Nike: It’s Data Analytics, Just Do It

Nike has proven itself since its start as a leader in innovation. It redefined shoe design and global supply chains. Now it is revolutionizing retail and sportswear through data analytics.

Retail has been completely transformed with the advent of digital. No one doubts this fact anymore. However, some legacy fashion brands that have been around for years have been able to use this transformational industry shock as a force of change within their own operation. One that stands out of the pack is Nike who has managed to grow despite digital by driving a successful transformation from a legacy consumer goods business to a technology-driven DTC enterprise.

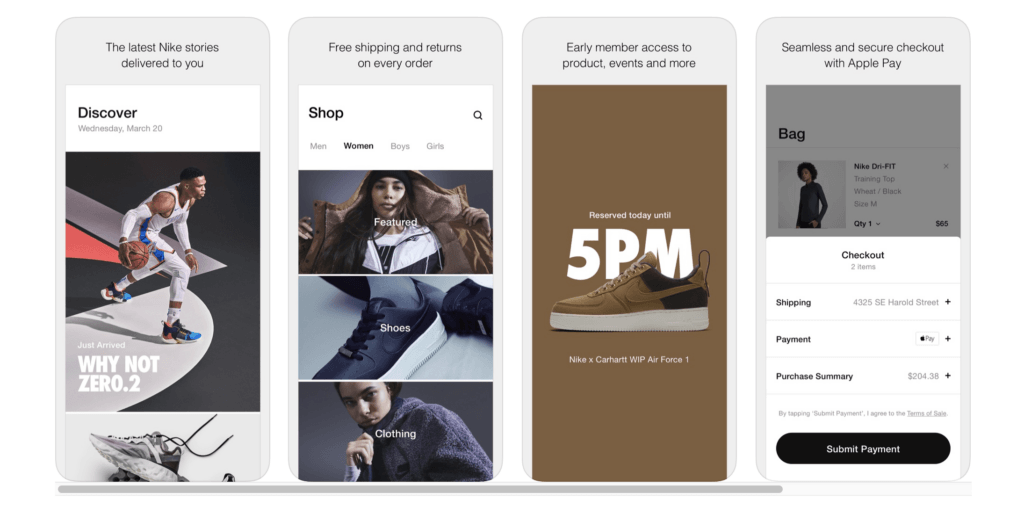

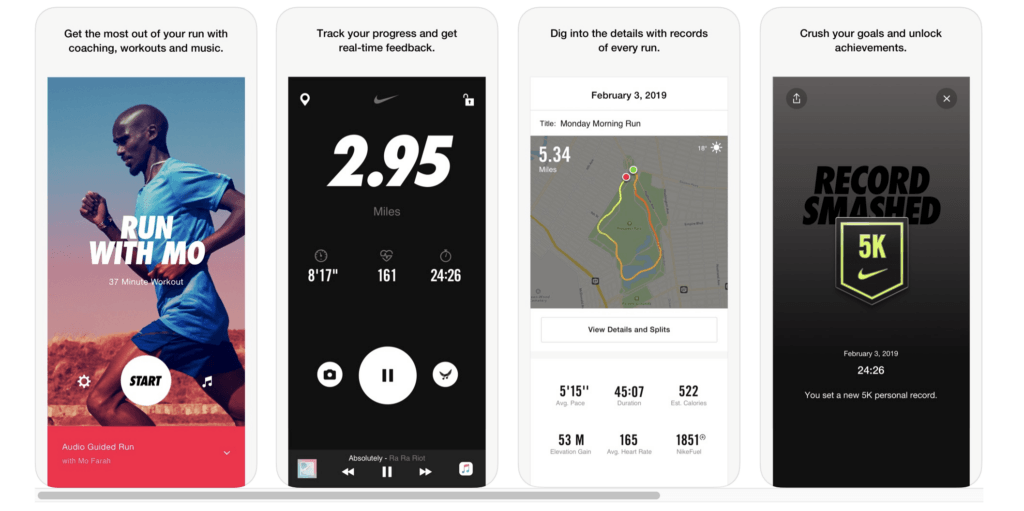

Key to Nike’s digital transformation and the embrace of big data into its operation is its wide-ranging arsenal of mobile apps, seven of them:

- Nike app – offers wide-ranging sales support and houses its general loyalty program.

- Nike Run Club – logs users’ fitness goals and progress with a focused interface on running.

- Nike Training Club – logs users’ fitness goals and progress with a wider scope than running.

- SNRKS – provides insider access to launches and events for those customers whose footwear purchases are less function and more fashion.

- Nike Connect – uses near-field communication to scan the tag of a jersey, allowing users to unlock exclusive content

- Nike Adapt – controls connected footwear, adjusting its fit or customizing the lights.

- Nike Fit – uses a combination of computer vision, data science, machine learning and artificial intelligence to cultivate a digital foot morphology based on 13 data points

Through this rich app ecosystem, Nike not only improves customer experience and empowers these customers, but it also collects and helps them generate a significant amount of data that better help it understand them. Nike can use these data for straightforward applications such as personalized recommendations and content delivery to its customers that is hard to replicate by competitors. Moreover, it makes the customer experience transcend the purchase of sportswear and shoes, it becomes integrated into the actual use of these items.

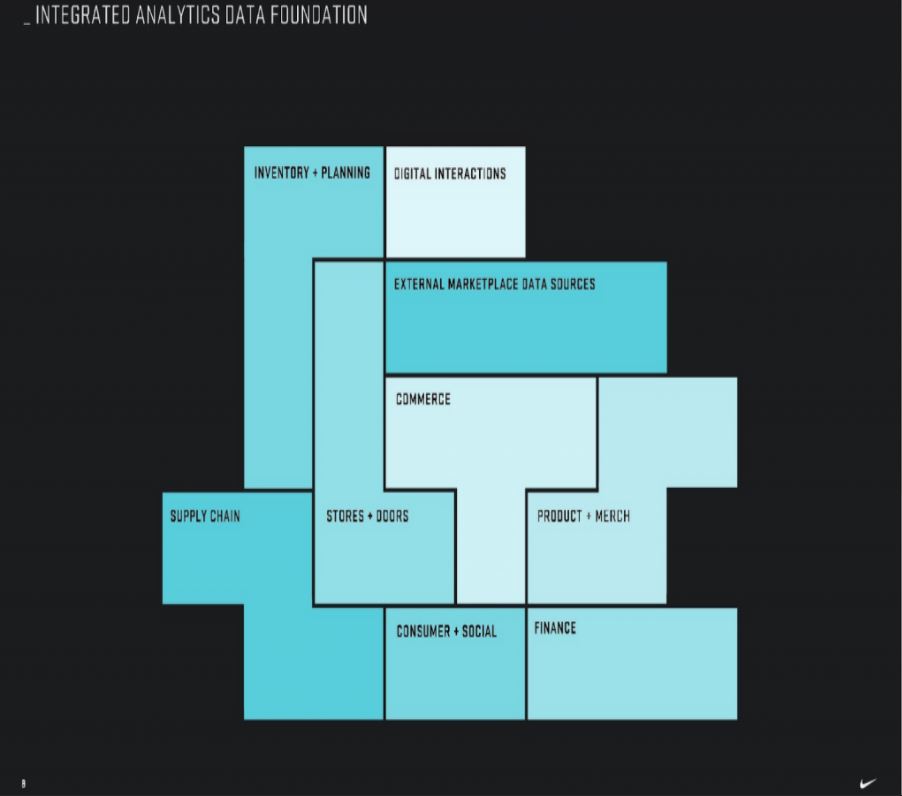

In order to better use the data collected through its apps, Nike made two key acquisitions in the past years. In 2018, Nike bought Zodiac, a marketing-focused tool that allows it to analyze the data it collects from its various apps to better understand customer habits and predict purchasing decisions.[i] Nike has incorporated Zodiac into its app to facilitate personalized product recommendations and content. In addition, in 2019, Nike bought Celect, a demand-sensing analytics platform that “provides proprietary insights that allow retailers to optimize inventory across an omnichannel environment through hyper-local demand predictions.” Through this inventory management platform Nike is able to more effectively decide what products to produce and where to sell them.[ii] Furthermore, Nike has put together a formidable enterprise analytics foundation across its operations, from finance to marketing, which links its recent data analysis asset acquisitions with its apps data and the company as a whole.

While Nike, has had a successful digital transformation in recent years by shifting its business model to be focused on the better collection and use of their customer’s data, there are still challenges ahead for the company. Competition is now not solely focused on other legacy sportswear retailers, but on nimbler DTC digitally native competitors with different cost structures that are disrupting Nike’s business, along with tech companies that are better equipped to collect customer data than Nike, such as an Amazon. These new competitors are nothing like those of Nike’s past, and while the company has done a great job reinventing itself, maybe it is will not be enough.

Moving forward Nike has to focus on three main levers driven by its growing data analytics capability. First and foremost, it has to enhance its ability to collect user data. It could potentially achieve this through higher focus on the expansion of its existing app portfolio or the acquisition of external yet adjacent apps that dominate the market such as Strava. Second, is the use of its data to reinvent its cost structure to further emulate its DTC competitors. And the third is to further integrate its data analytics processes into its content creation capabilities which have been a hallmark differentiator of the brand since its early years, and is something that is increasingly important for the younger generations who are flooded with all kind of content in their digital lives. Nike is taking the steps in the right direction, but it still has some steps to go for it to truly reinvent itself as a tech company.

[i] https://news.nike.com/news/nike-data-analytics-zodiac

[ii] https://news.nike.com/news/nike-celect-acquisition

Nike indeed is a great example of a data-driven company. I am wondering however if its mobile strategy is allowing to make the most out of the data capabilities. 7 different apps bring -without any doubt- problems to link the data out of these apps to one single customer (e.g. people having different e-mail addresses in the different apps).

Since the mobile channel is mainly used to create a personalized experience facilitating both upsell and cross-sell in the long-term, it feels much more natural to me to bundle all functionality into one single app.

After all, a bank doesn’t have separate apps for it current accounts, savings, investments…, isn’t it?

Thank you for the insightful post. I am curious to know if Nike’s strategy going forward is focused mainly on online sales vs offline sales in past? Seems like they are trying to engage customers via various apps but are they also leveraging data to improve offline experience?

Thank you for a great post, Francisco! Do you think Nike’s move to Data Analytics was intended to drive online sales or do you think it was a natural extension as a purpose brand of bringing the training of star athletes to the masses?

Thanks for sharing Francisco. I am surprised that Nike has decided to launch 7 independent apps, instead of encapsulating the entire ecosystem in a master app. What are your thoughts about the tradeoff between complexity and targeting specific niches, given that mobile apps is not precisely the core business of Nike (or is it now?)

Thank you very much for this, excellent post!

As already mentioned by Tim and Tomas, I’d be curious to know your opinion on whether having 7 different apps is the best strategy to maximize data collection and analysis.