New York Times Digital: Progress Through Trial and Error

After introducing a “pay wall” to readers in 2011, The New York Times has launched several digital initiatives to grow online readership, and the results are mixed.

The proliferation of digital media has impacted many traditional media sectors, especially print journalism.

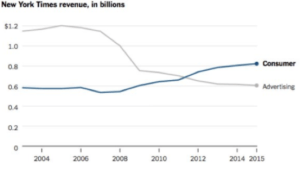

With the advent of the mobile internet, news publishers transitioned much of their editorial content online to satisfy reader demand. General news organizations, specifically, the New York Times (NYT), have struggled to find an appropriate strategy for distributing and monetizing their content online. After pursuing an online ad revenue based strategy for several years, the NYT realized that digital advertising revenue failed to offset the losses in revenue from the industry-wide decline in print advertising and newspaper circulation.

The NYT introduced a pay wall for online readers in March 2011. In this initial strategy, NYT allowed readers to access up to 20 online articles per month, after which they were required to pay for a subscription (print or digital) to view additional online content. At this time, the “pay wall” approach had previously worked well for niche news publishers such as the Wall Street Journal, and the NYT hoped to replicate this success. To date, and in comparison to other traditional newspaper publishers, the NYT pay wall has been a relative success — the service managed to attract ~1mm digital subscribers that generate a significant portion of the NYT revenue (~$400mm). However, the NYT has spent the last few years tinkering with its digital strategy as digital subscriber growth leveled off in 2013 and 2014.

Using best practices from its “pay wall” approach, the NYT shifted its focus from a general news subscription service to offering niche apps that attract specific audience segments that each have different use cases. This niche app strategy aimed to expand NYT’s reach by attracting new subscribers with more affordable subscription packages than the NYT’s general news offering. In 2014, the NYT released an array of apps including NYT Opinion for $5.99/month, NYT Now for $7.99/month, and NYT Crossword for $6.99/month. To its dismay, none of these appeared to achieve the right product-market fit that would significantly grow NYT’s digital subscriber base.

A specific example is the NYT Now app. NYT Now was a well-designed product meant to attract mobile-savvy millennial users by providing curated, short-form news stories that kept readers informed. After a highly anticipated release, the subscription-based app did not achieve the level of user adoption desired by NYT leadership. In a last attempt to expand reach, NYT Now was transitioned to a free app. Even then, the app did not help drive NYT subscription growth or conversion. While many users and online reviewers praised the design and features of the NYT Now app, NYT ultimately shut down the app in August 2016 (NYT Opinion shuttered in 2014).

Although the NYT Now app was not a success, NYT incorporated popular features from the app into its general NYT app, which will serve as the company’s core owned and operated digital distribution platform. The company has learned that segmenting its readership was not a successful approach, and that it must leverage third party destinations such as Facebook and Twitter to in order to reach younger audiences.

While many have categorized the NYT’s digital strategy as “flailing”, it is clear that NYT is one of the few traditional media companies that has made an effort to embrace and experiment with the impact of digital platforms. Outside of the apps mentioned in this post, NYT has pursued other “long shot” initiatives such as distributing Google Cardboard headsets to its print circulation to promote its NYT VR app released in November 2015.

Although the NYT has a growing list of digital failures, the company’s innovative experimentation with digital platforms will pay dividends as its audience continues to shift to a mostly online readership.

References:

http://www.recode.net/2016/9/1/12732004/sam-dolnick-cliff-levy-new-york-times-digital-strategy-nytnow-virtual-reality

The New York Times’ new app strategy seems lackluster at best — so what does it do now?

4 takeaways from The New York Times’ new digital strategy memo

Thanks so much for the post, Michelle. I hadn’t realized that the NYT had tried such a segmented approach to content distribution via various apps. I’m curious if some of the challenges with the pay wall (and its plateauing subscription growth) is due to tech-savvy readers (in particular, the millennial demographic) gradually figuring out ways around the pay wall (e.g. googling a specific article and using the google redirect to avoid the wall). I imagine that the NYT digital team is constantly looking for ways to combat these avid NYT readers who find creative ways to not pay for the content they’re accessing. It would be interesting to see what kind of subscription growth results from the implementation of stronger pay walls and if it’s sustained growth.

Thanks Michelle! I am an avid fan of the NYT and also didn’t know about their niche apps. I agree they are making big strides in digital news – especially on Facebook by using 360 videos and Live almost daily now. I wonder if they need to shift their focus from new customer acquisition to up-selling their existing customer base. My guess is that their core readership may already have subscribed to the platform and the next step would be to find ways to capture more revenue from them, instead of finding new readers.

Thank you Michelle, The New York Times has always been so called General interest publication, which means it covered a very broad range of information, starting from breaking news and ending up high quality journalist investigations. Unfortunately the most recent trend in the industry is that content is becoming more and more customized and localized (even with globalization). With this trend NYT had to change its model and so far it’s one of the most successful publishing houses on the market. I think they have consciously decided to position themselves as a niche product of high quality – like Cartier of newspapers and looks like their calculations work fine. Their revenues are growing (most publications are declining), even though the structure of the revenues is changing dramatically. They are good in capturing value through additional online services, but I’m sure with a time they will have to make a huge change in their business model.

Most recently all media is converging into media content generating platforms. And most successful media companies are already there. If 10 years ago newspapers generate their own content, magazines generated their own content and it was different, TV channels generated their content and it was video content, radio stations generated another audio content and online media generated online content, right now all these outlets are converging into single content generating platforms that generate one content and transfer it into different media. This is the way the NYT should go if it wants to stay competitive with other media. I believe that paid subscriptions model will work for a number of years, but it’s not sustainable, because it has to compete with online media that are free of charge and way faster in news coverage than publications. In order to succeed the NYT should converge into multimedia content generating platform and let it be high-quality content generating platform.

Thanks Michelle for this great post. We clearly see a commoditization of information happening in the digital age, certainly at the expense of quality. With the public become more and more aware of issues of fake news, I wonder wether consumer behavior is not going to shift to a higher willingness to pay for accurate good quality journalistic content. At the end of the day, we still need journalists to add value by verifying sources, conducting research, and filtering out information. I wonder besides subscription and pay wall, what kind of new innovative business models could be imagined to enable this transition?