Shazam: Predictive Analysis for the Music Industry

Popular music app Shazam leverages big data in surprising ways

Shazam, a digital music company that traces its founding back to 1999, leverages big data in unexpected ways. Shazam currently exists as an iOs, Android, and web app that allows users to identify songs they might hear on the radio, on TV, while out shopping, or even at a loud club by listening to just a few seconds of music. Once Shazam identifies the song users can take further actions, such as purchasing the song on iTunes, searching for it in Apple Music or Spotify, or adding it to a playlist on one of those subscription streaming services. And the best part: it’s free to users.

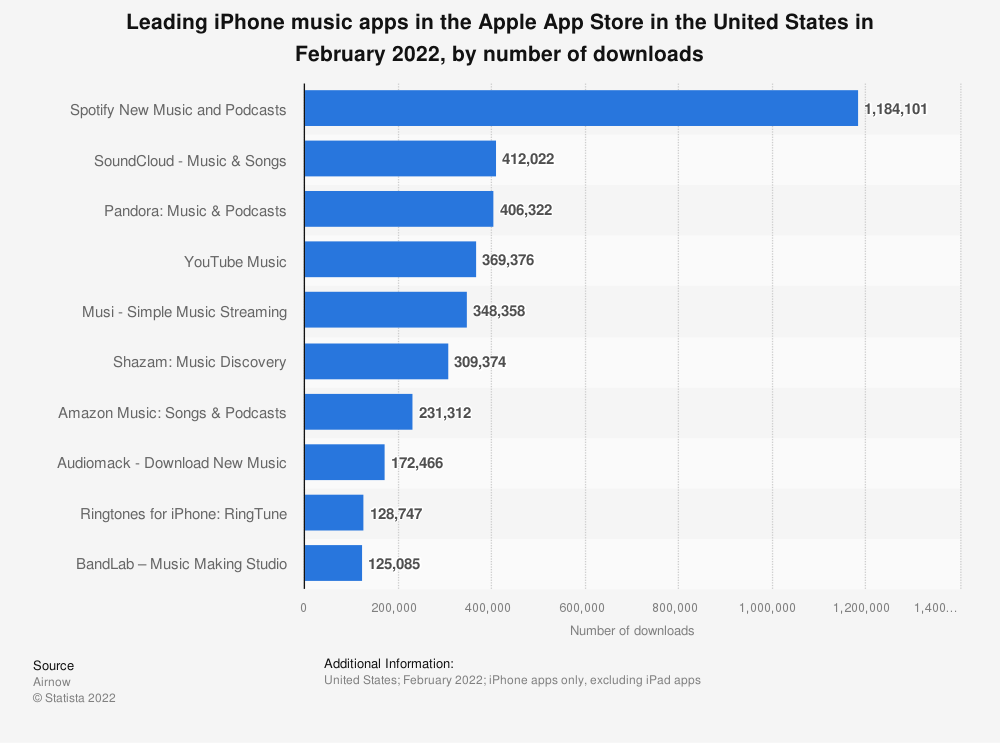

Shazam is unlike many of the top music companies alongside which it is frequently ranked for usage. A glance at chart below shows Shazam alongside music giants such as Spotify, Soundcloud, and YouTube Music. The difference between Shazam and all the other companies is that it is the only one on which you can’t listen to an entire song all the way through. Think about that for a moment – an app that only gives you a sample of a song is still competing handily with the likes of Amazon Music and Pandora.

Shazam reached 1 billion total downloads in 2016, and by 2020 users around the globe were “shazaming” 20 million songs per day. Shazam’s sheer volume of usage means that it sits on a veritable treasure trove of data – which is critical to its bottom line, given that consumers do not pay to download or use the app. While Shazam did generate some profit through ads prior to 2018, it also made a commission when users downloaded a shazamed song on iTunes, or later when they subscribed to Spotify or Apple Music through the app. Shazam’s biggest value generation, however, comes from predictive analytics.

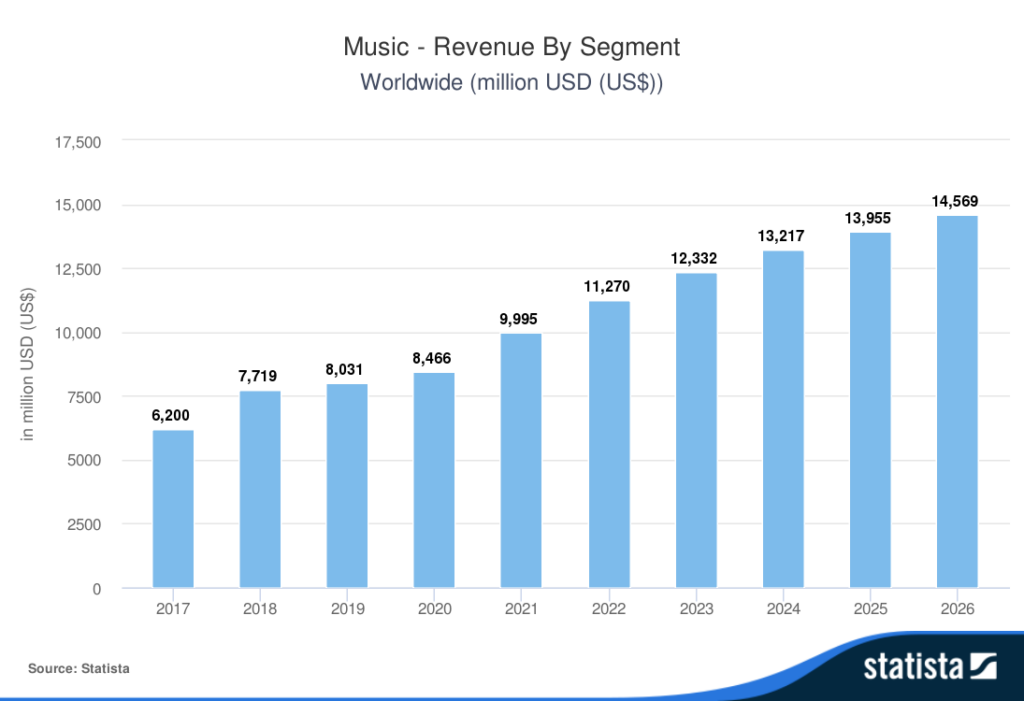

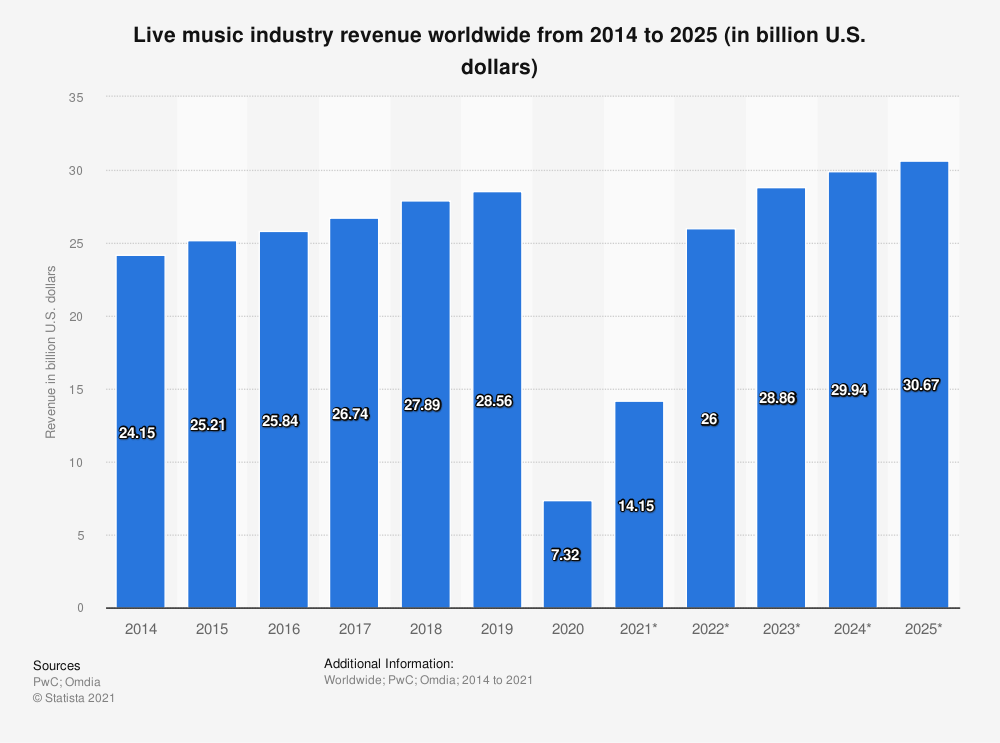

Predictive analysis is critical in the music industry, which is a billion-dollar market with steady predicted growth. Tom Cunningham, a VP at Pariveda Solutions, a consulting firm dedicated to solving complex technology and business problems, focuses on predictive analysis in the music industry. He shares that “we use predictive analytics in the music industry to understand what it is people want to hear, which is going and already has had a profound effect on the music industry. But it’s going to continue to have a profound effect on the way that we interact with music, the way that we consume music, and the way the music industry heads into the future.” By examining what songs and artists users shazam, and with what frequency, Shazam is able to predict which artists will be popular or which songs will be hits, often before such traction is recognized on charts and streaming data. Shazam sells this data to companies that can turn this data into profit. One excellent example is the live concert business which, after an obvious dip in 2020 and early 2021, is predicted to be a nearly 29-billion dollar industry in 2023. By leveraging Shazam data concert promoters can determine where artists should tour, how large audiences are likely to be, and what demographic they are likely to attract. Another more mundane (but lucrative) example of the value of such data is that “customers have more positive brand engagement with shops that are playing “cool music.”

Shazam’s decades-long commitment to building an app that users loved paid off when Apple acquired the company for $400 million in 2018. This followed a trend of streaming services purchasing predictive analytics companies outright, including The Echo Nest (purchased by Spotify), Next Big Sound (an MIT startup purchased by Pandora), and Symmetric (purchased by Apple Music). While back in 2018 it wasn’t immediately clear what Apple would do with Shazam or its data, the parent company continue to operate Shazam under its original name and branding. While users can still search for a song result on Spotify or Tidal from within the app, that functionality is more hidden and Apple Music is front and center on nearly every page within Shazam. Apple’s most recent play is a full integration into iOs 14.6 that allows iPhone users to use Shazam seamlessly in various places on their phones without needing to open the full app.

Apple, which “is not particularly acquisitive compared with other tech giants such as Alphabet or Microsoft” (CNBC) bet big on Shazam, and it will be interesting to see where the company takes the app in the future, and how they might optimize it for further integration with Apple products.

As an avid Shazam user, I had always wondered how they were making money–thank you for solving this mystery. The part I found particularly interesting was how the data could be used for forecasting in industries involving concerts, tours, and live music. I wonder if the app will eventually incorporate predictive algorithms to show “given you like x, we think you might also like y…” (akin to Netflix), or if it can be used as a measure to see what other “hot songs” are happening in the area individuals may want to know about. For example, “top shazamed songs in your area this month”. Would this go against Apple’s privacy concerns? Does having Apple as a parent company impact or even limit what it does with the data collected?

Great post, thanks Julia!

Hey Heili, thanks for your comment! You’re spot on, that’s actually another way Apple is now leveraging Shazam data (but I ran out of words to detail it). Apple creates a weekly “Shazam Discovery Top 50” that projects up and coming songs, and also uses individual user data to create curated playlists similar to Spotify’s “Made For [Your Name]” playlists. I don’t know about the geo tagging privacy concerns you mention, though I think they’re valid concerns. I imagine that as long as users consent to share location with the app (which I personally don’t do on Shazam) they can receive notifications when artists they like are playing shows nearby. I’m glad you shared your thoughts on this as an avid Shazam user!

Similar to Heili, I too am a big Shazam user and never quite understood how it works. I do wonder how they balance the qualitative data with quantitative data. How does the company discriminate between a “shazam” of a song and whether or not the listener had a positive/negative review of it? I wonder if they track how long a user listens to the song or where in the song the user is most interested in listening and how this helps inform the future of music?

This is super cool! Thanks for sharing!

Stephen, that’s a really interesting point that I hadn’t thought of! I suppose users could Shazam songs that they really don’t like (I know I’ve wanted to know who sings a song I hate so I can avoid the artist), but I think the general assumption is that Shazam shows interest, and quantity here = popularity. I think you’ve pointed out a really interesting blind spot, though!

Thanks so much for this wonderful read, Julia!

You make a fantastic point about how an app with seemingly just one function can compete with some of the music giants.

I do wonder to what extent the usage of Shazam translates to fans actually attending a music concert? Is there a certain percentage of users Shazaming(?) that end up actually going to the concerts? How do they calculate that?