Friendsurance: Friends with Benefits?

Friendsurance has the ambitious goal of disrupting the multi-trillion dollar insurance industry.

Conditioned by their experiences with highly customer-centric companies like Amazon and Uber, consumers are expecting more from all companies they interact with, including their insurers. To many customers – particularly those of younger generations – insurance feels opaque, confusing, and expensive. To address this growing customer dissatisfaction, insurers, both start ups and incumbents, are seeking new ways of doing business. One of the business models that has emerged is peer-to-peer or crowdsourced insurance.

Friendsurance, launched in Germany in 2010, was one of the world’s first peer-to-peer insurance companies. When launched, the founders sought to disrupt the insurance industry by making the experience of searching for and purchasing insurance more customer-friendly. [1] Since Friendsurance opened its doors, several others around the world have pursued similar business models, including Lemonade in the U.S. and BoughtByMany in the U.K. [2]

How it works

Friendsurance has formed partnerships with dozens of insurance companies and offers these insurers’ products (particularly auto and home) to customers through its online platform.

Customers select the insurance product that they are interested in and are connected to a small group of other customers whom have a similar insurance need. These connections can be made by Friendsurance or by customers themselves. These customers’ premiums are pooled together. A portion is paid to the insurance company and another portion is kept by Friendsurance in a “cashback” fund. As claims are made over the course of the year, the cashback fund decreases. At the end of the year, any remaining cash in the fund is distributed to each customer in the group; on average, 80% of customers receive cash back totaling roughly 30% of premiums paid. In other words, Friendsurance is pooling risk through crowdsourcing. [3]

Figure 1: How Friendsurance works

Value Creation and Capture

For customers, Friendsurance creates values in three primary ways.

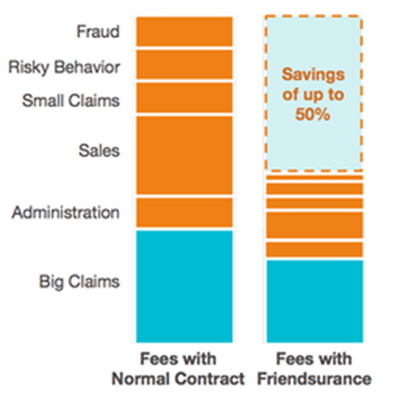

- Save money: Insurers are paid less per policy by customers because Friendsurance retains a pool of cash for smaller claims. If few or no claims are made, customers ultimately save money on their premiums when they receive cash back. Savings result from reduced fraud, better risk pooling, and reduced processing and sales costs. [4] Additionally, customers’ premiums never rise.

Figure 2: Cost savings with Friendsurance

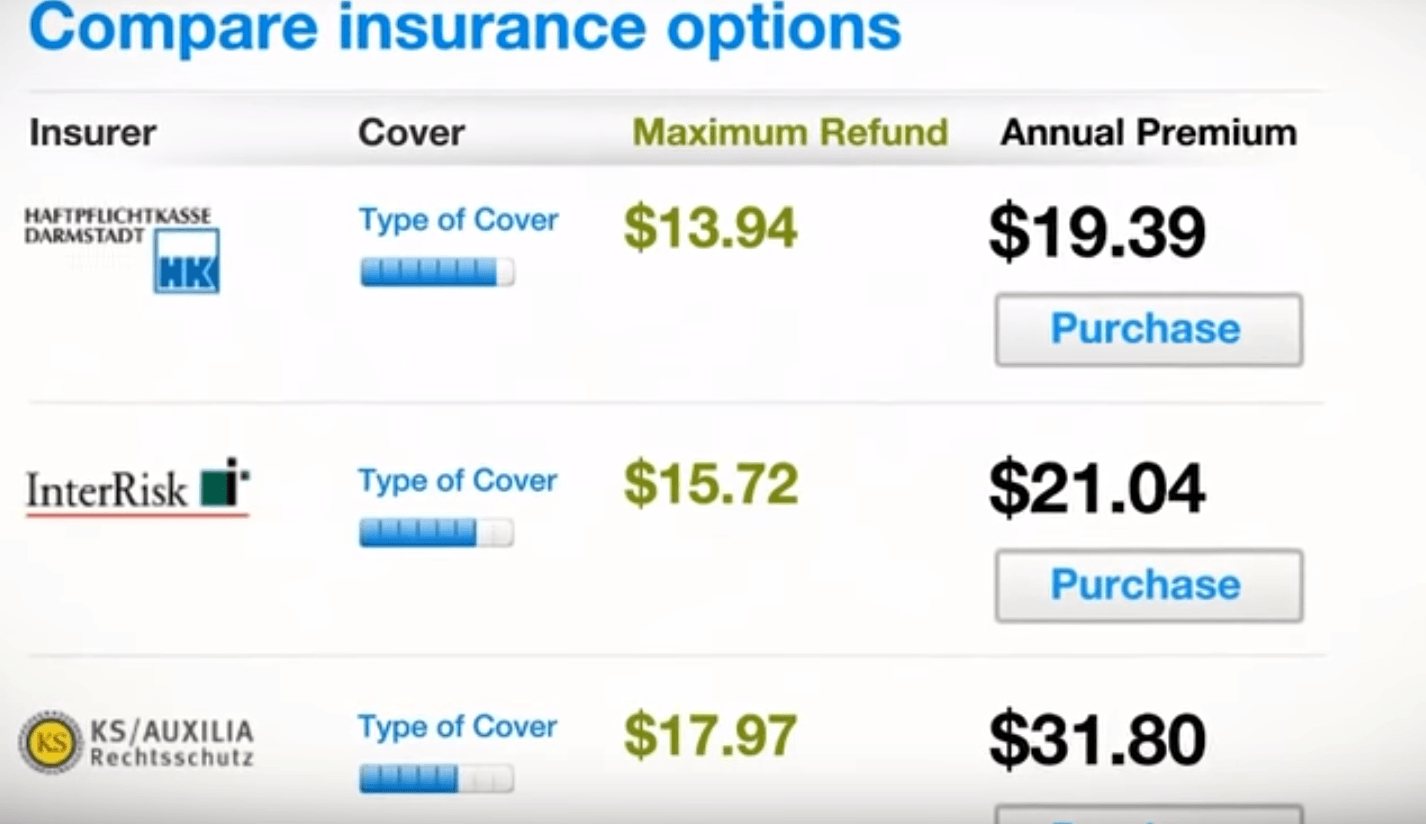

- Transparency: The insurance industry is notoriously confusing, and customers struggle to compare policies across insurers. Friendsurance provides an intuitive, user-friendly platform where customers can easily compare similar policies across more than 70 insurers, enabling customers to identify what’s best for them by optimizing for features, policy cost, and potential cashback. (see Figure 3)

Figure 3: Ability to compare insurance policies through Friendsurance [5]

- Ease of claim reimbursement: Friendsurance manages smaller claim reimbursement from the pool of cash preventing customers from having to directly interact with the large, bureaucratic insurance companies. [6]

For insurers, Friendsurance creates value by acting as a distribution vehicle, particularly by targeting those customers that are typically difficult for insurers to engage (i.e., younger generations). Friendsurance also removes the need for insurers to manage smaller, more costly claims and reduces their overall claim ratios.

Friendsurance captures value by charging a commission fee to insurers when a customer buys one of the insurers’ products. Customers are not charged any fees by Friendsurance.

It remains unclear how disruptive the peer-to-peer model will be for the insurance industry. While Friendsurance now serves more than 100,000 customers in Germany, it took them almost eight years to reach this level. This relatively slow growth may, in part, stem from inertia driven by customer skepticism around start-ups that involve their money (even if there is quite widespread dissatisfaction with traditional options). [3] In other cases, some early peer-to-peer insurers such as Gather (focused on small business insurance in the U.S.) and Guevara (focused an auto insurance in the U.K) recently shut down operations. After seven years, Friendsurance recently launched in its second market, Australia. It will be interesting to see how successful this expansion will be and if Friendsurance can execute on its ambitious goal of disrupting one of the world’s largest and most antiquated industries.

Sources

[1] https://www.friendsurance.com/, accessed March 2018.

[2] Jeremiah Owyang, “Market Snapshot: Crowd-Based Insurance Startups on the Rise,” http://www.web-strategist.com/blog/2016/05/24/market-snapshot-crowd-based-insurance-startups-on-the-rise/, accessed March 2018.

[3] Guy Chazan, “Tim Kunde’s Peer-to-Peer Approach to Insurance,” The Financial Times, September 7, 2016, https://www.ft.com/content/9f2de95e-49e6-11e6-8d68-72e9211e86ab, accessed March 2018.

[4] Hugh Terry, “Friendsurance in Germany makes insurance social again,” The Digital Insurer, https://www.the-digital-insurer.com/dia/friendsurance-germany-makes-insurance-social-again/, accessed March 2018.

[5] “Sharing Economy Friendsurance,” https://www.youtube.com/watch?v=ngx8RZfH1n8, accessed March 2018.

[6] “Friendsurance Business Model,” https://vizologi.com/business-strategy-canvas/friendsurance-business-model-canvas/, accessed March 2018.

Very interesting model. I wonder which part of the company’s success is due to the crowdsourcing part (sharing with 9 other connections) and which is due to the fact that they provide more transparency to the platform and cash back for users. I can see instances where the crowdsource aspect can actually be a detriment due to privacy concerns as users might know which of their friends are making the expensive claims, and that can lead to potential animosity. Would the company be less or more success for example, if they actually removed this aspect of their model but kept everything else?