Venmo – Winning a Larger Share of Consumers Wallet

Finally asking ourselves ‘what did we do before Venmo?’ and ‘how does Venmo create value?’

Nowadays it is common to hear consumers and especially millennials say, ‘I don’t know what we did before [insert any of the following] Uber, Amazon, and Netflix.’ While these are great questions and each company has disrupted the respective incumbents within the taxi, brick and mortar, and entertainment industries – I would argue that Venmo has leveraged digital technologies in a more valuable and transformative manner by enabling seamless money transfers between individuals. This brings to light two questions ‘what did we do before Venmo?’ and ‘how do they create value today?’

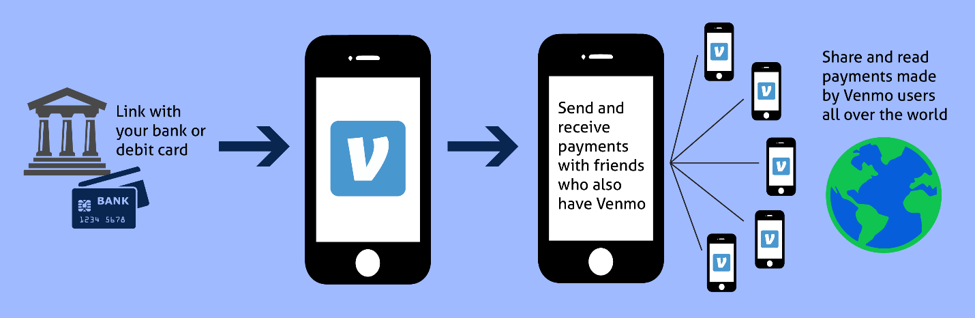

Before jumping to Venmo, we need to first understand the current fintech environment in which it plays. Today, the overall fintech landscape is large and recreating several tenants within the financial sector with key players establishing a presence within a specific vertical of financial services and specializing in a product category. Major fintech verticals include lending, blockchain/cryptocurrency, personal finance, payments/billing, capital markets, wealth management, money transfers.

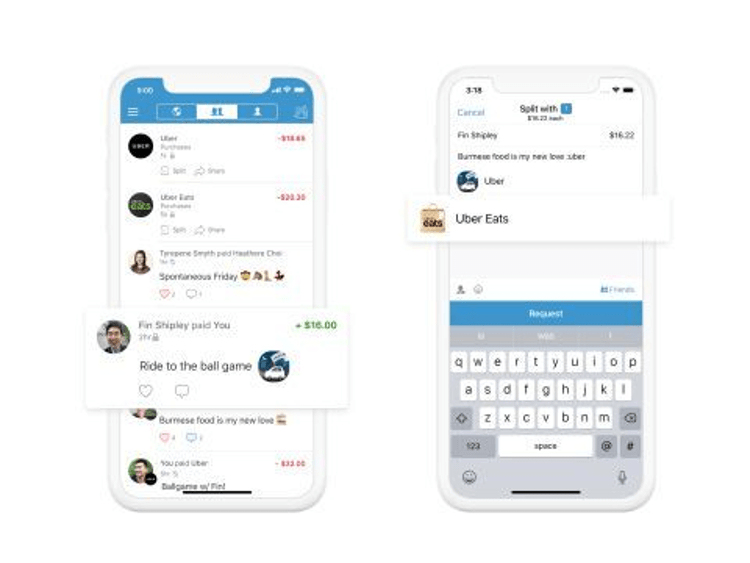

Within this evolving ecosystem, Venmo has carved out a substantial piece in the peer-to-peer money transfer market through a mobile platform with an elegant interface, digital transfer mechanism, community nature, and quick sign-up process. This marketplace stronghold ultimately attracted an acquisition by PayPal for $800M in 20131.

To understand Venmo’s current success, which stands at 40M active Venmo users and on pace to facilitate an annual payment volume of $100B, we must better understand how individuals could transfer money directly to one another1. Before Venmo, consumers had several options, which each had its own set of frictions, including but not limited to:

- Withdraw cash from an atm

- Write a check

- Wire transfer

- Chase QuickPay (required at least one party to have a Chase debit card)

First, Venmo addresses consumer needs by enabling users to quickly transfer money among parties through a safe and protected platform. Venmo eliminates the friction that existed in this market given the previous inconvenient and cumbersome option. As a result, the product’s key features including instant transfers, quick withdraws, application designed bank and many more make Venmo a marketplace innovator. By following banking lending laws in combination with secured transactions, Venmo has established user trust providing repeat usage and customer growth. As a result, the platform scale and rapid consumer acceptance demonstrate a clear product-market fit – thus creating value for consumers.

In addition, Venmo has leveraged a unique revenue model to capture value through the platform in parallel to the freemium model that most consumers use. Venmo at the core is essentially a banking / peer-to-peer transfer marketplace and as a result has to deal with the classic two-sided platform problem – needing enough active users on the platform finding the product beneficial and encouraging others to join, which in turn enables Venmo to expand. To address this customer adoption hurdle, Venmo decided at inception to launch a freemium model – helping it gain critical mass with both user acceptance and traction. Although the basic service is free to use, Venmo has added additional features that incur a transaction fee. For example, instant transfers to a linked debit card or bank account can be completed in 30 minutes or less, however, a fee of 1% of the transfer value is incurred2. Likewise, Venmo charges businesses a 2.9% fee when consumers use the app to pay3. However, one common misconception is that Venmo invests consumers in application ‘Venmo Balance’ to generate additional revenue which is currently not a revenue stream being pursued.

Overall, Venmo is a digital winner for disrupting the banking industry by establishing a free easy to use peer-to-peer money transfer platform while developing a robust revenue model. As this platform continues to grow it will be able to leverage its financial expertise to offer additional services including expanded B2C payments, credit cards, and recurring payments/billings. Moreover, with strategic geographic expansion in markets like Australia, Europe, and Canada, gaining acceptance as a method of payment accepted by brick and mortar and online vendors, and leveraging the social network will assist Venmo in growing consumer acceptance and use. As a result, Venmo is a digital winner and remains positioned to be a leader within the growing fintech space.

Sources:

- Rosenbaum, E. (2019). Venmo has digital user base putting heat on Square and banks, but no plan to profit from it. [online] CNBC. Available at: https://www.cnbc.com/2019/04/25/venmo-discloses-huge-digital-user-base-but-no-plan-to-profit-from-it.html.

- The Balance. (2019). Here’s How Venmo Compares to Competitors. [online] Available at: https://www.thebalance.com/how-to-use-venmo-and-how-it-compares-to-competitors-4776387.

- Sraders, A. (2018). How Does Venmo Make Money and Is It Safe?. [online] TheStreet. Available at: https://www.thestreet.com/technology/how-does-venmo-make-money-14763957.

Great blog! I also agree that Venmo is a digital winner and I can’t think of any service that offers the same quality and user experience. I’m curious to see how Venmo’s social experience (app interface, transaction timeline etc.) sets them apart. I believe the way the app is set up (like the use of emojis, ability to see what friends are charging each other) provides a setting that “masks” the potential awkwardness of requesting payments. It’s possible that this is something that could easily be copied by competitors and potentially improved upon. However, I believe Venmo has captured such a large share of the market and has thus created powerful network effects. Getting anyone to move off the platform now would be a huge challenge.

Robert, this is a really interesting post. I am from the UK, and prior to coming to the US last year, I had never used Venmo, and now cannot understand how it is not widely used internationally. Back in the UK, we continue to use banking host apps as well as platforms such as PayPal, Revolut, and Transferwise, which aren’t quite as user-friendly. I’d be interested to hear your opinions on this, and how Venmo can expand across the pond. Additionally, I am curious to know how Venmo has managed to achieve such success over similar platforms, such as Zelle, especially when Zelle has a partnership with Bank of America.

Partha, I completely agree with your points. I’m from Spain and was living in the UK before HBS, and had also never heard of Venmo before coming to the US. Two things that strike me are: 1) How Venmo is much more user-friendly than the platforms we use in Europe, such as PayPal and Transferwise, and 2) Why hasn’t a “European Venmo” appeared in the last couple of years or why haven’t the traditional platforms adapted to become more user-friendly? This would have allowed them to attract the younger generation into using their services on a more day-to-day basis (like someone mentions below, even just allowing the use of emojis makes the platforms more fun to use!)

Totally agreed that Venmo is a digital winner. One of the questions I had though was on the common misconception that Venmo doesn’t invest the money we have sitting in “Venmo balances”. I do wonder why that’s the case since if most consumers already think that (aka you’re already taking a reputational hit), it will be a missed revenue opportunity with no perceived volume demand downside. If they are worried about potentially the financial risk associated with that, then perhaps it might be worth marketing that they don’t invest the Venmo balance and that marketing might encourage additional users to join, thereby increasing the network effects of this platform.

Great post! I’m a huge fan of Venmo and find that it makes life (esp as a student) tremendously easier. I often wonder how defensible this model is, however. PayPal’s app offers the exact same service but with a much higher level of security. The lack of security with Venmo payments is not often discussed, but I think it will become more of an issue in this data-privacy scrutinizing world. There also aren’t many barriers to entry, and switching costs for the consumer are pretty low. I even continue to use Zelle and PayPal to send money to family members and my landlord, all of whom don’t use Venmo because of the lack of security. I think if Venmo wants to dominate the peer-to-peer payment category going forward, they will need to integrate with other platforms or find ways to make their service more sticky than it is currently today. It also only takes one headline of a data breach to scare everyone off and send them to Zelle or an emerging competitor.

I agree with a lot of your points! I do wonder if there is a space that venmo is not capitalizing on and that is around charitable giving. From your post and my understanding venmo is largely free to use c2c but costs businesses about 3% off customer payments. With a large majority share of the marketplace in the US for c2c transactions it may not be necessary for venmo to tackle this charitable giving transactions in order to remain competitive but i would argue that this type of transaction could be a new market for venmo as the demand for smaller contributions to these causes could go up with venmo’s platform (and perhaps increase stickiness of venmo in multiple types of financial transactions). The current business model is an issue for lean, non-profit, organizations that may not want to loose on donations at such large margins. The other thing that would be interesting to understand in global market is how foreign transaction fees and/or exchange rates would come into play.

Great post!! Venmo is indeed a winner and continues to innovate by grabbing more share of our wallet and transaction. Moving forward I envision Venmo creating a whole fintech eco-system. The p2p money transfer market is a need across the globe and would be interesting to see Venmo capitalize on this opportunity by aggressive international expansion, while the biggest challenge would be the regulatory barrier involved abroad. Similarly another use case of cross-border transfers would be another lucrative expansion strategy, again with its own set of regulatory challenges such as AML. What I feel may be the largest opportunity maybe to add more value added features to the core app and allow for functionalities similar to something like Wealthfront. What Venmo has, is a strong active consumer base, stickiness to the platform will allow it to monetize in several areas in the coming years.

I find Venmo’s product to be very useful as a consumer, but I’m curious what they would have done to become profitable or support their operations (outside of VC funding, perhaps) had they not been acquired. The path to monetizing their platform at a sustainable level does not seem very clear to me. Although they deliver a great product to a large user base, I just don’t see where they could make enough revenue to turn a profit. I would be interested in seeing what Venmo’s largest revenue streams are. As it is right now, however, they may not be very concerned about this because they have the support of PayPal’s resources behind them.

Similarly to Jen, I wonder if Venmo is truly profitable, or if it relies on subsidized payment processing through Braintree/Paypal. It may be anecdotal, but I don’t know anyone who uses either Venmo Offers or Instant Transfers.

Another puzzle for me is Venmo’s newsfeed. How does it generate user value? And how did we become so complacent with our privacy to be okay with out daily transactions to be on display by default? PSA: If you haven’t sent your transactions to private, you might want to go into settings and do so 😉

I’m interested to see if Venmo eventually turns to using it’s balances to do some lending similar to banks. I can’t imagine the current revenue streams you mention are enough to make it profitable (as discussed by others above), but also wonder if they have the capabilities to overcome regulatory items to lend in that way. I also wonder whether those same regulatory hurdles will make the international expansion piece difficult – seems like there are already incumbents in a lot of the other countries because it’s a model that is very difficult to get the approvals necessary everywhere quickly, which slows Venmo down.