TAL: Online Education Transformation in Covid 19

TAL: a leading tutorial institution with strong offline network

TAL Education Group is a leading K-12 after-school tutoring services provider in China. The acronym “TAL” stands for “Tomorrow Advancing Life”, which reflects TAL’s vision to promote top learning opportunities for Chinese students through both high-quality teaching and content, as well as leading edge application of technology in the education experience.

TAL Education Group offers comprehensive tutoring services to students from pre-school to the twelfth grade through three flexible class formats: small classes, personalized premium services, and online courses.

TAL also operates www.jzb.com, a leading online education platform in China. TAL achieved US$2.56 billion revenue in FY19, and US$850 million ~ US$872 million (YOY 20~23%) in Q4 FY20 (by Feb. 29, 2020).

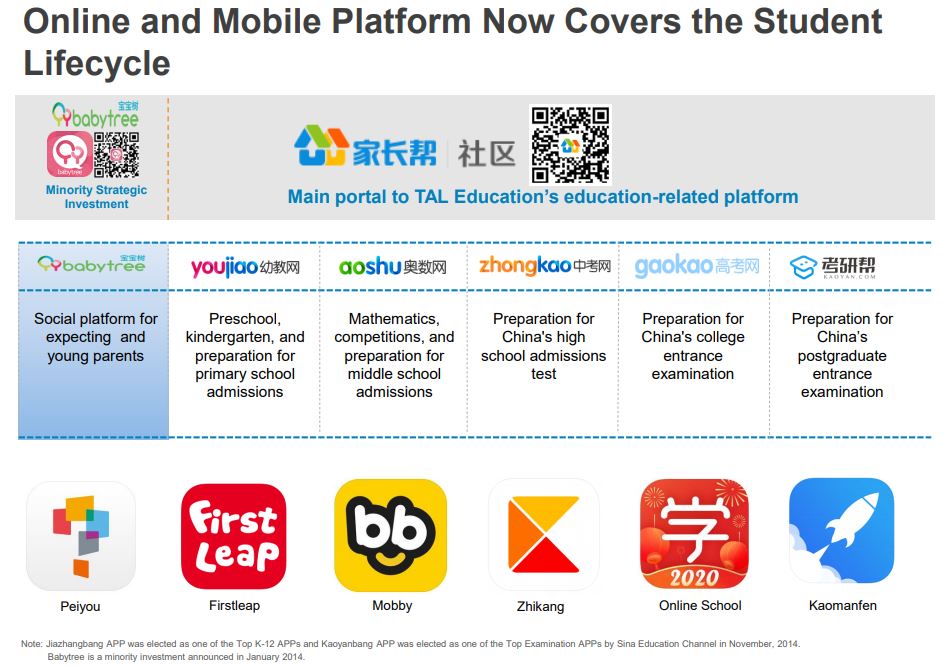

TAL has been actively investing in online education since the early 2010s. By Q3 FY20, online education contributes 18% revenue to TAL, with multiple product offerings across student life cycle.

However, offline face-to-face education still dominates TAL’s revenue (82%). TAL’s learning center network currently covers over 50 key cities in China. As the Chinese tutorial market is still super fragmented, TAL has tremendous challenges to expand in lower tier cities, which is mostly captured by local tutorial institutions.

Transformation to online education in Covid 19

In order to fight against the Coronavirus pandemic in Wuhan and across China, the China central education bureau announced all national schools and education programs should adopt online education only. This obviously brought tremendous challenge to TAL. If without the Covid 19 lock down, TAL had already signed tens of thousands of students for its winter break tutorial programs. The cancelation of these winter programs means huge repayment to customers and incapability of the TAL brand.

TAL made an almost immediate decision to fully transform to online education, and to turn this crisis into a branding campaign and a customer acquisition opportunity.

To C: launch free online education classes

The Chinese national education bureau announced to postpone the spring semester start date for all schools on Jan 27. Besides, the national bureau also requires “stopping school classes but continuing learning.” Almost immediately, all leading K12 education companies donated free online classes and open cloud technology platforms.

TAL was one of the leaders in this campaign. TAL launched free national live classes. Meanwhile, TAL quickly launched its online education app, utilizing the ClassIn platform which TAL invested in 2017, to move all offline classes to online live classes. TAL prepared its teachers through many training sessions on online live classes, e.g., how to use the app, how to tailor the education material for online classes, etc. TAL offline sales support staff also communicated with parents and students through phone calls and wechat discussions. Thanks to this quick effort, most of current students stayed with TAL and moved to its online classes.

To B: launch free cloud platform for 3rd-party education institutions

TAL announced to form RMB 100 million fund for the Coronavirus initiatives, in which RMB 20 million was donated to the Wuhan city, and RMB 80 million was donated to education programs. The latter has three initiatives: 1) Free live education application platform and technology support to support online classes for all national K12 schools. 2) Online education technology solution for 3rd-party local tutorial institutions. Any private education institutions can use TAL’s online education solution for free until the end of the pandemic. TAL will also provide operation and technology support services for these 3rd-party partners. 3) Xuersi.com and TAL’s hundreds of teachers will provide free live classes and self-education classes to national audiences.

By March 2020, TAL has accomplished online education service and support for 2 million students from 508 public K12 schools in 32 provinces.

This ecosystem approach not only delivered terrific brand campaign for TAL, but also acquired new students almost at very low acquisition cost for TAL, especially for K12 students and lower-tier city students who used to be very expensive to acquire. In addition, it also helped TAL to test its education solution product in order to transform from a class provider to a technology solution provider.

TAL’s competitive advantage in online education

During this process, TAL also demonstrated its competitive advantage from its long-term investment in education technology.

- Peiyou school and Xuersi.com are the two current major online education products within TAL’s offerings. Among 70 offline Peiyou schools, 30 schools already offer the same online education products which is the same as its offline classes. Most offline teachers were very experienced in using the online platform to engage students. Therefore, in other cities, TAL was able to quickly launch the same online education products with capable teachers and students support team. TAL’s competitors had not fully integrated their online/offline offerings, and therefore were lagging behind TAL in this rush time.

- TAL launched its open education ecosystem in Dec. 2018, which included an open education technology platform, education industry alliance, SaaS service platform to provide education solutions for other education institutions (to B) and government (to G).

- TAL has been actively investing in cutting edge education technologies. During this transition, TAL adopted the ClassIn platform by EEO, an education technology startup that TAL invested in its round A+ financing in 2017. EEO launched a dedicated live classroom application, ClassIn, in Nov 2015. ClassIn has been quickly adopted by 200+ clients including New Oriental, TAL, Udacity, Pearson, and many universities.

Challenges in the post Covid 19 era

TAL has achieved temporary success in the online education battle. However, there still remains three major challenges for TAL:

- How many users will remain on TAL online education program in the future? For instance, although all schools were shut down and moved to online education in the spring semester, the school year will actually extend to later this summer. In other words, there will be very limited available students for TAL in the summer break, which used to be its peak season.

- How many users will ultimately convert to paid users in the future? Since online education were mostly offered as free programs during the pandemic, how many students and parents will actually buy in the concept of pure online education and pay for it?

- How to deal with the cannibalization between online vs. offline classes for TAL? TAL has built vast presence in 50 cities in China. As online education increase its penetration during this pandemic, how can TAL position itself to better solve the cannibalization between online and offline classes? In particular, online classes is not very scalable as we would expect. TAL’s online education are small live classes, and sold at a lower price per hour compared to TAL’s offline classes. As a result, will the online education transformation lead to lower profitability for TAL?

I always think about Zoom or other companies that are having so much more people using their products during COVID-19 as winners. I didn’t think about the major changes that they had to made to their operating system or technical infrastructure in such a short time to accommodate so many more users. I want to expand this to post COVID-19, I believe that since TAL was able to adapt so fast to the market they will also be able to re-adapt to the new normality. Another factor that I think would help TAL is that now everyone knows about them and if parents loved the experience they will for sure sign up their kids for summer school or after school learnings for every day. The last but not least, the new reality after the pandemic will be quite different and will use a lot of remote/online activities and learning is one of them. For example kids can do the work online when they are sick or not able to go to class. TAL has the opportunity to shape the new reality post COVID-19 and that is an opportunity more than a threat.

Great post! As you mentioned, I would also be concerned about the value capture opportunities for the B2B segments, particularly with both public and private schools. I understand they used COVID-19 as a free trial period and were forced to do so by regulations, so I guess that most of the 3rd parties and schools who shifted online will abandon the platform when the normal offline scenario is back if they shift to charge for it like a SaaS.

So, unless the goal of B2B is to acquire new customers for the support B2C business line, it would be interesting for TAL to try freemium models or ad-based revenue generation.

Thanks a lot for sharing, great post! I agree, TAL has done an amazing job in adapting to the new normal at a phenomenal pace. I do think that the brand effects will be long-lasting. On the cannibalization issue – I think one opportunity that TAL may explore for the future is a hybrid online-offline model, where they leverage their offline centers for certain parts of the learning experience and the online component for other parts – that could be an opportunity for them to leverage both assets and strengths toothier advantage.

Great article Amanda!

I think this phase for TAL should be the data collection phase, where the company gets access to all this data from this increase in subscription. The company should then use this data for its benefits. An example could include TAL moving towards more of competency based education to help students focus directly on their weaknesses and improve them (i.e. adapt the study plan to the speed at which the student is learning, the mistakes he/she has done, etc.). Another way they could leverage the data is to monetize it by selling to/ partnering with schools to provide them high-level performance reports and recommendations for study plans based on closely monitored performance of students.

TAL could also gamify the experience to keep the students engage for longer, beyond the COVID crisis.

Great post! The online education industry has been growing significantly in the last decade. I agree with you that Covid-19 has further fueled the growth and demand for online education. I believe this trend will remain as investments move into the sector to improve the customer experience.