Netflix: the rise of a new online streaming platform universe

Description: Netflix was the first media company to capture a new consumer generation, “cord-nevers” and “cord-cutters”, via a robust online streaming platform, where it connects content providers and content consumers, building value for the whole ecosystem.

Netflix is on-demand video streaming platform, that connects video content providers and final consumers, most of whom are either “cord-cutters” or “cord-nevers”. As of 2017 Netflix was valued at $60 billion, reported $11.7 billion in revenues, had 117.6 million streaming members worldwide and boasted 50 billion hours of content watched. In 2013 it started developing its own original content and in 2018 claimed to spend $8 billion on original content production, aiming at around 700 original TV shows.

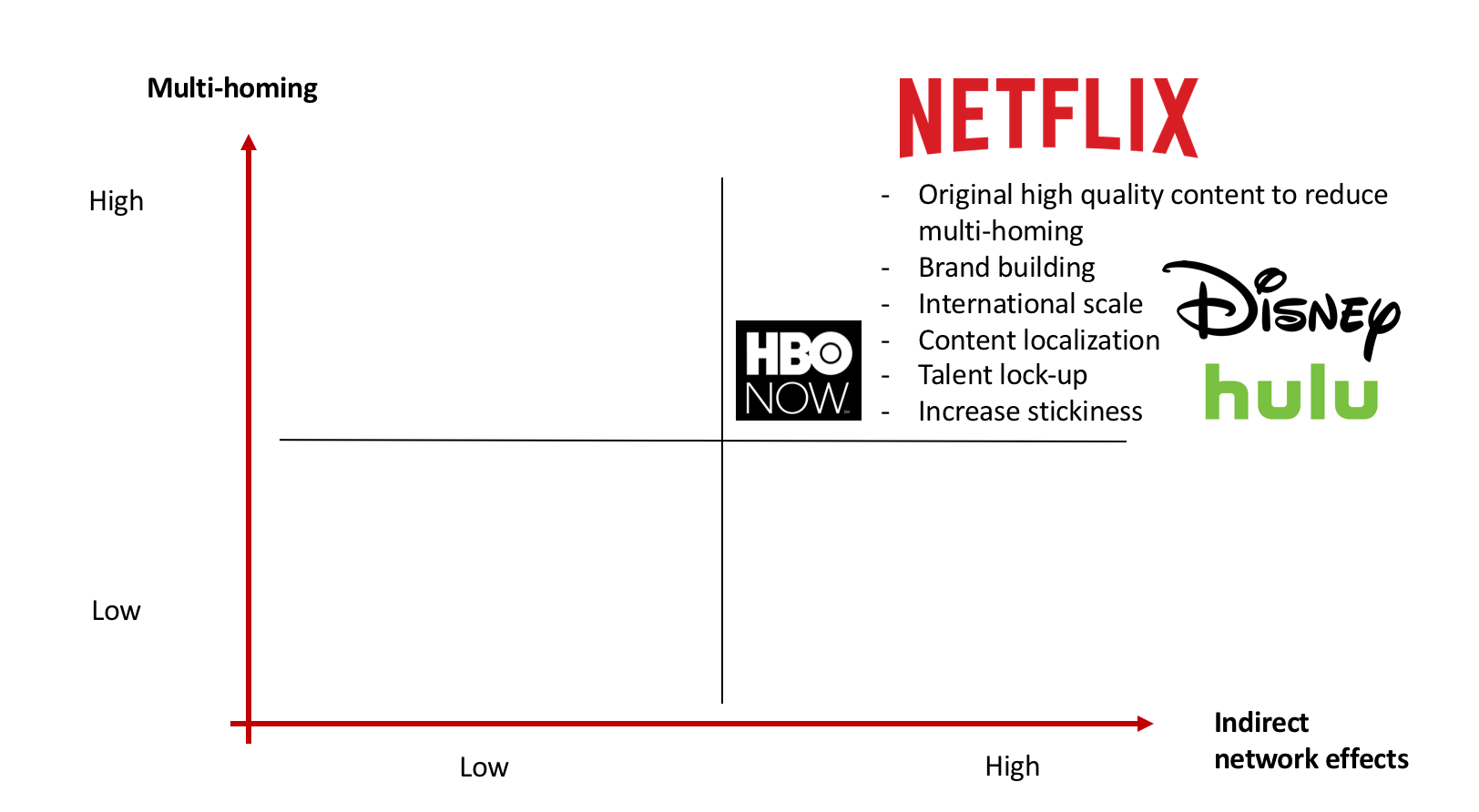

Just like social networks of the world, Netflix doesn’t exist in the world of “winner takes it all”, but rather in a highly-competitive environment with high indirect networks effects (the more viewers it has, the better chance it has to get best content and talents and vice versa) and multi-homing (streaming services are hugely dependent on the top shows and cannot prevent consumer from switching to other platform once the top show is over).

Value creation: Netflix provides value to the whole ecosystem – both consumers and content providers.

- Affordable price. Netflix, first among content providers, introduced monthly subscription fee as low as $7.99, offering a vast amount of content for everyone.

- Accessibility. Netflix made it possible for people to watch video anywhere anytime, capturing growing multi-devicing trend. Importantly, Netflix created value through offering personalized recommendations and helping customers chose a video to watch without searching & evaluating content in its vast library.

- Benefits for content providers. Netflix has become a great new channel for the content distribution of the media companies, paying high prices for the licensing deals. Its fast-growing audience allowed it to close more exclusive and larger deals with the best companies out there including Disney, Warner Brothers etc. Over time, of course, these companies realized that Netflix was much more of a direct competitor than just a distribution channel.

- Original content. First, with critically acclaimed shows like Stranger things, Orange is a new black and House of cards, it helps to attract more viewers on the platform and increasing binge-watching. Second, with more traditional media companies realizing the scale of threat Netflix presented, original content became a tool to defend itself when the licensing becomes trickier. And just in time: Disney pulled out most of its content in 2017 in preparation to launch its own OTT (over the top) service, and others will probably follow shortly, too. Over the time, Netflix will substitute its current content providers with producers, directors and actors, working with them directly.

Value caption: Netflix is one of a few digital platforms that doesn’t have advertising. Instead, it offers a tiered monthly fee ranging between $7.99 and $13.99 depending on the number of devices and video quality chosen. Such set up depends largely on growing client base as fast as possible, which Netflix has been doing successfully over the years both in U.S. and internationally.

There are several ways Netflix can reinforce its stronghold:

- Scale up: Netflix survival relies heavily on scale – both to afford its ad free model and sponsor its growing original content production. It should push harder international expansion and localization of its content, which it has started already: so far it has 80 original productions from outside the U.S.

- Improve consumer stickiness and reduce multi-homing through versatile original content and improved recommendation algorithm

- Leverage its first mover position and lock long-term exclusive deals with top talent (directors, producers, actors) to secure future pipeline of high quality content

- Differentiate by building a stronger brand, especially outside of the U.S.

- Reduce its exposure to studios

Sources:

http://variety.com/2018/digital/news/netflix-disney-streaming-service-reaction-1202672649/

http://variety.com/2018/digital/news/netflix-700-original-movies-series-2018-1202711940/

https://hbr.org/2016/08/the-best-platforms-are-more-than-matchmakers

https://d3.harvard.edu/platform-digit/submission/netflix-winning-in-21st-century-media/

https://hbr.org/2016/08/use-big-data-to-create-value-for-customers-not-just-target-them

https://hbr.org/2014/10/capture-more-value

https://www.statista.com/statistics/272545/annual-revenue-of-netflix/

Thanks for the post! I see the larger investments in original content a strategic necessity and one that makes more sense with content creators such as Disney defecting. Interestingly, the more netflix invests in original content, the less it becomes a true “platform” and it starts to resemble a media company with online only distribution, i.e. its becoming a pipeline business like Amazon growing its retail operations. My big question for Netflix is what the maintenance expenses really are, since the company keeps spending tons of money to grow users. The market so far is treating these expenses like “growth” capex, but if it turns out to be maintenance, it becomes a much less attractive business.

This is a very interesting subject Iryna, thank you for writing about it!

I completely agree with the comments regarding the importance of content development and deal exclusivity to ensure sustainability, but I think it may not be enough for the long term survival of the platform. In an industry with low switching costs and thus high multi-homing tendencies, creating original content I think will only further encourage users to multi-home in order to get differentiated alternatives. Therefore, I believe that differentiation, in areas other than content, as you mentioned, is the safer way to go. Increased social media-like attributes, such as peer recommendation and / or following, could be included in Netflix to increase the engagement and time that users spend in the platform. As competition increases it will be interesting to see how companies create additional value in order to attract users.

Thank you for such an interesting post!

Like one of the comments above, I had the same thought about how much is Netflix really a “platform”, especially given its increasing number of original productions? New productions are high capex, strategic, and will be distributed over multiple channels eventually. I understand that one may think of creating unique shows and movies as a means to reduce multi-homing but who is that really helping? Won’t Netflix benefit more by distributing its content over a large set of platforms over the longer term? Won’t the users (who multi-home a lot) benefit from being able to access content wherever they want? I think of Netflix more as a production house with a technology driven distribution channel, whereas a platform is a place that facilitates exchanges between buyers and sellers. If Netflix becomes the largest seller on its own “platform” and users buy directly from Netflix, then does it really remain a platform? I’m not so sure…

Great post Yrina!

Netflix is an exceptional example of platforms that have succeeded, and I find its search engine recommendation among the platforms’ most outstanding features, but in the World of FB, TW, IG and SNAP my question is if they are maximizing such feature at its full potential.

While Netflix has proven very good at understanding our own tastes and recommending related content, in the era of social media, I have observed people wanting to know and see things that they care about, but also things that their group of belonging or even influencers care about. I can easily see Netflix’s next step in evolving its content recommendation algorithm being in line with becoming a social media platform, where users rate and recommend content, that others can see and also decide to watch. “Follow me on Netflix”, “Sign up to Katy Perry’s watchlist”, having experts verified profiles organizing livestream community movie-sessions, or even customizing your Netflix profile are things that I could see happening soon, that could reinforce the power of the network and could also provide space for new revenue streams. As with social media, there some consequences that we should beware, for example: content homogenization and virality! But why shouldn’t Netflix leverage the thing it is best at: analyzing its users watching behavior to push for relevant content?

Nice choice. There many trade offs and dilemma’s in Netflix model. Despite all the beauties of Netflix brand and model, computing with Amazon platform is the biggest challenge for a company. I think the main challenge is to deal with multi-homing. Hence, exclusive content is the main differentiation point. As multi-homing drives exclusive content, Netflix is facing the danger of moving backwards from platform to product. As it gets more integrated, all the advantages of indirect network effects might be negatively effected. That’s why, competing against platforms is dangerous even for platforms.