Glamsquad: Making Over the Beauty Services Industry

Can Glamsquad build a platform of scale in on-demand beauty?

Glamsquad connects customers with stylists for on-demand in-home beauty services. The company began as an “Uber for hair blowouts,” and today offers hair, make-up and nail services in New York City, Los Angeles, Washington DC, and Miami. The Glamsquad platform has potential to take share of the $40+ billion beauty service industry. Indeed, in 2014, the same year it was founded, it booked ~$8 million of sales and has since grown to generate more than triple that annually. Its success garnered over $24 million in venture capital backing.

How It Works

Glamsquad’s value proposition to its users is convenient beauty appointments for the busy woman. Appointments and payments are handled online, and services can be rendered at the customer’s home or workplace. The user avoids the hassle of booking an (often last-minute) service before a meeting or social function, and needs not travel to a salon. The stylists are also vetted for quality assurance and undergo a background check for safety purposes. The target customer is a woman whose time is valuable and scarce, and who would do the cost-benefit analysis of beauty services.

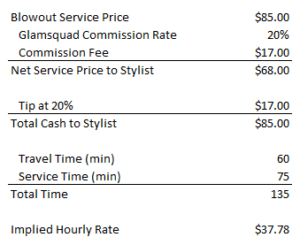

The value proposition to its stylists is access to demand or customers. Approximately 65% of the beauty industry workforce is freelance. This is a huge opportunity. Work hours can be inconsistent, and stylists rely on salon or store make-up counter work. Glamsquad would theoretically supplement the stylist’s current book of business and reduce idle time. In return, the company takes a 20% commission. Below is an estimate of the dollar-value to a stylist:

Competitive Landscape

The core competition is the brick-and-mortar salon. New efficient and convenient models such as Drybar, a salon for fast blowouts (no cuts, no color), pose the strongest competition as they offer easy online booking and rapid turnaround. They also offer stylists greater seat turnover, which translates to greater commission. Other competition comes from online platforms such as Manicube, which provides on-demand nail services in NYC, and Vive, which manages schedules for last-minute salon blowouts.

Platform Challenges

Network – The competitive space has high indirect network effects. Customers want reliable access to good stylists in order to reduce their wait time and to allow for last minute appointments. Stylists want access to a large demand base to provide steady work flow. Getting to critical mass is difficult especially with existing competitors becoming more efficient and flexible in scheduling.

Geography – Because of the indirect network effects, Glamsquad has only tapped dense cities. These cities have concentration of working women with busy social schedules and discretionary spending. Importantly, these geographies have a trained customer, one who learned that getting her hair professionally blown out isn’t a luxury but a routine weekly upkeep. Businesses like Drybar have done a lot of this customer education for Glamsquad. Glamsquad will next need to prove its model will gain critical mass in tier 2 and 3 markets, where the customers aren’t as trained.

Multi homing – Stylists’ earnings from Glamsquad are attractive on a per hour basis (see analysis above). However, a stylist needs a certain number of jobs to make a day or week of earnings. A stylist before Glamsquad typically supplemented her salon work with a private word-of-mouth business. A stylist is likely to continue to do this after Glamsquad. There is also no reason for the stylist to pledge her services to one online platform.

The customer also exhibits multi-homing behavior, though to a lesser extent. Historically, customers learned that once they’ve found a trusted provider whose expertise and artistry suits their taste, they don’t switch for fear of dropped quality. However, for convenience, customers have also historically gone to a new salon if a last-minute need arises.

These dynamics would indicate that there likely won’t be a winner who takes all in this space.

Ethics – Should we hold Glamsquad to a similar ethical judgement as we do, say, Walmart for not providing a sustainable income for associates? I think that we ought to adjust our standard for the differences between traditional and platform work. Stylists on Glamsquad gain not only cash but also valuable flexibility in working hours. They are also used to the ebbs and flows of freelance work, they’re not employees, and the price of their services reflects this.

Scaling the Business

There are a few strategies that Glamsquad can pursue:

- Differentiate services by incorporating the latest beauty trends

- Add supplementary services to drive customer stickiness, such as style blogging or loyalty programs

- Lower the commission rate in order to be even more compelling on an hourly-rate basis for stylists

- Go faster, enter new markets where trained customers and stylists are in abundance, for example wherever Drybar is successful

Thanks for sharing, Afaf! I really enjoyed reading this post. I’m curious about what you think of the demand side of the platform. Is the value proposition compelling enough to address a large enough market? I think that a lot of women use DryBar or other salons not just because of the convenience, but because of the experience – it can be luxurious, or at the very least comfortable and familiar. I wonder if hiring someone to come to your home is still an experience that is uncomfortable for many, and may be a barrier to adoption – especially when the price points are relatively high.

Separately, I am curious about the company’s quality control procedures – do they use a ratings system? How do they vet and onboard new stylists onto the platform?

Hi Julia! Glad you enjoyed this. On the demand side, I agree that Glamsquad’s value proposition is weak for women who enjoy the salon experience. But the value proposition makes more sense for women for whom salon-quality services are not a luxury but a lifestyle necessity. Blowing out their hair or getting their manicure isn’t “for fun” but rather a regular part of the maintenance that’s necessary for their professional appearance. The question stands, what slice of the market does this represent? Will that slice grow as customers shift their view of beauty services from a luxury to a necessity?

On the supply front – Glamsquad takes in thousands of stylist applications and accepts less than an eighth of them. Part of the vetting is built into the system by the cosmetology schools and local licenses to practice. Glamsquad also has a requirement of 2 years of work experience. Finally, there is a training period in which the stylists are taught the signature looks from Glamsquad’s look book. There are no ratings, but the optional cash tip approximates that.

Thanks for the post Afaf! I could totally see a market for this product, not sure how big it is though. The prices do sound exorbitant but I think the customers have a high willingness to pay. I wonder if other players could enter the market and drive prices lower? A question on the customer side – how do you think GlamSquad protects itself from the possibility that customers may eliminate Glamsquad commission by working out an offline arrangement with the hairdressers they like the most and live nearby?