NBCUniversal: Can the peacock become a phoenix?

COVID-19 has disproportionately affected traditional media conglomerates relative to their streaming-only competitors. NBCUniversal is one such facing production freezes, theme park closures, and declining ad revenues. Despite setbacks, the company is innovating today to build digital capabilities and services that will help it succeed after the crisis.

A FIRE IS BURNING

With more people homebound than ever before, many believed entertainment media providers would emerge as winners from the COVID-19 crisis. American consumers are now streaming an average of eight hours of television per day, double pre-crisis levels, and news networks are breaking viewership records regularly [1]. These positive trends, however, belie deeper issues that the industry is facing.

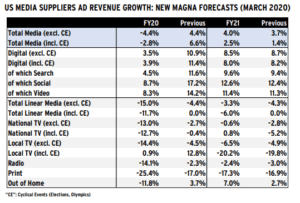

Media companies are dealing with challenges on all sides, from production and theme park shutdowns to significant declines in advertising dollars. Spring is typically a busy season for live sports and pilot productions, but closures have and will continue to force providers to rely on old content to keep viewers entertained. Additionally, there was a 13% drop in overall TV ad revenue in March driven largely by a 76% decline in sports-related ads due to NBA, MLB, and NHL cancellations [2]. With many of the world’s largest advertisers suffering from reduced sales, traditional TV ad spending is expected to be down 12% overall in 2020 [3]. Digital ad sales will likely experience some growth, but it will be much lower than expected as video producers struggle to fill all the ad inventory being created by people streaming more at home [4].

For these reasons, COVID has and will continue to have a disproportionately negative impact in the short term on diversified media providers regardless of what they do. The crisis will exacerbate viewers’ movement from traditional and paid television to streaming services unless providers take steps now to come out of this period more resilient and digitally savvy. NBCUniversal is one such company that has been significantly impact by COVID, but has basic building blocks in place to use digital innovation to emerge stronger and more resilient from the ashes of COVID.

PEACOCKS CAN’T FLY…

NBCUniversal (NBCU) is a Comcast-owned media conglomerate that includes the NBC Broadcast Network, the Universal Pictures Movie Studio, a number of theme parks, and various news and entertainment cable channels. The theme park and movie businesses have been hardest hit by coronavirus shutdowns with movie production and premiers halted and the parks shut down through May 31st. Theme park revenue was down 32% in the first quarter, and the company expects to lose an additional $500M if the parks aren’t reopened in June [5]. Workers have been furloughed in both divisions, but the CEO has hinted at lay-offs coming soon if current conditions continue [6].

The TV side of NBCU has fared only moderately better. NBCU’s ad revenue was down 7.6% in March despite rising viewership numbers, which was worse than competitors ABC and Fox, who actually saw small increases in revenue [7]. Despite reporting no losses from sports rights or the postponed Olympics (amortization costs are only incurred when sporting events happen), the TV-related components of NBC’s business have been hard hit by production shutdowns of over 35 of its channels’ live and scripted shows [8]. NBC’s Broadcast Network and channels are facing increasingly stiff competition from incumbent streaming competitors who are still able to offer new content because of their backlogs or innovative ways of producing new shows despite lockdowns (e.g. Netflix, Amazon, YouTube, Facebook). COVID has also accelerated competition in the streaming space by encouraging launches of Quibi and a streaming service from Apple (both offered at low- or no-cost), and the May launch of HBOMax [9].

….OR CAN THEY?

The impact of COVID on NBCU was unavoidable, but the company has taken important steps to influence its fate in the long run. The most important of these steps is launching the Peacock streaming platform to Comcast subscribers in April and nationally in July. The platform is structured to rely mainly on ad revenue, but offers subscription options to access premium and ad-free content [10]. While late to the streaming game and reliant on shrinking ad dollars, this platform is promising for NBCU because (1) its low-/no-cost will attract multi-homing viewers, (2) exclusive access to shows such as Parks and Rec and The Office (starting in 2021) will drive people to the platform, and (3) it will give the company a new source of customer data.

NBCU is also cutting out the middle man when it comes to movies and ad-driven shopping. In a highly controversial move, the company bypassed movie theaters’ 90-day exclusivity period to release its Trolls World Tour as a premium video on demand (PVOD). The movie has grossed $100M in revenue since March 1, and is a big step by Universal Studios to “own” the trend of declining movie theater attendance [11]. NBCU also recently launched the Checkout system, a technology that will enable consumers to buy products via specially designed ads and content [12]. This platform will increase the company’s attractiveness to advertisers and will provide another data source for the company to leverage, where before they didn’t have visibility into consumer’s buying behavior.

RISING FROM THE ASHES

Like a phoenix rising, NBCU should use the digital innovation foundation it built during COVID to succeed after the crisis. For the Peacock channel, it should use the data from customer’s profiles and viewing habits to improve customer engagement, ad targeting, watch recommendations, and enable data-driven show development. Additionally, the company needs to continue securing exclusive rights to its shows that may previously have been available on other platforms and should offer new exclusive content that drives new subscriptions. The platform’s freemium model will also help with initial subscription growth, but NBCU should consider building up the subscription business in the long run to reduce dependence on advertisers. Making content worth paying for will be key to achieving at least some freedom.

Digital movie premieres is the next step for Universal Studios to innovate on and capture more value from the traditional movie launch process. There will be significant pushback from theaters (AMC is already threatening not to show Universal Pictures movies because of the Trolls release), but simultaneously making movies available in theaters and for purchase on Peacock is something worth fighting for [13]. In addition to bypassing distribution fees, such releases would further drive up subscribers and accelerate the fuel the data flywheel (i.e. more subscriptions leads to more data, which makes algorithms smarter, creating a better product, which attracts even more subscribers).

Finally, NBCU should closely incorporate the Checkout system into Peacock to create a symbiotic relationship across the two sides of its platform – subscribers and advertisers. The consumer-specific data created from Checkout will enable more accurate ad targeting (i.e. improve user experience) and will make it easier for advertisers to attribute revenue from ads. In addition to being able to sell the data to other companies, Peacock and NBCU more broadly will be well-positioned to capture ad dollars because of its happier, more transparent, and growing subscription base.

ENDNOTES

[1] https://www.broadcastingcable.com/news/magna-forecasts-13-drop-in-national-tv-ad-spending

[2] Ibid.

[3] https://www.broadcastingcable.com/news/national-tv-ad-revenue-down-12-8-in-march-smi

[7] https://www.broadcastingcable.com/news/national-tv-ad-revenue-down-12-8-in-march-smi

[12] https://together.nbcuni.com/capabilities/nbcuniversal-checkout/