GoodRx or GreatRx?

GoodRx is taking the healthcare industry by storm. In an industry that relied on trade secrets to thrive, GoodRx in employing a unique digital platform strategy to increase price transparency to end customers. What makes them click?

The US healthcare system is a complex system with several nodes in the value chain. While this system has prevailed for several decades, the industry is undergoing a paradigm shift due to changing macro trends and evolving consumer behavior. Some key drivers of this transformation are the following1 –

- Increased drug spending

- Higher co-pays and deductibles, leading to an increase in disintermediation of insurers (and higher out-of-pocket payments)

- Reduced competitiveness of Pharmacy Benefit Managers (PBMs), resulting in lower rebate retention

- Decreasing revenue from pharmacy store fronts

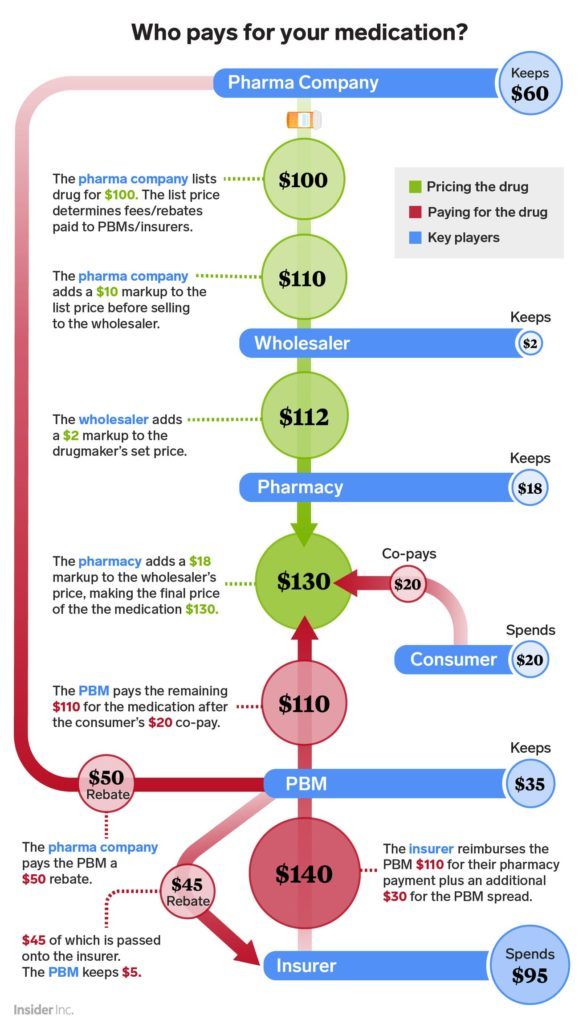

The graphic below highlights the nuances of drug pricing, and how the different players in this market mutually interact. PBMs negotiate with drug companies on behalf of insurers and employers, and obtain margins through rebates and volume discounts.2 In recent years, PBM margins have been bearing the brunt of the aforementioned market trends, and their business models that were traditionally predicated on price opacity and ‘trade secrets’ are being put to a severe test.

GoodRx – value creation and capture

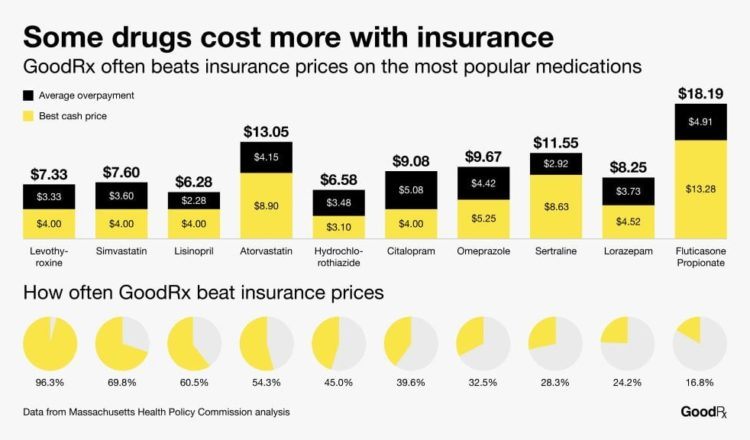

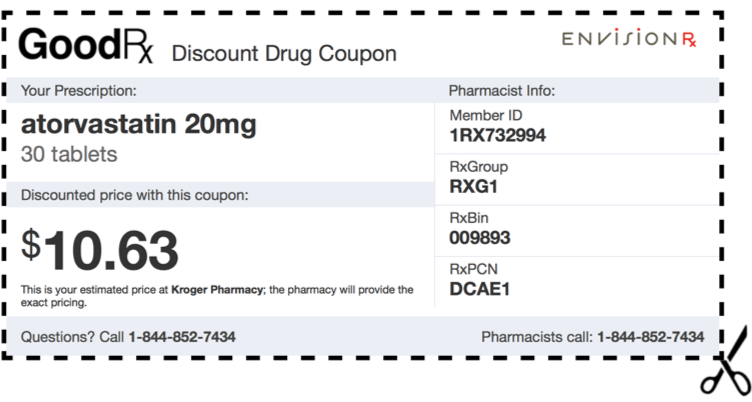

GoodRx addresses these market inefficiencies by introducing an online platform between consumers on one side, and drug stores and PBMs on the other side. The company promises price transparency to consumers, and displays a list of drug stores in the immediate proximity with the prices for any drug the customer is looking to purchase. Given the vastly fluctuating retail prices of drugs from one store to another, this allows customers to find the cheapest place to purchase. The value-creation opportunity for GoodRx on the consumer side is evident – consumers are often price-sensitive, but the current system obscures drug pricing from the customer until they get a prescription filled out and go to the pharmacy to pick it up. GoodRx allows the customer to check prices online, and compare different stores in the vicinity. The retail prices of drugs are so variable that even for insured customers, GoodRx often finds prices in neighborhood pharmacies that are lower even than the co-pay.

GoodRx compiles this list of prices by partnering with pharmacies and PBMs. Pharmacies are incentivized to participate on this platform, because it increases the volume of customers looking to buy drugs. Also, drug stores often see higher margins on generics than on brand-name drugs, even when they sell the generics at a competitive price. GoodRx allows the customer to choose between alternatives when they are shopping for a drug, and therefore, increases the likelihood of purchase of a generic drug. Pharmacies also contend with a large percentage of primary non-adherence (sometimes as high as 30%), where the customer never picks the prescription drug up3. GoodRx helps in reducing this number, and consequently, the cost of inventory.

PBMs are constantly seeking new sources of differentiation in a market that is seeing increasing horizontal consolidation among insurers, and higher pricing power of employers. PBMs are incentivized to share pricing data with the GoodRx platform because this will help shift the cost burden completely from the insurers to the consumer, and therefore, subsidize overall costs of the insurer. In fact, the primary source of revenue for GoodRx is from the PBMs4.

Network Effects

In many ways, GoodRx has a defensible platform strategy. There are strong cross-side network effects between the different parties on the platform (consumers, pharmacies and PBMs).

Consumers <-> Pharmacies – Pharmacies seek to increase customer volume, and customers are looking to price shop across more pharmacies. Therefore, increase in the numbers on one side translates to higher value for the other.

Consumers <-> PBMs – Similar to the previous relationship, a larger number of PBMs implies more pricing data for the consumers, and a more sizable user base translates to higher margins for the PBMs.

PBMs <-> Pharmacies – As the number of pharmacies on the platform increases, PBMs can cut costs for the insurers further as the likelihood of the GoodRx price being lower than the co-pay increases. On the other side, pharmacies are very cautious about honoring agreements with PBMs. An increase in number of PBMs on the platform strengthens the legitimacy of this previously untested business model, and allows pharmacies to consolidate their partnership with GoodRx.

Disintermediation, Switching Costs and Multihoming

However, in the absence of significant same-side network effects, acquiring new users on any of the sides may be increasingly less scalable. Also, the network architecture is based on local clusters that are somewhat isolated from one another (particularly, on the customer and pharmacy sides, which are mostly located in urban areas). Academic literature5 tells us this exposes the platform to disintermediation, as other players with a hyperlocal strategy may enter the space, or the local pharmacies may form a consortium and offer a similar service. This risk is somewhat mitigated because of the pharmacy market being dominated by large pharmacy chains.

Several insurers are increasingly seeking vertical integration with PBMs. If that happens, GoodRx may be disintermediated, and insurers may instead leverage the cost synergies from the integration to reduce the co-pays and deductibles. Regulation protects GoodRx from this risk to some extent, but in a constantly evolving regulatory environment, this is a risk they should be aware of.

The strong cross-side network effects increase switching costs for all sides, and reduce the likelihood of multihoming. This is a huge competitive advantage for GoodRx, and may also enable monetization opportunities on other fronts. As consumers are unlikely to switch even when there is advertising, GoodRx may consider increasing this portion of their revenue.

What lies ahead

GoodRx has an opportunity to scale further within the US, and with a recent private equity acquisition by Silver Lake Partners, have the capital to grow. Their international growth strategy may be affected by their network architecture with local clusters and high exposure to regulations, but their use of platforms to disrupt a traditional industry is likely to be replicable in other markets as well.

References :

- Trends Disrupting Pharmacy Value Pools and Potential Implications for the Value Chain, McKinsey & Company, Jan. 2018, healthcare.mckinsey.com/trends-disrupting-pharmacy-value-pools-and-potential-implications-value-chain.

- Everybody Is Talking about the High Cost of Prescription Drugs. Here’s Who’s Actually Responsible for the Prices You Pay. Business Insider, www.businessinsider.com/why-prescription-drug-prices-are-high-graphic-rebates-healthcare-industry-2019-2.

- Prescriptions Never Picked Up at Pharmacy a Cause for Concern. Pharmacy Times, www.pharmacytimes.com/news/prescriptions-never-picked-up-at-pharmacy-a-cause-for-concern.

- Medication Pricing – So This Is How It Works. MDedge, www.mdedge.com/psychiatry/article/157623/business-medicine/medication-pricing-so-how-it-works.

- Why Some Platforms Thrive and Others Don’t. Harvard Business Review, hbr.org/2019/01/why-some-platforms-thrive-and-others-dont.

Really loved the comprehensive analysis, what strikes me after living in NY for a while is the consolidation of pharmacies down to a few players. It seems almost a duopoly between Walgreens and CVS, (Walgreens acquired Duane Reade which was the other big player in pharmacies), so I wonder how can a platform thrive in such an environment? I could see the case where it empowers smaller players to be discovered and offer better prices, but there is also just the convenience factor of having a Walgreens and CVS in what seems to be every other block on NYC. The bigger point I guess is that I would be curious to see how well Good Rx’s business model handles these competitive pressures (you mention vertical integration being a threat) and whether its value proposition is stronger in certain markets over others (and if so what those markets are).

Seems like an important service they are providing customers in a traditionally very opaque industry. Thank you for providing such a robust analysis.