The democratization of fine art: How much for 0.02% of that Picasso?

Using blockchain technology, Maecenas is democratizing the fine art market by building a platform that tokenizes masterpieces. Similar to the way an individual can own a piece of a large company, so too can an investor own a piece of fine art, opening the previously inaccessible world to a whole new set of possibilities.

Fine Art… the asset class?

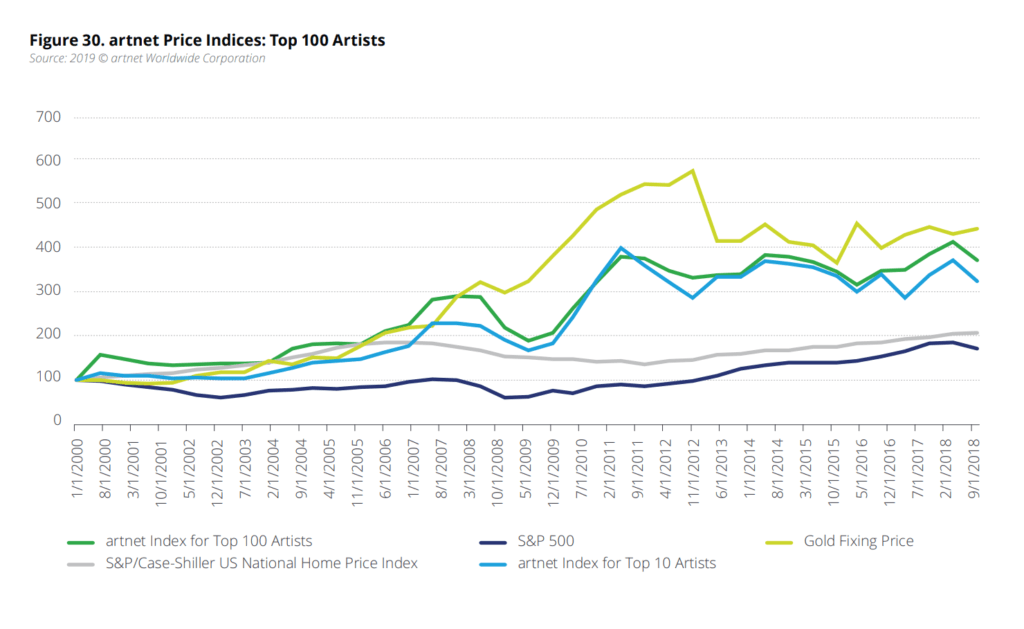

For centuries, the fine art market has been only accessible to the upper class. The majority of its owners were wealthy individuals or large institutions, requiring millions in order to simply participate. Even once you entered this world, its inner workings and details were opaque, with many of its market dynamics driven by hype and by the decisions of a select few. Despite (or potentially as a result of) these dynamics, the fine art market has been one of the best performing asset classes in the world (see below) [1]. Yet this asset class has always been reserved for the ultra-wealthy, purporting the notion that the rich only get richer. In an industry that has seen very little innovation for centuries, could blockchain be the vehicle that democratizes the fine art market?

A new way to buy art: The Maecenas Platform

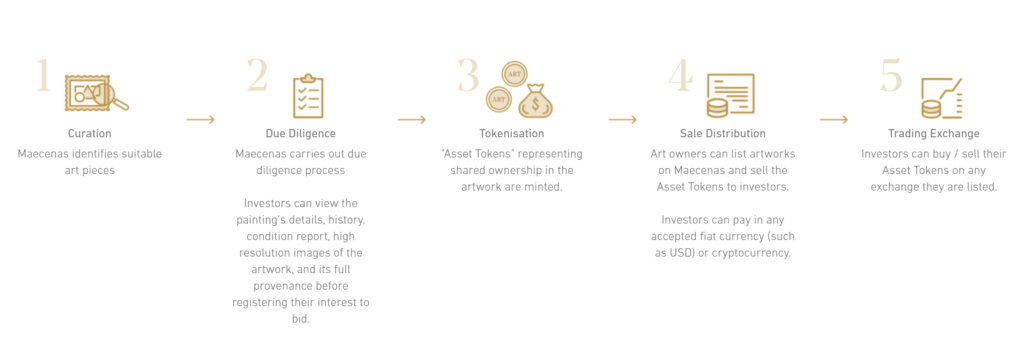

Given the market dynamics above, Maecenas seemingly combines the old world with the new. Maecenas has built a platform that creates tokens of a fine art piece that represent ownership of the asset, similar to the way stock represents ownership in a company. These tokens are then put through a dutch auction that allows individual investors to bid on masterpieces, the total bids then setting the overall price for the asset. In order to purchase these tokens, Maecanas has issued an ART token, a cryptocurrency based on the Ethereum platform. This platform uses smart contracts to execute transactions automatically, removing any subjectivity from the process. In addition, since all of the information is stored on the blockchain, the idea is that the information is free of any human judgement or manipulation. Given this architecture, how do the various stakeholders of this ecosystem benefit from this new paradigm [2]?

How this platform benefits the various stakeholders:

Art galleries

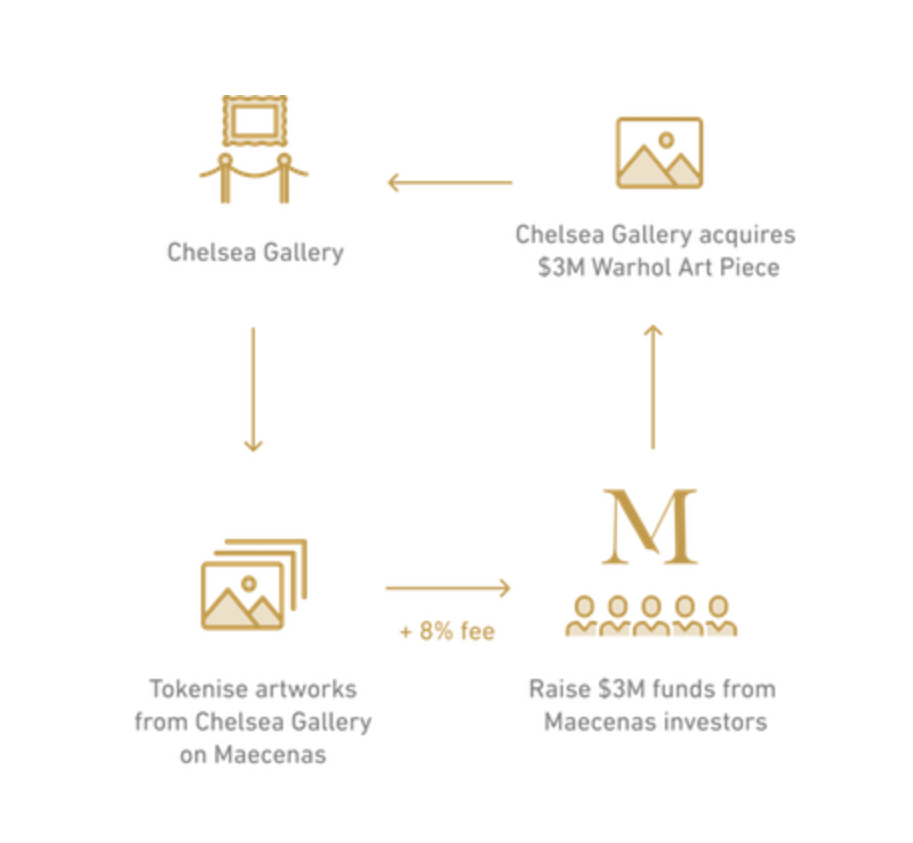

Under current market conditions, if an art gallery needs liquidity, it needs to sell its paintings in order to fund day to day operations. With Maecanas, it can raise this cash by selling part of its painting, while still keeping majority, which allows it to keep the painting in its gallery. In exchange for this cash upfront, it pays licensing fees similar to the way dividends pay out when you own a stock. This then provides a lot more flexibility for the gallery.

Individual investor

Previously, an investor would need to raise a lot of money in order to participate in this market. Using Maecanas, you and me can put a lot less money by buying ART tokens, then buy 0.02% of a fine art masterpiece. Maecanas has democratized fine art, giving the people exposure to an asset class previously inaccessible to most of the public.

Family offices and High Net Worth Individuals

For the ultra wealthy looking to diversify their own portfolio, Maecanas allows these investors to hold a much larger set of assets, investing in various artists without having to shell out the capital normally needed to participate in this marketplace. By owning only parts of the asset, the investor can be exposed to various types of art from around the world.

How does Maecanas capture value from this two-sided platform?

Under the old model, art auction houses and galleries would charge anywhere between 25-50% in commissions for selling your artwork. Art fund managers will charge 20% of any profits made, plus a 2% annual fee on the cash invested. Each of these parties charge hidden fees, using the opaque nature of the market to become incredibly profitable. Maecenas charges a mere 1-8%, with a guarantee via the blockchain technology that no other hidden fees will appear. The smart contracts take care of the settlement of all transactions, providing stakeholders with a safe, reliable way to transact fine art.

Network effects

Like all platforms, Maecanas benefits from network effects. On one side you have sellers, who want to sell on this platform if there are enough buyers. The buyers will come if there is enough liquidity on the market to trade these assets, thus reinforcing the platform’s network. In order to truly expand and disrupt a centuries-old market, Maecenas needs both sides to come together.

The new future of art

In order to put this all together, there are still plenty of questions that need to be answered. For one, blockchain needs to prove itself as a reliable system that cannot be hacked, building trust with both investors and sellers alike. If it does work, and Maecanas leadership can convince many of the traditional art owners to put their assets on the platform, it can truly revolutionize the fine art market as we know it. Will this platform give you exposure to that Monet you’ve always wanted? Here’s to giving art back to the people!

Sources:

[1]: Deloitte Art & Finance Report, 2019

[2]: https://www.maecenas.co/whats-maecenas/

[3]: https://hackernoon.com/revolutionizing-the-art-industry-with-blockchain-d836m34vb

[4]: https://www.cnn.com/2019/04/19/tech/bitcoin-art-maecenas-singapore/index.html

Thanks for this, a very interesting company. However, call me traditional, I still find beauty in having a piece of art exposed in my house instead of knowing I own a percentage of one I cannot see, possibly exposed on the other side of the planet.

This platform value proposition seems more targeted at opening the door of the art market to financial investors hedging their risk than allowing art aficionado to quench their desire for art. Maybe AI can help fill this gap: https://www.youtube.com/watch?v=IuygOYZ1Ngo.

Very interesting post, thank you for sharing with us. In reading this, I can’t help but think about how this kind of platform can help artists retain more of the value being generated by their work. I am imagining now if artists retain minority stakes in the pieces they sell they can benefit from increases in prices and even bequeath these minority stakes to beneficiaries after the artist’s passing.

Fascinating idea. Thanks for writing about this one. I’ll be keeping an eye on Maecenas to find out how this one plays out. I would be curious to know how Maecenas enforces ownership rules over the pieces of art. With the traditional model, ownership is controlled by physical possession. However, by selling many pieces of equity to a large number of individuals, how does any one shareholder ensure that the he/she will have a fair degree of managerial control over the artwork? Nonetheless, I think if this company gains traction, it would fundamentally change the secondary market for art.

Thank you for the very interesting post, I am amazed by the idea. I wonder if democratization is really the right idea, I see it appealing to only a handful of people who would most likely be interested in profit than art itself. In the long term, speculation will probably incentivize the value of pieces to rise and so we could argue that it doesn’t make it more democratic.