GoodRx: Winning in the Prescription Drug Market

In the US, rising prescription drug costs have left many Americans struggling to afford their medications. GoodRx seeks to reduce the cost burden of prescription drugs.

The Cost Burden of Prescription Medication

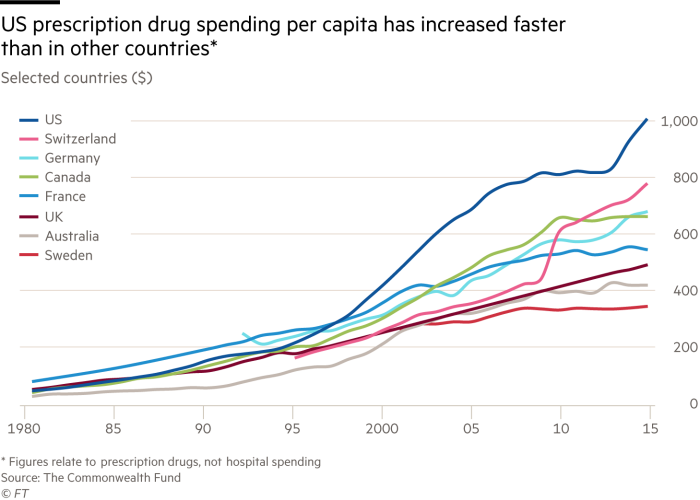

Prescription drug costs in the US are not only among the highest in the world, they are also rising at a faster rate. Between 2012 and 2017, the average price of the 20 most commonly prescribed branded drugs for seniors increased at a rate 10x that of inflation. For the 43% of US citizens under age 65 who are on high deductible plans, as well as the 27 million people in the US without medical insurance [1], these costs are particularly concerning.

Image: Prescription Drug Spending Per Capita [2]

In 2019, a survey by the Kaiser Family Foundation found that a quarter of Americans taking prescription drugs report difficulty in affording their medications [3]. The implications of this are tremendous. Due to the prohibitive cost burden of prescriptions drugs, patients are rationing their supply to stretch it out over a longer period of time, or simply failing to fill the prescriptions at all. One in four patients with diabetes in the US are rationing their use of insulin [2].

Approximately three in ten adults do not take their medications as prescribed, due to the cost. Within this group, 19% reported not filling a prescription, 18% replaced the prescription medication with an over-the-counter drug, and 12% reported cutting pills into parts or skipping doses [3].

GoodRx: A Digital Platform for the Prescription Drug Market

Video: How GoodRx Works (Source: GoodRx)

GoodRx has emerged as a dominant player in helping patients navigate the prescription drug market. Valued at about $2.8 billion [4], GoodRx is a digital platform allowing users without health insurance or those with high deductible plans to compare generic drug prices and receive discounts. Through its partnerships with pharmacy benefits managers, GoodRx generates revenue through transaction fees on each sale as well as membership fees from its premium program GoodRx Gold.

Patients are increasingly looking for more clarity into drug pricing. Despite the proliferation of information across many other aspects of a consumer’s life, including restaurant options, menu prices, transportation options, and more, information about the cost of prescription medications is still disproportionately opaque. This is a consequence of a number of compounding factors, such as variations between insurance plans, deductibles, out-of-pocket costs, and more.

What Does This Mean for Customers?

Driven in part by the widespread adoption of digital technology amongst younger age groups, younger patients are largely more interested in the cost of their care, compared to older patients. In a poll conducted by Truven Health Analytics and NPR, while 23% of poll respondents between the ages of 35 and 64 said that they consider the cost of a medication before filling the prescription, 65% of respondents under the age of 35 reported doing the same [5]. For patients of the “digital native generation,” providing access to information is a key opportunity.

GoodRx is capitalizing on this opportunity by offering users more affordable and transparent prescription drug pricing. By allowing users to search and compare drug prices across pharmacies, GoodRx places some measure of control over the costs of their care back into the patients’ hands.

In addition to greater transparency, GoodRx alleviates the cost burden of prescription medication through discount programs. Users are able to obtain a GoodRx discount card for free, gaining access to discounts at over 70,000 US pharmacies, accumulating in savings of $355 on average each year [6].

By addressing the high costs of prescription medication and making it possible for patients to shop around for the best available options when it comes to filling their prescriptions, GoodRx is ultimately encouraging better compliance in taking medications and, in turn, facilitating better patient outcomes. It is clear that GoodRx is changing the dynamics of the prescription drug market and emerging as a digital winner.

Sources

[1] Jack Kaufman. “10 startups tackling the problem of high prescription drug costs.” https://www.mobihealthnews.com/content/10-startups-tackling-problem-high-prescription-drug-costs

[2] Hannah Kuchler. “Why prescription drugs cost so much more in America.” https://www.ft.com/content/e92dbf94-d9a2-11e9-8f9b-77216ebe1f17

[3] Kaiser Family Foundation. “Poll: Nearly 1 in 4 Americans Taking Prescription Drugs Say It’s Difficult to Afford Their Medicines, including Larger Shares Among Those with Health Issues, with Low Incomes and Nearing Medicare Age.” https://www.kff.org/health-costs/press-release/poll-nearly-1-in-4-americans-taking-prescription-drugs-say-its-difficult-to-afford-medicines-including-larger-shares-with-low-incomes/

[4] Christina Farr, Alex Sherman. “GoodRx valued at about $2.8 billion after Silver Lake investment, sources say.” https://www.cnbc.com/2018/08/06/silver-lake-invests-about-2point8-billion-into-health-tech-start-up-goodr.html

[5] Katherine Hobson. “Why Do People Stop Taking Their Meds? Cost Is Just One Reason.” https://www.npr.org/sections/health-shots/2017/09/08/549414152/why-do-people-stop-taking-their-meds-cost-is-just-one-reason

[6] GoodRx. https://www.goodrx.com/

Really enjoyed this post Jen! I wonder what are GoodRx’s plans with respect to expansion into or strategy around the insured population. Does this market have barriers to entry that may be too significant or would insurance plans pose a large obstacle toward GoodRx’s current model? With insurance plans particularly conscious to the rising costs of healthcare in the U.S., I wonder if there are mutually beneficial partnerships that can be developed so that insurance plans can receive lower pricing and pass on these savings to consumers.

Thanks for sharing, Jennifer! GoodRx has become extremely popular and definitely helps people save money on important medications, however, I am curious to see if GoodRx remains popular as the prevalence of high-deductible health plans increases. Many people are now on high-deductible health plans, which require patients to pay a certain amount of money “out-of-pocket” per year in order to receive better coverage on costly prescription drugs. While GoodRx helps patients save money on prescriptions, insurance does not count a patient paying for a prescription using GoodRx toward their deductible, so it makes it more difficult for patients to get better coverage to make that prescription cheaper later in the year. I wonder if patients will start to look at how much they save using GoodRx and compare that to how much they would save if they pay with insurance and reach their insurance deductible. That math would be fairly complicated and I imagine patients would rather just save money immediately using GoodRx (rather than later in the year), so I am interested to see how insurance will respond to GoodRx.

Interesting post. It seems that although the TAM in the US might be relatively small – it’d be interesting to see the numbers on mobile-savvy price-conscious customers among those with high-deductible or no insurance plans? – they can grow internationally, for example, in India where over 80% of generics purchases are out-of-pocket. In addition, it’d even more exciting opportunity (in the US) if they could do the same trick with insurance plan choice optimizer. On the flip side, I see the challenge for GoodRx in their use of private data and potential risks of security related to that – basically they have a digital database of, say, insulin-consumers which can be sought after by advertisers, etc.