Kiva: A crowdlending twist on traditional microfinance

Kiva utilizes an innovative peer-to-peer crowdlending platform to enable budding entrepreneurs across the globe to access the funds they need to help themselves out of poverty.

Kiva, founded in 2005, was one of the first non-profit platforms developed to enable “crowdlending” of loans to entrepreneurs in developing countries unable to access credit in more formal manners. Kiva’s innovative model of using the internet to enable peer-to-peer transactions has largely been successful to date. Over 1.3M individuals have lent to over 1.7M entrepreneurs around the world, with a total of almost 1M loans amounting to $773M.

How it works

Kiva utilizes its website to feature entrepreneurs across the world, complete with the entrepreneur’s picture, the loan amount requested, and a description of what the loan will be used for. Individuals can then enter the Kiva site, browse entrepreneur profiles with the ability to filter for industry, region, and other characteristics, and can choose an entrepreneur to whom they’d like to lend. Lenders can contribute as little as $25 to participate.

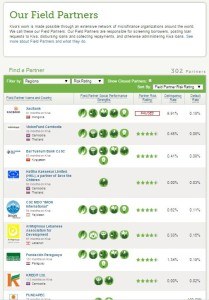

Kiva operates in 83 countries via 300+ field partners, i.e. microfinance institutions (MFIs) which Kiva has formed partnerships with. These MFIs actively screen borrowers for risk and intent, and funds which are sourced via Kiva lenders are ultimately delivered to the entrepreneur through the MFI. Kiva’s partners generally follow traditional practices and charge interest to their clients in order to support their operations (though Kiva itself does not charge any fees on loan amounts). However, through Kiva, the MFI generally has a larger source of funds through which they can serve more clients. Kiva follows an extensive risk due diligence process before partnering with new MFIs to ensure financially sound operations and control for fraud or exploitative financial practices.

Incentivizing lenders

Unlike other crowdfunding sites like Kickstarter or GoFundMe, Kiva’s differentiating aspect is that it’s a lending platform, not a money investment platform, so lenders can expect to not only help someone in need, but can also get their money back (at 0% interest). This has generally proven true, as Kiva has had an astonishing 98.5% repayment rate across all of its loans.

Beyond limited lending risk, Kiva generally offers lenders a trustworthy platform. Kiva does not charge fees on loan contributions, and does not use any of the lent funds to support its own operations, instead funded externally via grants and donations. Additionally, Kiva’s extensive due diligence process to manage its field partner risk is supported by Kiva Fellows—volunteers who apply to spend ~ 10 weeks working at one of Kiva’s microfinance partners to help identify potential fraudulent activites—further limiting costs Kiva faces.

Finally, Kiva generally offers people a “feel good” way to support budding entrepreneurs and microbusinesses across the globe. Its peer-to-peer model allows lenders to actively find entrepreneurs they wish to support and develop connections with those individuals that would otherwise be lost in a traditional lending model. On average, Kiva lenders support ~10 different loan campaigns during their time on the platform.

Expanding with Kiva Zip

In 2011, Kiva piloted its Kiva Zip model, a further innovation on its crowdlending platform. Through Kiva Zip, Kiva is hoping to provide small businesses with 0% interest loans (compared to the traditional interest charged by MFIs) by utilizing an entrepreneur’s personal network as a measure of creditworthiness and asking them to vouch for the entrepreneur. After reaching a specified threshold of funding to be received by those who have vouched for the entrepreneur, the entrepreneur’s loan campaign then becomes public for others to contribute towards (again starting at $25). Additionally, Kiva Zip offers the additional perk of being able to have direct conversations with borrowers once lenders have contributed to their loan, compared to the traditional Kiva model in which lenders essentially have no communication with borrowers. However, Kiva Zip repayment rates are lower than the almost 99% seen in the traditional Kiva model. Currently, Kiva Zip operates as a Beta in the US only, with the goal of launching across geographies once it moves past its Beta phase.

Potential problems

While the Kiva model is largely praised for its ability to garner interpersonal connections, concerns exist around the inherent lending biases formed as a result of showcasing photos alongside loan descriptions, as suggested by a recent article in The Atlantic. Thus, it’s especially important for Kiva to be aware of typical lending patterns, potentially using data to help actively manage the lending process to prevent against massive variations between campaigns (e.g. perhaps more detailed borrower recommendations based on a Kiva lender’s history).

Sources:

http://www.kiva.org/about/stats

http://www.kiva.org/zip

http://www.cnbc.com/2015/08/06/alternative-small-business-loans.html

http://www.nation.co.ke/lifestyle/smartcompany/How-online-lender-is-transforming-lives-through-small-loans/-/1226/2818906/-/pde99w/-/index.html

http://www.theatlantic.com/business/archive/2015/08/crowdfunding-success-kickstarter-kiva-succeed/400232/

Thanks for the post. The Kiva Zip sounds like Kickstarter where small businesses can use as a platform to raise funds, except the way to prove credibility is different. How does Kiva Zip incentivize lenders to lend in this case? Do they get any interest payback? Or similar to Kickstarters they also will see the lenders as early supporters and give them the products once they are out in the market?

Informative post! I didn’t really know that Kiva was a charitable loan platform – thought of it more akin to all the typical lending platforms out there. I was very surprised to see that the Kiva Zip product is resulting in lower repayment rates. The fact that there is more interpersonal communication and the fact that entrepreneurs have to seek out others to validate their creditworthiness should serve to increase repayments. After all, I believe that is the very premise on which CommonBond was founded. What do you think might be the reason? Could it be the nature of the beta groups that they have launched with?

One explanation that I have read might be that the microfinance institutions that Kiva is partnering with “pay back” the loans to Kiva if their lenders default in order to keep access to Kiva’s borrowers.

Great post! I have been using Kiva for years and keep on going back although it has some flaws as you pointed out.

An intersting aspect of Kiva in the context of crowdsourcing is that they “outsource” a range of tasks to the community. For example, translations of loan applications are often done by community members as well.