. social media data, Nielsen data).5

In 2019, it launched its Intelligent Retail Lab to experiment with AI solutions to envision the future of retail. Walmart is leveraging the internet of things (IoT) coupled with AI to continue transforming its retail operations, with a focus on digitizing the brick-and-mortar stores. One example relates to digitizing its physical stores by using technologies such as cameras and sensors on shelves to track products (e.g. availability, freshness – example color of a banana) in order to optimize inventory. The data will first be used to inform the need to restock the shelves in real-time and then, once enough data has been collected (customer behavior, item availability, etc.), to forecast that need. This will enable Walmart to service customer faster, improve customer satisfaction, and reduce costs.6

The company is investing in many technologies to generate value across the customer journey. Walmart will capture this value in a variety of ways, some mentioned above. On the customer side, these include improving customer acquisition, increasing customer lifetime value, reducing customer churn, increasing sales, etc. On the operations side, these include reducing costs, increasing productivity, speeding decision-making, reducing fraud, etc.

Yet, like many other traditionally brick-and-mortar retailers, Walmart is still struggling to compete with players such as Amazon. The two main challenges are:

- Ability to attract top tech talent (e.g. data scientists, data engineers). This is mainly due to the high demand for these skills, with a shortage in supply as well as the attractive jobs offered by FAANG (Facebook, Amazon, Apple, Netflix and Google).7

To address this, Walmart can rely on a variety of mechanisms such as attracting talent through high wages/ other incentives, training its staff and creating academies to support upskilling (something it has already started exploring), creating employee exchange programs with tech companies to improve its employees’ digital skills (similar to P&G and Google), etc. - Walmart online shopping: a money losing machine.8 Walmart has already been making huge investments in e-commerce, particularly with its acquisition of Jet.com for $3.3billion in 2016.9 The acquisition helped Walmart gain some grounds in online shopping, but it still has a long way to go (Amazon: 38% of US online shopping, Walmart 4.7%).10

With the retail online shopping market exhibiting “winner-take-most” characteristics and with shift away from offline shipping towards online shopping, Walmart should continue pushing to increase its market share in the online shopping market. This will in turn enable it to capture more data, improve its operations and increase market share– a flywheel effect. Walmart should continue investing to improve its online offerings (including mobile), acquiring other companies to complement its capabilities (could also help with tech acquihires) and partnering with other providers to gain more market shares (e.g. Google Home to gain an edge over Alexa).

Walmart is striving to be the leader of omni-channel strategy in retail. Data is at the center of this vision, both internal data (e.g. in-store data, online data) as well as external data (e.g. social media, weather, Nielsen). Walmart should continue growing its analytics capabilities to fully capture the value of data (collect more data, increase use cases, etc.) and should continue innovating to reshape the future of retail (e.g. analytics+IoT+robotics).

Endnotes

1 “5 Ways Walmart Uses Big Data to Help Customers”, Walmart, August 2017.

2 “Walmart Is Investing In Shopper Data”, Forbes, December 2017.

3 “Retailers: Adopt Artificial Intelligence Now for Personalized and Relevant Experiences”, Adobe Blog, May 2017.

4 “How Big Data Helps Walmart Get the Turnover Of Half A Trillion Dollars Per Year”, Skywell Software, August 2018.

5 Ibid.

6 “Walmart Unveils A New Lab Store That Uses AI”, Forbes, April 2019.

7 “Walmart: The Big Data Skills Crisis and Recruiting Analytics Talent”, Forbes, July 2015.

8 “Inside the conflict at Walmart that’s threatening its high-stakes race with Amazon”, Vox, July 2019.

9 Ibid.

10 Ibid.

Thanks for writing about this! I think the piece you brought up about attracting talent is really key in Walmart’s case. It’s really challenging to drive large scale innovation without the right team in place. The high competition for tech talent, especially in the bay area and New York where their teams are located, seems like it will be a consistent challenge for the company in the future. Although they might have many ideas for how to use AI and machine learning to improve their business it will be interesting to see the extent to which these can be deployed quickly.

Thanks for sharing! In reading about how they are leveraging technology in stores–I thought about how Lowe’s is leveraging an instore robot to track inventory and help customers find products (http://www.lowesinnovationlabs.com/lowebot). I wonder if a similar product could help Walmart? Walmart already has the inventory technology piece as you mentioned but they could benefit from helping customers find products since their stores are so large and selection is so vast. This might help build baskets to drive average order volume. Additionally–they could configure the robots to help facilitate an online transaction if the item is not available or out of stock in stores. This could help drive their e-commerce business. There are lots of interesting ways Walmart can leverage technology to improve their omnichannel experience!

Very interesting article – thanks a lot for sharing, Danielle. I think it is great to see that traditional retail companies are starting to use more advanced artificial intelligence to improve their operations. One company that is really interesting to look at in this retail AI space is StockX – a marketplace for shoes that leverages data science in order to identify the right spot-price for shoes that are offered on their platform through a marketplace model. You may want to check them out.