HBO Max: From Underdog to Power Player

How HBO Max used its connections to Warner Brothers to change streaming during the pandemic.

The success of Netflix has motivated almost every major player in media to launch their own streaming service. From content juggernauts like Disney, to traditional cable networks like CBS, company after company has decided to commit the massive investments required for the opportunity to fight in “Streaming Wars.” The front runners in this fight seemed obvious: Netflix with almost 200M subscribers and tens of billions to spend on content [1]; Disney reaching ~80M subscribers within a year [2]; Apple spending $6B to develop its first line up of original programming [3]. Then, a global pandemic hit.

HBO Max, with a slow and steady growth in users and with a few billion dollar investment (small by comparison to other streamers), went from an also-ran to a game-changer. In December 2020, Warner Brothers announced that all of its 2021 blockbusters would be released on HBO Max at the same time they reached theaters. The announcement of this deal was a shake-up to the industry in many ways: 1) theaters already struggling with long term closures during a pandemic now faced a direct threat to their value proposition as blockbuster distributors, 2) the fight for streaming wars expanded in scope beyond just original content and bingeable TV to include new frontiers where those like Netflix and Apple didn’t have a natural advantage, and 3) HBO Max’s parent company signaled a more integrated approach to how it would manage its newly acquired Warner Brothers business.

This announcement has had immediate positive effect on HBO Max, despite criticism from industry creatives and theater groups. With just one blockbuster release in December in Wonder Woman 1984, HBO Max more than doubled its subscriber base [4]. When many new major movie releases like Tenet have seen tepid theater results and others like Black Widow have seen delay after delay, HBO Max was able to turn a challenge into an opportunity and give its parent company some way to capitalize on the investment made in a blockbuster like WW84, despite somewhat middling reviews.

HBO Max was not the only streamer with the necessary connections to major studios to stream blockbuster releases; most obviously, Disney seemed poised to re-invent the theatrical release with its live-action version of Mulan. However, Disney was not willing to commit to streaming in the same way and instead charged a $30 fee for any account to access this single new title, rankling many fans and users in the process. While HBO Max has a higher membership price point than many streamers at $15/month, this membership now comes with thousands of hours of historical content and new theatrical releases.

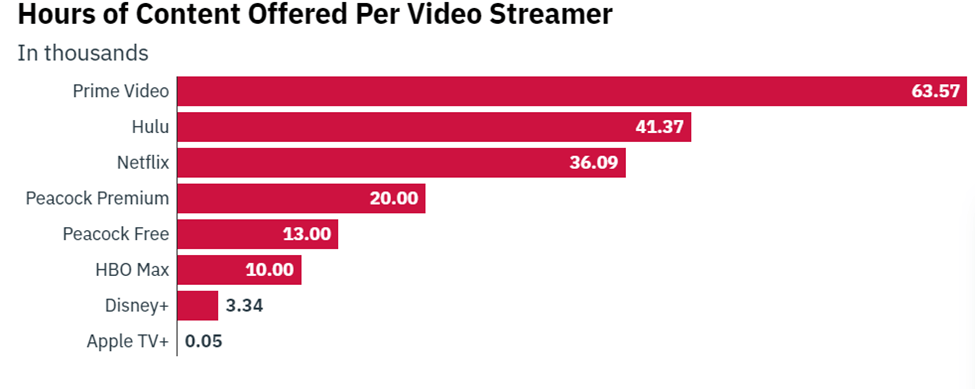

Capturing theatrical releases alone is not enough to captivate an audience in streaming, even in a pandemic when viewers are starved for quarantine content. Luckily, the closer relationship with Warner Brothers also gives HBO Max another strong advantage in a pandemic world: depth of content. Despite being one of the newer kids on the block, HBO Max gives subscribers more hours of content to pass their time while in quarantine than Disney or Apple with the Warner Brothers library (see figure below).

Source: Variety.com [5]

Finally, HBO Max has made the right investments to position itself for success post-pandemic. Before the pandemic, HBO Max’s ability to realistically reap a return on major content acquisitions, like $425M spent on Friends [6], seemed daunting with a relatively small subscriber base. Now that theatrical releases are serving as an innovative customer acquisition strategy that would not have been available in a pre-pandemic world, HBO Max can instead rely on more classically “bingeable” content like Friends, South Park, and Doctor Who to serve as more of a retention tool to keep customers paying their monthly fees after signing on to see the movies they no longer feel comfortable watching in theaters. HBO Max’s ability to maintain success over time will play out over time, but it certainly appears to be putting together the pieces needed to retain and grow its customer base [7].

Plenty of digital companies have done “better” financially or publicly than what HBO Max has achieved during the pandemic, but few have adapted their strategy so nimbly and in ways that so cleverly play to their unique advantages relative to their competitors. For that reason, I name HBO Max the streaming “winner” of the 2020 pandemic.

Sources:

[1] Lee, Edmund. “Everyone You Know Just Signed Up for Netflix.” The New York Times, 21 Apr. 2020, https://www.nytimes.com/2020/04/21/business/media/netflix-q1-2020-earnings-nflx.html#:~:text=Netflix%20has%20182.8%20million%20subscribers,the%20world’s%20largest%20entertainment%20services.

[2] Bursztynsky, Jessica. “Disney+ Emerges as an Early Winner of Streaming Wars, Expects up to 260 Million Subscribers by 2024.” CNBC, 11 Dec. 2020, https://www.cnbc.com/2020/12/11/after-showing-massive-growth-disney-hikes-5-year-subscriber-goal-.html.

[3] Alexander, Julia. “Apple TV Plus Can Afford to Gamble $6 Billion in a Way That Disney and Hulu Can’t.” The Verge, 20 Aug. 2019, https://www.theverge.com/2019/8/20/20813761/apple-tv-plus-budget-money-disney-netflix-hulu-warnermedia-hbo-amazon.

[4] Jarvey, Natalie. “The High Cost of Chasing Netflix for NBCU and WarnerMedia.” The Hollywood Reporter, 3 Feb. 2021, https://www.hollywoodreporter.com/news/the-high-cost-of-chasing-netflix.

[5] Littleton, Cynthia. “Inside HBO Max, the $4 Billion Bet to Stand Out in the Streaming Wars.” Variety, 14 May 2020, https://variety.com/2020/tv/features/hbo-max-launch-streaming-friends-warnermedia-1234604475/.

[6] Young, Julius. “The $425 Million HBO Max Spent on ‘Friends’ is Working Out.” Fox Business, 29 July 2020. https://www.foxbusiness.com/lifestyle/425-million-hbo-max-spent-friends-working.

[7] Baysinger, Tim. “WarnerMedia Realigns Content Acquisition Teams into Two Groups.” The Wrap, 21 Feb 2020. https://www.thewrap.com/warnermedia-realigns-content-acquisition-teams-into-two-groups/

In the world of content creation, HBO has been a disruptor since the late 90s. From “Sex And The City” to “The Sopranos,” HBO aired more violence and nudity than any other network had ever dared to engage in. That calculated risk is embedded in HBO’s corporate culture, and continues to field the company’s success in the streaming wars. Traditionally, HBO has always been the network to push the boundaries.

After writing my blog on ViacomCBS and learning about its revenue losses from theater closures, this line of your blog struck me as particularly interesting:

“In December 2020, Warner Brothers announced that all of its 2021 blockbusters would be released on HBO Max at the same time they reached theaters.”

At first glance, it seems that the primary motivation for WarnerMedia’s move was to threaten or take business from the movie theater industry. However, perhaps this move was meant to supplement the financial losses to HBO due to theater closures.

Disney refusal to launch Black Widow through their streaming service, even applying the $30 Premier Access fee, seems to be due to contractual obligations. Marvel Studios has a standard compensation structure “giving key talent (like Scarlett Johansson in this case) back-end bonuses based on their respective film’s success at the box office”. Because of the language in the contract, the studio is not allowed to stream the movie. There seem to be negotiations to modify the contract language so that key stakeholders can “receive adjusted compensation depending on whether the film opens in theaters or debuts on the Disney+ streaming service.” Another side effect of COVID: new contract language for Hollywood actors.

Source: https://insidethemagic.net/2020/12/disney-plus-marvel-movies-tm1/

Very interesting insight here. I agree most with the power of having the comfort shows you mentioned: South Park, Friends, etc. I think a great recent example of this being done poorly would be Netflix not retaining The Office, another binge-able show. Netflix could have deployed the same strategy as HBO to keep The Office and make sure that customers were retained.