Rarejob: Disruption in English learning segment

Disruptive English conversation lesson to all non-English natives regardless of location

It is common knowledge that most Japanese cannot speak English very well. Japanese learn spelling and grammar in school but they rarely practice how to communicate in English. We learned in our RC year about Englishnization of Rakuten. The company adapted English as a common language as the founder and CEO Mikitani believed that it is the fastest way to make employee speak English and adapt to the global competitive environment.

A lot of Japanese have realized the importance of English in order to become competitive business professionals, and the demand of English learning has surged year by year. However, English conversation lesson was costly. It normally cost around $20 to $100 per hour. With the mission of “Chances for everyone, everywhere”, Rarejob provides affordable on-line English conversation lesson which only costs $5 per hour. It soon became No.1 English lesson provider in Japan and listed on Tokyo Mothers Board in 2014, only 7 years after its inception in 2007.

Value Creation

Rarejob provides affordable English conversation lesson by utilizing free internet communication device a.k.a. Skype with Philippine university students (or BA holder) as teacher. Philippines uses English as a common language and thus they are English native. The company’s customer satisfaction rate is exceptionally high as 99%. And the brand equity of is really high both from supply and demand side and thus it has successfully created barrier in both segments.

User satisfaction rate

Introduction of Philippine teachers

Value capture

Rarejob adapts monthly subscription model, starting from approx. $60 per month. It can receive cash up- front and thus maintain low working capital, as it does not require much inventory and other fixed costs (no need of rent for English lesson etc). Also it does not require much CAPEX.

Operation model

It is a two sided market place provider between non-English native students and Philippine English teachers. It receives monthly tuition from students and provides the portion (approx. 20%) to the Philippine who provide part-time English teaching through Skype. Rarejob provides screening of lecturers, English learning platform, and curriculum counseling and customer support.

Future of Rarejob

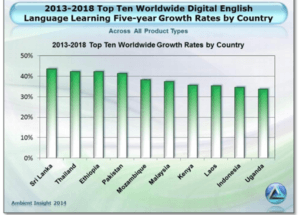

Rarejob has disrupted English conversation lesson industry in Japan, not only in individual markets but also BtoB market such as corporates and schools. The business is easily replicable and it expanded its business into Brazil. The revenue has been doubled since FY2013 and there are more market potential to eat share of incumbents in Japan and penetrate into emerging markets, where people are keen to study English but there is a gap of supply – demand. According to Ambient Insights, the growth of digital English language learning is tremendous and many countries showed over 30% CAGR in the last 5 years. Unlike many “freemium” English learning contents available through online, people who want to learn how to communicate in English have more willingness to pay to human interaction interface, as it is the only way to improve English conversation skills. It is not so far away from achieving mission of “improving English skill of 10 million Japanese” and move ahead of its mission.

Global demand of digital English Language Learning

Reference

- Rarejob Homepage, https://www.rarejob.co.jp/

- Rarejob recruiting page, https://www.rarejob.com.ph/

- Rarejob annual presentation, http://www.bridge-salon.jp/movie/6096_160513_7lSdod/present.pdf

- Ambient Insights 2014, http://www.ambientinsight.com/Resources/Documents/AmbientInsight-2013-2018-Worldwide-Digital-English-Language-Learning-Market-Executive-Overview.pdf

- The Next Billion Learners: Disrupting English-Language Education Programs, http://evolllution.com/opinions/billion-learners-disrupting-english-language-education-programs/

Nice post Tomo. As you mentioned this seems easy to replicate and hence may face threats from competitors in the short run. Is the brand equity the main differentiation feature from its competitors currently? If they need to source teachers from other countries, will they still be able to maintain a price point of $5 / hour for the lessons?

Thanks

Thanks for the post Rahul. Yes the entrance barrier is low in the industry. However, I believe first mover advantage works in the model for cost advantage and brand equity to solicit supply (teachers) and demand (students), at least in Japan. Customers are sticky and not so price sensitive if the price differentiation is in the range of single digit. Also they build their reputation in supply side and their recruiting network, word-of-mouth effect is strong to solicit qualified suppliers.

In addition, their back-end service has been established and they have more cost improvement opportunity by bringing the function in emerging markets such as Philippines and India.

Said, it is true that once they reach to the saturation point of retaining Philippine teachers, they need to seek other geographies. Then, they will face the challenge and it is true that their cost of acquiring supply would be higher and price point will be need to be scrutinized.