LTCM: Intelligence and Investment Returns are Not Highly Correlated

“I supposed it takes maturity to know that models are to be used but never believed”

Henri Theil, Econometrician

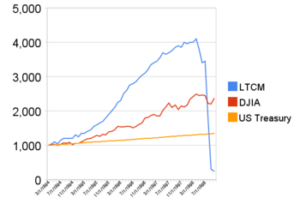

When Long-Term Capital Management (LTCM) started its operations in February 1994, its stated value creation was quite attractive. Based on quantitative models generated by several brilliant minds including two Nobel Prize winners in financial economics. (Myron Scholes and Robert Merton), six partners with academic pedigrees linked to MIT and/or Harvard, the company was about to exploit the deviations from fair value in the relationships between liquid securities cross nations and asset classes.

The team had not only extraordinary academic pedigree but also many of the LTCM partners were former members of the very successful Salomon Bond Arbitrage group. The goal was therefore to profit from the academic’s quantitative model and the trader’s market judgment and execution capabilities.

They would create order out of chaos.

Although the company was organized as a hedge fund and therefore had very few disclosure obligations, the statistical model behind its value creation had to be persuasive enough to amass $1 billion between November 1993 and February 1994 when it started trading.

LTCM’s main strategy was to make convergence trades. These trades involved finding securities that were mispriced relative to one another, taking long positions in the cheap ones and a short position in the rich ones.

The basic principle of LTCM strategy was that in the long term, the price of a security would converge to its fair market value even though there may be mispricing in the long term.

A few historical dates and data points in LTCM short life:

- February 1994: Operations started with $1.01 billion in capital.

- 1995: after fee return: 21%

1996: 43%

1997: 41%

- August 1, 1998: LTCM equity stands at $4.1 billion; September 1, 1998: $2.3 billion; September 22, 1998: $600 million.

- August 1998: Russian Financial Crisis; Russian government defaults on its domestic currency bonds.

- September 1998: 11 banks inject $3.625 billion under the supervision of the Federal Reserve Bank of New York

- 2000: LTCM is liquidated

“I supposed it takes maturity to know that models are to be used but never believed”

Henri Theil, Econometrician

LTCM strategy was not only not disclosed and hid behind the opacity typical of hedge funds but also had had a uniquely high level of complexity. At the basis, several types of trades had been identified and presumably back tested as providing a perfect negative correlation and creating a riskless portfolio with a positive return.

What are the possible root causes for the failure of LTCM?

- The model was too far from human judgement

- The Asian Financial Crisis and then the Russian crisis happened almost simultaneously. These were judged to be rare events but yet were highly disruptive and happened in the same short time.

- Its risk is due to its reliance on short term history and risk concentration. Using the same covariance matrix to measure risk and to optimize positions inevitably leads to biases in the measurement of risk.

- Several other hedge funds had been created exploiting similar LTCM trading strategies and growing fast. This affected the correlation across trading strategies.

- Unexpected correlation or the breakdown of historical correlations

- Even or especially the most sophisticated financial models are subject to model risk and parameter risk.

“Risk is based on the assumption of the existence of a well-defined and constant objective probability distribution which is known and quite possible. Uncertainty has no scientific basis on which to form any calculable probability.”

John M. Keynes 1937

Sources:

“The Failure of Long-Term Capital Management” Ludwig Chincarini; Bank for International Settlements

“Risk Management Lessons from Long-Term Capital Management” Philippe Jorion European Financial Management

“LTCM Case”; Elodie Ruche

“Lessons from the Collapse of Long Term Capital Management” by David Shirreff