Quantopian: How Main Street Became a Worthy Competitor to Wall Street

How architectural change disrupted the hedge fund industry

Quantopian is a hedge fund that is powered by crowdsourced quantitative trading signals, otherwise known as “alphas”, developed on its an open innovation platform. What makes Quantopian so unique is their transparent and collaborative approach to strategy generation in a traditionally opaque and secretive industry through its platform. Quantopian has continued to grow in a period where traditional hedge funds are declining.

Understanding Hedge Funds and the External Environment

Hedge funds are alternative investments that employ different strategies or alphas to provide returns for their investors. On average 921 hedge funds closed each year from 2014 to 2017, a reflection of the fact that it is harder to find strategies that consistently generate positive returns these days. The methods to generate “alpha” are becoming increasingly sophisticated and funds who have continued on their business-as-usual course have found it increasingly difficult to generate returns and are being forced out of the market. Investor money meanwhile is consolidating into the hands of the larger firms who continue to make large investments in technology, data, and analytics. The hard question is how can a firm compete with large industry players with deep pockets to invest in sustaining innovation?

Quantopian’s Innovation

Quantopian offers a research platform posted on its web browser and template strategies that individual contributors can build off of and share and learned from. This is similar to Threadless in that designs are shared and rated. A concise summary of the platform is provided below.

However, I argue that unlike Threadless, which differentiated itself through its unique designs in its shirts, Quantopian is not differentiating itself through the unique generation of its strategies – it simply follows the current trends. Rather Quantopian’s innovation is architectural in nature and meant to enable it to keep pace with the technological change that so many other hedge funds have found difficult to envision or execute.

Core Concepts Reinforced

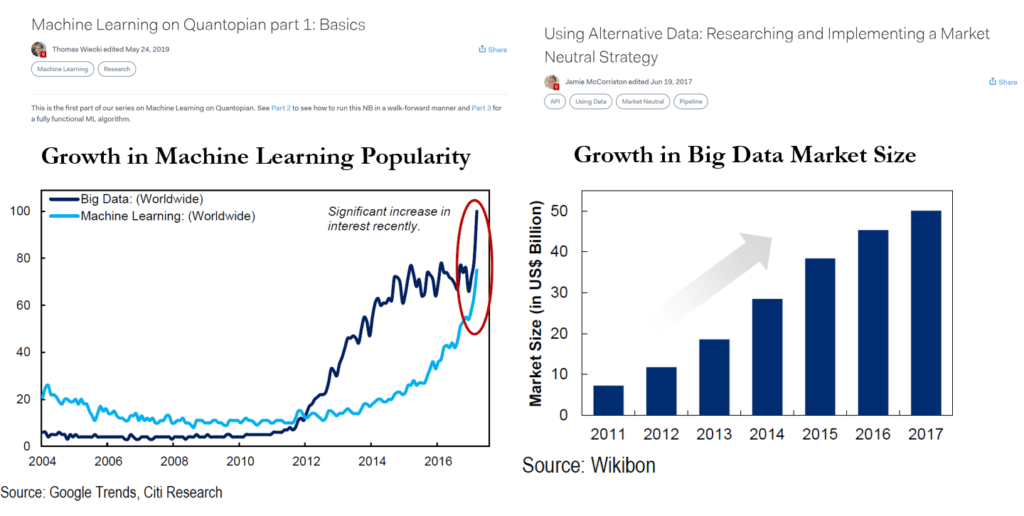

Quantopian’s blogs, webinars, and other materials educate their community on traditional aspects of quantitative investing. They do not offer a radical new approach to investing – rather they help explain and make accessible current trends in the industry. The figure below, for instance, shows how Quantopian’s blog posts are in response to the growth of big data and new, non-traditional datasets (known as “alternative data”)

An illustrative example of what both Quantopian and a traditional hedge fund are interested would be the application of credit card data to forecasting sales growth of a retail company.

What you might do if you’re trading Chipotle, let’s say, you’d look at the credit-card [data]. Well, that requires a tremendous number of machine-learning techniques to make that data useful and a tremendous number of data science and statistical techniques to make it insightful, and then you get to your financial model and you couple that maybe with geolocation data or some other thing. So that’s the new thing.”

Unfortunately, only the most well-resourced firms have the time and expertise to explore the merits of these datasets and evaluate which fits best into their investment process. Quantopian leverages an innovative crowdsourcing architecture to navigate the sea of data and sophisticated algorithms and find the bespoke strategies that fit into their broader portfolio.

Linkages have changed

Unlike traditional hedge funds, which develop strategies in-house with a select few investment professionals, Quantopian hosts contests open to all members of its community (over 225,000) to select its strategies. Also unlike traditional hedge funds, Quantopian does not own the intellectual property of the strategies – it licenses them from its creators under a revenue-sharing agreement. The specifics of the funding process are below – but the key takeaway is that while the architecture (i.e. the contests) are different for generating strategies, the strategies themselves as we discussed above are similar to those generated at the traditional hedge funds who are investing in sustaining innovation. The rest of the processes that make up the business are similar as well – like a traditional fund, Quantopian is subject to the same regulatory requirements, and has traditional support teams such as finance, public relations, and accounting. What the architectural innovation allows Quantopian to do is outsource the most expensive part of its operations – its R+D – at a fraction of the cost. Quantopian claims to have paid over 300K in royalties over the past year, but that can only be a third of what one investment professional makes at a traditional fund.

Closing Thoughts:

Quantopian’s architectural innovation in developing a crowdsourcing platform to generate strategies as opposed to building them in-house has allowed them to compete against well-entrenched, dominant firms with deep pockets while avoiding the fate of so many others that have not been able to keep up with the pace of technological change in the industry. Given its success, both entrenched players and new entrants have looked to emulate parts of its innovation. One thing we do know is that the democratization of wall street is very real and will only continue to grow in the future!

Sources

[2] Citi Research, Searching for Alpha: Big Data 10, March 2017

[3] Vault Guide to Hedge Funds, 2018

[4] Quantopian.com

Excellent post! I am very excited to see how Quantopian evolves, particularly given the recent change in investment leadership and product strategy.

A couple of quick questions – how do you think they can reconcile the community-generated alphas with their internal investment strategy? Since community alphas are very broad in risk and industry exposure and return profile, should they have an internal investment strategy and filter the alphas they get to a subset that aligns with their thesis? Alternatively, can they let the community jointly and dynamically determine the thesis, and focus purely on synthesizing the raw alphas to maximize risk-adjusted returns?

Also, is there an equivalent of slant (https://econbrowser.com/archives/2010/02/what_drives_med) and bias on this crowdsourcing platform? For instance, since early adopters of technology are likely over-indexed on the platform, the alphas might reflect an inordinate bias towards the technology industry, perhaps?

I agree with loremIpsum – the most interesting thing here is how they use this crowdsourced strategies for their own portfolio. I’d try some dynamic tracking of portfolio performance and re-balancing portfolio towards strong performers.

An interesting thing is that if it becomes really popular trends on this platform could influence the market (most likely indirectly through tracking by other players). I don’t know if the market will be more or less volatile as a result.

Thanks for the post – it’s awesome btw.