Sephora – Blurring the line between Digital and Physical

The beauty pioneer that reinvented itself and the industry through technology

Background

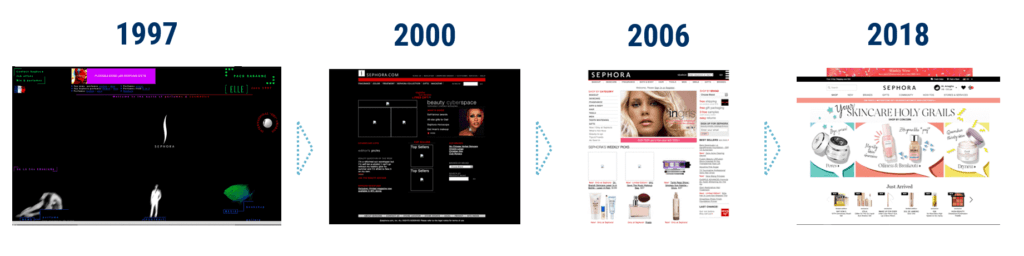

Sephora, a multi-national chain of personal care and beauty products has built an empower through digital innovation and come out as the winner in the cosmetics retail space. It’s commitment towards digital has not only made it successful in the beauty space but has set an example for all brands looking to transform through technology. Here, we explore some of the digital initiatives that the company has successfully executed and how they’ve helped them create and capture value.

Sephora’s Innovation Lab

Sephora converted one of its warehouses into a lab space in 2015 which was previously used to design and test its store layouts. Today this lab is used to build and test digital solutions to enhance the shopping experience both in-store and online. The lab holds a complete model of a physical store which is used to try different ideas. Store associates provide feedback on technological experiments. While many companies have set up such i-labs, Sephora is unique in that it has maintained the physical store within the lab space to thoroughly test in-store experiences before roll-out. This helps Sephora manage it costs optimally and hence, capture value for itself through increased margins.

Sephora has created value for its customers through its products and store experiences that solve customer pain points and increase the willingness to pay. Along with the launch of the Innovation Lab came multiple digital offerings from Sephora – 1. Pocket Contour, a mobile-app feature that provided contouring tutorials based on the user’s face shape 2. Using beacons (IoT location-broadcasting device) in stores to provide personalized notifications to users as they walked past certain events, sales, services, etc. 3. Sephora Flash, an Amazon prime equivalent for free and fast shipping.

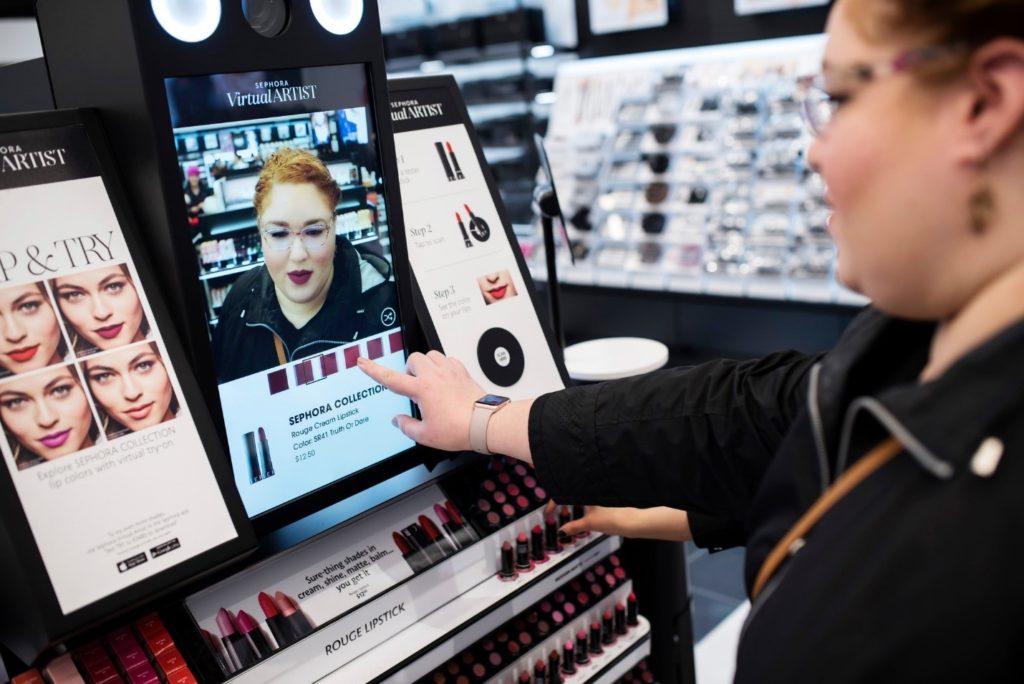

One of their most successful products is the Virtual Artist app released in 2016. Sephora identified a crucial customer pain-point in messy make-up trials in store and the apprehension of buying products online without the customer trying them on. Virtual Artist uses augmented reality for users to virtually try on makeup. Sephora partnered with ModiFace (augment reality tech provider for beauty) to create mobile and in-store versions. The company doubled-down on its AR investments by launching other products such as ColorIQ (to find foundation and concealers that match user skin-tone) and Skincare IQ (quiz to provide recommendations for user’s specific skincare needs). Sephora was quick to identify skincare as a major growth category and through the launch of Skincare IQ, has generated sales that have surpassed makeup sales.

Omni-Channel Strategy and other initiatives

The leadership at the company is completely bought-in and driven by digital. Sephora took a big leap in digital retail by combining the in-store and online teams into omni-retail department. The company truly believes that it falls upon the retailer to make sure the transition between channels is as smooth as possible, reducing the effort for the customer. One example of how Sephora achieves it: Makeup artists add products used during in-store makeovers to the particular customer’s profile for them to browse through and buy online. Also, makeup tried on the Virtual Artist app can be purchased online and located instore. With this omni-channel strategy, Sephora has been able to combine online and offline customer profiles, gain data around behavior and hence, provide personalized recommendations that increase its value proposition.

Other digital initiatives that have helped drive the exponential growth at Sephora:

- Sephora Assistant: Messenger chatbot using AI that allows users to book makeover appointments, which saves administrative costs.

- Beauty Board: A social-media platform created for collaborative browsing and connecting & creating with the community

- Google Assistant app: A voice-enabled application for users to book services, take quizzes and listen to beauty podcasts

What Next?

Sephora’s unique selling point has been the use of technology in its physical stores. To continue its lead, Sephora has opportunities and risks for the future that it needs to be prepared for. Currently, with the amount of data that Sephora is accumulating, it has the potential to push into building personalized cosmetics. As tech giants like Amazon and other beauty players like Ulta and Glossier catch up on the technology front, Sephora needs to find ways to maintain its position. Using its community to further lock-in customers, applying the knowledge gained in-store through associates to understand customer journey, customized products might be ways to overcome the looming competitive threat.

Sephora has been successful in reimagining beauty industry and gaining from its digital investments. Its continued experimentation with new technologies and customer insights will define if it can remain ahead of the curve.

Sources

https://www.fastcompany.com/3043166/first-look-inside-sephoras-new-innovation-lab

https://www.cbinsights.com/research/report/sephora-teardown/

https://www.retaildive.com/news/sephora-reveals-the-next-big-thing/559167/

Great blog, Trishi! I did not know that Sephora was the only beauty brand that maintained a physical store within the lab space to test in-store experiences. This speaks about the brand’s retained focus on customer experience, and not just product innovation. Today with other forms of marketing like those through social media influencers advocating for specific brands, I wonder if Sephora (with that data that it has already) can create its own “influncers” platform or some form of “crowd-sourcing” to advertise but exclusively for Sephora.

All the digital steps taken so far seems to align with making the customer experience better. While that has an advertising component, I am thinking if Sephora will indulge in pure advertising “Digital” initiatives too.

Wonderful post! Sephora is a best in class example of how a company embraces digital innovation to improve the customer experience. Trial of new products is and will continue to be a difficult problem to solve within the e-commerce space, specifically as it relates to categories like beauty, apparel, food&bev, furniture, and baby products. Most retailers have tried to overcome this with robust return policies which is nice but doesn’t address the root cause of the problem. As you mentioned, Sephora has really one-upped just having a good return policy and seeks to directly address the issue of “how will this look on me?” Their innovations not only solve a tangible customer problem but also making the shopping experience fun! I would assume this would increase their time spent in app and overall engagement leading to increased revenue.

I continue to be surprised how other beauty retailers (ex. Ulta) have completely lagged behind in innovating on behalf of the customer. I view Sephora’s tech as their competitive advantage but I wonder if they would ever license it out to other retailers?

Hi Trishi! Thanks for an interesting post!

I had no idea Sephora were so innovative in their digital endeavors. I did read recently however that Sephora is launching its biggest expansion ever in 2020, opening 100 new stores, and would not be surprised if their success (I’m assuming) is partially a result of their thought leadership in the industry.

One challenge that comes to mind, for Sephora and its traditional competitors, is the advancement of Amazon’s rise as the one-stop-shop for beauty products. Sephora seems to be working under the assumption that it has to win and retain customers otherwise considering its close rival, leading it to focus on expensively “one-upping” the retail store journey and client experiences online. Yet I’m wondering – is it also advancing its offerings while keeping Amazon and other less obvious competitors in mind? Is it appealing enough to the younger “online-only generations” that may not value the cool features in the store as much as the current “in-store shopping generations”, at least not to the extent where they seek out the physical stores? If potential buyers don’t experience or are aware of Sephora’s customer-focused approach through seeing or visiting stores, it may be that buyers instead turn to Amazon as they don’t fully realize the gains of going to a website separate from where they do the rest of their shopping (Amazon).

To keep its leading position going forward, Sephora needs to make its value proposition online as unique and attractive as it is in-store, enough to win future customers going to Amazon, ideally even stealing Amazon’s existing ones. Perhaps they are already there, but I’m not yet convinced. A thought worth considering.

A great read! I had no idea Sephora was so innovative!

I felt the same concerns Eve did. To me, every retailer’s biggest competition is Amazon and I wonder how Sephora plans to take on the online shoppers. I am wondering whether most people prefer to buy makeup online or in store. If the trend is moving to the latter, then Sephora would need to have clear answer to why their app. Also, I wonder if it better to open so many physical store or push people to buy online and economize on the infrastructure? Of course that would be letting go off their present advantageous differentiator.

Evidently, a very thought provoking read!

It’s great to read how commitment Sephora is to digital transformation and its knowledge on customer pain point and in-store experience. I’m curious to know its long term strategy in regards to digital and how to find the balance especially in the in-store experiences. For example, what is the right formula for a great customer experience between a digital assistant AI and a in-store beauty adviser/customer service rep?