Plaid

Plaid's two-sided transaction platform

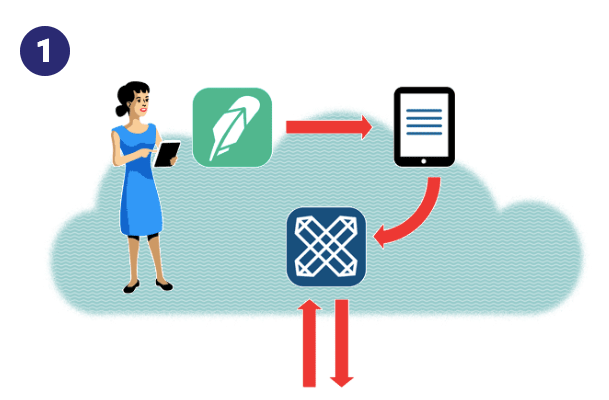

Plaid is a technology platform that enables applications to connect with user’s bank accounts. The company evolved out of the founders’ discovery that connecting bank accounts for fintech was a very painful process, so they sought to build a unified banking API that would solve this for other applications. To me, the company represents an innovative transaction platform because they have figured out how to build a two-sided network more effectively by targeting a limited set of participants on one side of the network. This approach comes with a few risks, which I will outline below.

Plaid is two-sided platform, which means it is successful when it reduces transaction costs for one or both sides of its platform. Plaid experiences cross-side network effects because more applications will be interested in joining the network when more banks are added to the platform: currently there are around 10,000 banks (Forbes). Plaid seems to have solved the chicken-and-egg problem that startups typically run into when trying to build a two-sided network. These kind of platforms can be very powerful because once erected, they create high barriers to entry for would-be competitors.

One interesting aspect of Plaid’s two-sided platform is that one side of the platform has a finite number of participants, which limits the work for Plaid to bootstrap the sides of its network. The number of banks for which Plaid can build connectivity are limited, so the customer acquisition costs are also limited. For the other side of its platform (applications/users), Plaid may still need to spend on customer acquisition, but by having one side of the platform be limited, it can save on some of the lift typically required (e.g. Upwork must attract unlimited numbers of freelancers and an unlimited number of clients to its platform).

On the other hand, precisely because the limited side of the platform is banks, the company is sometimes at the mercy of these banks – if the application fails because of the bank, the company has little recourse (their uptime is currently 95%). While would-be startup competitors face barriers to entry in starting a new two-sided network, banks might not: a consortium of banks could hypothetically provide the same service as Plaid, and potentially do so with higher uptime. Until recently, Plaid has likely survived in part because of its successful execution of the “puppy dog ploy” — making little fuss and remaining innocuous in order not to attract the attention of incumbents who might otherwise feel threatened.

Another threat to Plaid is that margins could shrink over time as its young tech clients start to focus on cutting costs. Competing services, especially if better funded, could easily compete by slashing prices.

Ultimately, Plaid is unlikely to be in a market that tips. There are not high switching costs for the clients using the API, there is the possibility for inexpensive multi-homing (e.g. clients using another API), and barriers to entry in this market are probably not sufficiently high. However, the way in which Plaid developed its two-sided network is worth consideration and potentially imitation for entrepreneurs interested in creating a two-sided transaction platform.

Citations:

https://www.forbes.com/plaid-fintech/#5691b08b67f9

In my previous company, we integrated with Yodlee which is a competitor of Plaid’s to display our customers’ bank account balances. I completely agree that the company creates a lot of value – especially for tech companies like mine, where we were working with customers who often had 5+ accounts scattered across many different banks, and struggled to see an overall picture of their accounts at any point in time. Despite the value created though, I think there are a number of challenges.

First, it’s definitely true that one side of the platform is capped since there are a finite number of banks. But, there’s huge discrepancy between the ease of integrating with the top 50 banks and the long tail of community banks and credit unions. I’m not entirely sure how Plaid builds their integrations, but with Yodlee it was a combination of direct access (OFX, other non-standard data feeds, sometimes files) and/or screen-scraping. What we found was that this was super error-prone. Especially in the case of screen-scraping, if the bank changes anything about the way their account screens are built, changes a header name, etc, the connection is broken until an engineer manually fixes. If the connection was broken with a big bank like BoA, that’d likely be fixed quickly because thousands of end customers are affected, but if you bank with one of the long-tail banks and your feed breaks, you’re usually in for a very long wait.

Second, in our case Yodlee advertised 18k connections, but many times those connections under the same umbrella – so BoA might have hundreds of account types across consumer, commercial, private banking. Regardless of whether this is the same way that Plaid reports connections, though there are a finite number of possible connections, that number is still very high and very challenging to maintain once they do exist.

I think there are two good pieces of news for Plaid though. I don’t think a consortium of banks would be successful entering this market. I don’t see how they’d ever be able to handle the long-tail of banks, and I can’t see much value in an app that only connects to the top 10-15 banks. Even if those account for a high % of accounts in the U.S., you’d lose so many potential end users.

Lastly, I actually think switching costs for the API customers are relatively high. Because there is such discrepancy in the data available for each bank, the formats, the timeliness, actually handling the data you get back from the API tends to be pretty complicated and requires custom error-handling on the application side. So even though you could likely switch from Plaid to Yodlee and still serve your BoA, Chase, WF customers without much trouble, it’d take a lot of rework to accommodate all of your long-tail customers. And, it may be a one-time thing, but once you’ve switched services, all of your customers have to re-authenticate to their accounts. Doesn’t sound like a big deal – but our customers HATED this process. And, if they’re slow to reconnect or have issues with the new service for any reason, you’re still paying monthly minimums for the service, while your customers are not receiving any value. Plaid has a reputation for being very developer-friendly, so if they’re able to elegantly handle the long-tail problem, I think they could definitely win this market.

Jillian,

Thanks for the interesting discussion of Plaid, a platform I was not previously aware of. I think you highlighted a key tension Plaid will face, the concentration of banks being both a plus (easier because it solves the chicken and egg problem), and a minus (harder because the banks can band together and possibly remove Plaid from the market). Specifically I wonder if there is a way for Plaid to greatly reduce the barriers to entry in order to keep new startups from competing with them and the banks from wanting to enter. One strategy that comes to mind, would be seeking out the large banks as investors. If say JP Morgan, Citi, etc all had an investment in Plaid they would be less interested in providing the service themselves as they benefit from the growth either way, and they would also be less likely to integrate with a new startup that they don’t have an equity stake in.

It’s really nice to read the blog since I did not even know Plaid before reading this. Similar to the question raised in previous comments, I am interested in how Plaid tackled with the “chicken-and-egg problem”. Is it because Plaid does not need to link customers and banks on the platform given a customer is already a bank user? Also, I am curious about how Plaid makes money. It does not look like a profitable business from current setting.

Hi Jillian,

Thank you for sharing about this interesting firm. I really enjoyed your point about how another better funded competitor could compete with Plaid on price. Dr. Greenstein and I had a brief conversation about the race to the bottom between platforms one day after class and he gave me a example of how a similar phenomenon happen in other industries such as airlines and those industries eventually end up focusing on high margin customers, e.g. business class travelers.

Side bar – Here is a link to an interview from yesterday’s Bloomberg Technology episode where a VC investor speaks about how Softbank and the dry powder in tech investing is unhealthy in his view.

https://www.bloomberg.com/news/videos/2019-02-22/why-keith-rabois-jumped-to-thiel-s-founders-fund-video

Nice. I totally see the issue of being at the whims of how participating banks choose to tweak and upgrade their digital infrastructure. When reading this I wonder how Venmo manages to get round that issue, though. Would love to discuss!