Quantopian: the democratization of Wall Street?

As quant hedge funds approach the $1 trillion AUM mark can crowd-sourcing investment algorithms proof to be a sustainable strategy to get an edge over the competition?

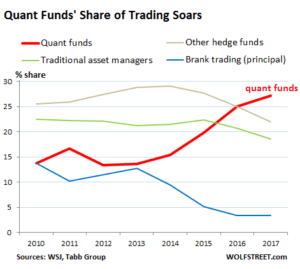

The hedge fund industry appears to be going through an arms race as systematic, computer-powered investment strategies gain traction and outcompete traditional investment strategies. Quantitative hedge funds now account for 27.1% of all U.S. stock trades up from 13.6% in 2013. Assets under management held by quant firms more than doubled from $408 billion in 2009 to $932 billion in 2017.

The success of quant hedge funds has been spurred by three main trends: (i) regulatory scrutiny has made it more difficult for investment professionals to get an edge by obtaining information from corporate executives, (ii) larger and more accurate data sets at the firm, industry and global level have become available to the public (iii) the rise of new technologies, specifically the advent of machine-learning, allows firms to better inform decision-making.

The basis of competition within the hedge fund industry is shifting. Firms are competing to attract professionals with completely different skillsets and heavily investing in technology as they try to maximize returns via sophisticated trading algorithms.

Quantopian is trying a different approach. Instead of embarking on an expensive and time-consuming recruitment process, they have created an online crowd-sourcing platform anyone can use to develop and test trading algorithms.

Value Creation

The thesis is that Quantopian can provide greater returns to investors by leveraging a diverse community of people that write investment algorithms and by allocating capital to those algorithms that meet certain criteria. The end goal is to develop and maintain a portfolio of highly uncorrelated investments.

Quantopian has successfully build its community of programmers (160,000 members and growing) by reducing the complexity of building trading algorithms and sharing the returns of profitable algorithms with their authors:

- Research: community members have access to Quantopian’s IPython environment where they can use and customize large data sets such as stock price, futures and corporate fundamental data. Their library has over 15 years of minute-level US equities data.

- Development: programmers can use the Quantopian platform to write the algorithms and backtest them for free. Their software runs the algorithms across multiple simulations using both historical data and walk-forward testing.

- Capital: Using a set of criteria, Quantopian selects the top performing algorithms and funds them. When a selected algorithm produces positive returns, the author receives a cut. The author of a funded algorithm doesn’t have to worry about the fund-raising process. In addition, Quantopian gives out daily prizes to the best performing algorithms.

- Training: Community members get access to online seminars on topics ranging from finance fundamentals to coding. Additionally, community members help each other with code problems and experienced professionals world-wide offer advice as well.

- Intellectual property: programmers get full intellectual property over the investment algorithms they develop. In contrast, in a traditional quant hedge fund the firm gets ownership over the algorithms developed by employees.

- Operations: the programmers don’t have to sit at a desk all day managing the daily operations of the algorithm. Quantopian does that for them and distributes earnings accordingly.

Value Capture

Quantopian allocates capital from external investors to algorithms that meet their performance criteria. Allocation sizes average $5 million per algorithm but vary depending on portfolio requirements and the algorithm’s performance and trading capacity. They intend to gradually ramp up the allocation sizes up to $50 million per algorithm. The author of the selected algorithm gets 10% of the returns generated, Quantopian charges a management fee (unstated) and the investors get the difference.

Additionally, there are cost advantages to Quantopian’s open-source model. First, attracting and recruiting physicists, mathematicians, coders and data scientists in the quant hedge fund industry is extremely expensive and time-consuming. Quantopian invests in its community-building efforts instead of competing with other firms for talent. Second, Quantopian can outsource its R&D efforts to the community instead of paying large teams of researchers.

Challenges

First, Quantopian will have to deliver the same or better performance than its competitors to attract funds. So far, the results have been mixed as their performance has lagged behind the industry average.

Second, there is a big question around how the crowd-source approach will work at scale. The performance of the algorithms may not justify increasing the allocation size per algorithm and, if this turns out to be the case, Quantopian will have a hard time scaling the platform.

Finally, Quantopian will need to invest in attracting talent to the platform as well as in training programs to ensure the community delivers quality algorithms. If only a handful of programmers get their algorithms funded, community members may stop contributing as the perceived likelihood of getting funded is low.

Sources:

https://www.wsj.com/articles/the-quants-run-wall-street-now-1495389108

https://www.ft.com/content/ff7528bc-ec16-11e7-8713-513b1d7ca85a