The Struggle of a Retail Giant: From Catalog to Clicks.

Among all industries transformed by the digitization of our economy, the retail industry has been among the first and most heavily affected markets during the last decade. The Information Age spawned many new powerful retailers like Amazon – and caused serious issues for established retailers that have been dominant for many decades.

One of the biggest companies struggling with the speed and intensity of digital transformation has been the German Otto Group. Founded in 1949 and quickly growing in size, Otto Group became the world’s biggest mail-order company by the end of the 20th century. From the first days of the company, the business model was focused on catalog shopping. For 60 years the Otto Group created superior customer value through a huge portfolio of products, the convenience of catalog-based shopping, and a very well known European brand. The company managed to capture a lot of this value and was able to maintain a strict profit margin policy (at least a 30% profit margin on every product). In 2014 the total revenue of the family-owned business (with 123 subsidiaries, e.g. America’s Crate & Barrel) was above $16.4 billion. [1]

One of the biggest companies struggling with the speed and intensity of digital transformation has been the German Otto Group. Founded in 1949 and quickly growing in size, Otto Group became the world’s biggest mail-order company by the end of the 20th century. From the first days of the company, the business model was focused on catalog shopping. For 60 years the Otto Group created superior customer value through a huge portfolio of products, the convenience of catalog-based shopping, and a very well known European brand. The company managed to capture a lot of this value and was able to maintain a strict profit margin policy (at least a 30% profit margin on every product). In 2014 the total revenue of the family-owned business (with 123 subsidiaries, e.g. America’s Crate & Barrel) was above $16.4 billion. [1]

Outdated Business Model and New Competitors

However, digital technologies threatened the traditional business model and put the Otto Group into serious troubles. Their traditional business model, which has been a major success factor for more than 50 years, could not create sufficient customer value anymore.

The convenience of mail-order and catalog shopping was now challenged by competitors which offered easy-to-use online shopping platforms, an even larger product portfolio, and generous return policies. The innovation processes of the family-owned business could not keep the pace with new digital innovators. In the minds of many customers the brand is still associated with their traditional business model – perhaps one of the main reasons why it struggles to attract younger target groups.

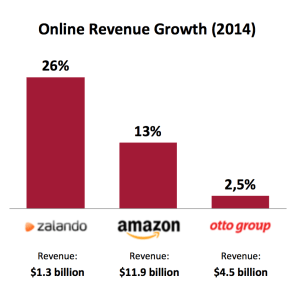

As a result, competitors like Amazon and Zalando (a fast growing European e-commerce company focused on fashion/lifestyle products) have been able to rapidly increase their market share within the last years and still continue to grow (figure on the left: growth rates for the German market).

While the importance of online sales is rapidly increasing [2], Otto Group was not able to convert their customer basis from “catalog to clicks”. A look at current online revenue growth rates of the three major German competitors reveals how the Otto Group struggles to retain its market position in this disruptive e-commerce business.

Investing in Digital Technology

After the management realized the serious – probably even existential – problems Otto faced in the e-commerce market, a new strategy was needed. To defend their position as one of the world’s largest retailers, the management set up a digital strategy and is now extensively exploring new opportunities for digital innovation. In particular, the company invests a significant amount of venture capital (more than $300 million within the last few years) into new business models and innovative start-ups that offer e-commerce, mobile, and software solutions. Furthermore, the Otto Group has to adapt many of their core principles and processes to the changing market characteristics. The strict 30%-margin policy, which persisted for many years, had to be changed. “We thought when we made prices more flexible, customers would start complaining but nothing happened, nothing at all,” Thilo Bendler, vice president of Otto Group, said. “Customers don’t expect prices to be the same for weeks on end. They understand it is a supply and demand rule.” [3]

Consequently, the Otto Group invested into start-ups that provided advanced solutions for predictive data analytics. Today one of these start-ups, Blue Yonder, operates one of the most successful data analytics systems for Otto, which provides dynamic pricing techniques and improved its demand forecasting accuracy by up to 40% [4]. The benefits that arise from the use of these new technologies make it possible to recapture a lot of the value that has been lost during the previous years.

It seems that the company is on the right track now, but the next few years will clearly show if their digital strategy pays off or if the adjustment came too late. Will the Otto Group be able to recapture the market share from their online competitors and transform the company from a ”Digital Loser” to a digital innovator that is able to compete in the challenging e-commerce market?

[1] http://www.forbes.com/sites/adamtanner/2014/03/05/amazons-war-on-germanys-18-billion-patriarch/.

[2] http://uk.reuters.com/article/2014/03/24/uk-germany-retail-idUKBREA2N16220140324

[3] https://www.internetretailer.com/2014/03/19/how-otto-group-progressed-catalogs-clicks

Interesting read David!

As further evidence of Otto’s digital transformation the company is trying to establish an open platform for e-commerce. It lets third-party developers create and publish apps to enhance the online shopping experience. Otto named the initiave “project collins” as a reference to management guru Jim Collins and his book “built to last”. Time will tell if they are right…

http://www.project-collins.com/