OLX: the unicorn the Tech World hoped for… or just another fantasy?

OLX, the world’s leading classifieds platform, missed the opportunity to go through the right Digital Transformation in a timely manner… Will they still be able to succeed?

As we wrap up the Digital Transformation course at HBS with the JD vs. Alibaba case, I can’t help but think how familiar the situation feels to me. Two years ago, before coming to my MBA I was working at OLX the Classifieds version of Alibaba for emerging countries. Co-founded by Alec Oxenford (1997 HBS graduate) and Fabrice Grinda, OLX has become the only of the four Argentinean unicorns which has not yet IPO-ed. On the opposite side of the e-commerce play, Marcos Galperin (1999 GSB grad) founder of Mercado Libre —the JD of the story— has seen his company grow exponentially, achieving a market capitalization of U$14.6 billion[1] up to date, and fighting courageously against Amazon’s expansion to the region.

For too long, OLX has turned a blind eye to the fully-integrated e-commerce play that Mercado Libre (Nasdaq: MELI) has been successfully deploying in Latin America, claiming that the second-hand market (used pre-owned goods) was a different animal with a strategy of its own, an idea reinforced by the fact that OLX was a global business with big operations in Asia, and therefore with different priorities. But the truth is that in Latin America MELI allows customers to sell used stuff in their platform, and not only connects buyers and sellers, but takes care of financing, distribution, returns, among other things… providing exceptional value and customer experience. And the same holds for the rest of the markets where OLX operates, although instead of MELI, with different competitors. Meanwhile, OLX has lagged to react.

In a context where big e-commerce players are betting to the integration of online, offline, logistics and data across a single value chain, what in the JD case we referred as “new retail”, can OLX still win given that they do not own inventory or have a logistics network?

This post will discuss two alternatives that OLX could explore to remain competitive:

Alternative 1: double down on digitalization, to generate a competitive advantage in the online space, focusing on creating an extraordinary personalized and seamless experience in boundaryless retail

At the end of the day, many networks work as intermediaries between buyers and sellers, to enhance peer to peer collaboration, just like OLX. Think about Uber, Lyft, Airbnb or even Spotify. OLX just needs to find the right formula that will direct those +54 million monthly listings to the right eyeballs that visit the platform +1.9 billion times a month[2] around the world.

Easier said than done, but let’s look at some recommendations that could help in this direction:

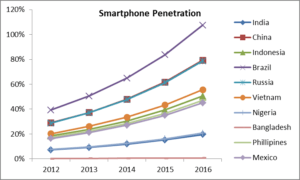

To double-click on what an “extraordinarily personalized” and “seamless” second-hand shopping experience can entail, we need to understand that a particular trend has impacted emerging markets radically changing consumer behavior: mobile penetration. Mobile made it possible to leapfrog the developed world internet adoption through PC, allowing people in developing economies to access internet though their smartphones or mobile webs[3].

Source: MRII

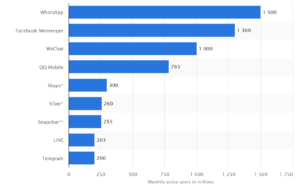

The corollary for that is that 76% of internet users use social networks, with the most avid users coming from emerging markets: in the Middle East 86% of internet users use social media, Latin America 82%, Africa 76%, US 71%, and Europe 65%[4]. And interestingly, messaging apps have also been growing exponentially with major penetration in emerging markets: This month, April 2018, the messaging app with most active users worldwide was WhatsApp, with 1.5 billion monthly active users, growing from a base of only 200 million users in April 2013 (only five years ago), and countries with greater WhatsApp penetration are all emerging economies, with Mexico and Brazil taking the lead with a 56%[5][6][7] WhatsApp penetration.

Most popular global mobile messenger apps (millions of active monthly users, April 2018:

Source: Statista

Fantastic! So OLX could delight its customers with a mobile-first ultra-personalized shopping experience that leverages machine learning algorithms that connects to social media to identify user preferences, uses mobile geolocation technology to show the right content at the right time, and WhatsApp for seller-buyer interactions.

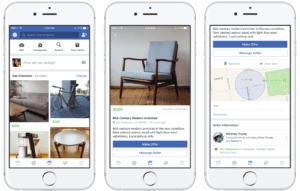

Sure, all of the above is true, but that the problem is we are two years late, and other players had also figured this out. Maybe Facebook didn’t think all the strategy through in 2014 when it decided to acquire WhatsApp for $19 billion[8], but surely they had thought it out in October 2016 when they launched their own marketplace. The TechCrunch article announced: “Facebook launches Marketplace, a friendlier Craigslist”[9].

Despite OLX had all the strategic elements at sight a few years before Facebook (there’s no better evidence for that than Alec Oxenford’s following venture launch: Let Go) there is a price the company will have to pay for executing slow in the Digitalization era.

In addition, OLX (as all other free shopping apps) have had challenges in making money from their businesses. Carrying large investments on their backs, they have focused on building huge audiences that they hope will eventually be able to monetize[10]. In that light, a second strategic alternative for OLX could be focusing on areas where they can really capture value.

Alternative 2: Segment the pre-owned customer experience journeys and focus on solving pain-points and capturing value through added services

Customers that buy a used iPhone charger will probably need very different things that those who are looking to buy a used car, and OLX knows that. A car is a high-ticket price item, non-recurrently purchased —at least not for average end-consumers— with high moral hazard issues that need to be solved: involving inspections, certifications, presentation of papers that asserts that a specific car do not hold fines or hasn’t been stolen, insurance, etc. On the other hand, the puppy you need to buy as a gift for a significant other, should be bought ideally between day 45 and 90 after the puppy’s birth, be vaccinated, and ideally come with pet food, toys and accessories like leashes, creates, and blankets to make the gift just perfect.

Defining these different customer journeys and becoming a solution-oriented network with integrated partners and services that make the experience enjoyable could allow OLX to capture the value of putting in place this integrated solution stack. The challenges of this approach is to avoid becoming too verticalized (and competing with other already vertical platforms), and finding the right local partners. In that line, prioritization and execution in the right markets with the right partners is critical. Contrary to the previous “personalization strategy” where tools and features can serve and be deployed to all users and markets, this play is highly-localized, each market and customer experience should be “cherry-picked”, and therefore could be problematic to scale up quickly. On the opportunity side, organizationally this last alternative should push for the formation of cross-functional local agile teams to take full ownership in experimenting, innovating and learning fast, which might create an environment of excitement that might allow OLX to capture good talent. Leaving the burden on that talent to find the new initiatives that will allow OLX to awake and become disruptive again.

From OLX we should learn that good timing for digital transformation is key, and that strategic errors or slow execution cost money and provide runway for new competitors to enter (and even get ahead). But, it will also be very interesting to be patient and see how things turn out: will OLX fail? Or will it stick around for a while? Can companies – backed with good money – comeback? Can you catch-up on digital transformations?

Can OLX innovate around the marketplace personalization strategy while Facebook is distracted solving for data security and #FakeNews? Or should they change gears and focus on solving customers journeys? What strategy would you pursue?

No matter what your answer is, it is very likely that OLX will teach us some good lessons around digital transformation over the next few years.

Sources:

[1] https://finance.yahoo.com/quote/MELI/

[2] https://help.olx.com.ar/hc/es-419/articles/212163126

[3] https://blog.mrii.org/the-real-value-of-mobile-for-mr/

[5] https://www.statista.com/statistics/258749/most-popular-global-mobile-messenger-apps/

[6] https://www.statista.com/statistics/260819/number-of-monthly-active-whatsapp-users/

[7] https://www.statista.com/statistics/289492/whatsapp-popularity-in-emerging-markets/

[8] http://money.cnn.com/2014/02/19/technology/social/facebook-whatsapp/index.html

[9] https://techcrunch.com/2016/10/03/facebook-marketplace-2/

Thank you Jean! This post reminded me to the Nokia case, and how a company can lose its competitive advantage by slowing down in the digital transformation process.

It also made me think how hard it is to make decisions when the future is uncertain and there is not recipe that can guarantee success. These two alternatives show feasible paths, so how should we think about choosing one? What framework should we use? I don’t have a clear answer, but I would recommend thinking about:

i) what are the key advantages that OLX has (data, user base, brand?) and which of these alternatives can build on that?

ii) what alternative will create more differentiation/ barriers to entry in the future?

iii) if there are high network effects, are we set in a position to win?

And finally, I thought about a third alternative, selling the company to a big tech. Maybe there’s more to win by selling the data and user base, so that the founders can think about the next Unicorn for Latin America.