FedEx: Navigating disruption storms with no clear skies ahead

FedEx is facing the threat of two of the most severe digital disruptors: Amazon and Uber. As e-commerce operations gain more relevance in supply chain distribution networks, the tech giant is aggressively increasing the vertical integration of its distribution network. In parallel, Uber and several digital innovators are introducing new business models in different steps of the supply chain, covering the shipping, freight, warehousing and last-mile verticals.

“We’ll let the points be counted up at the end of the game.”

Mr. Fred Smith, FedEx Founder and CEO

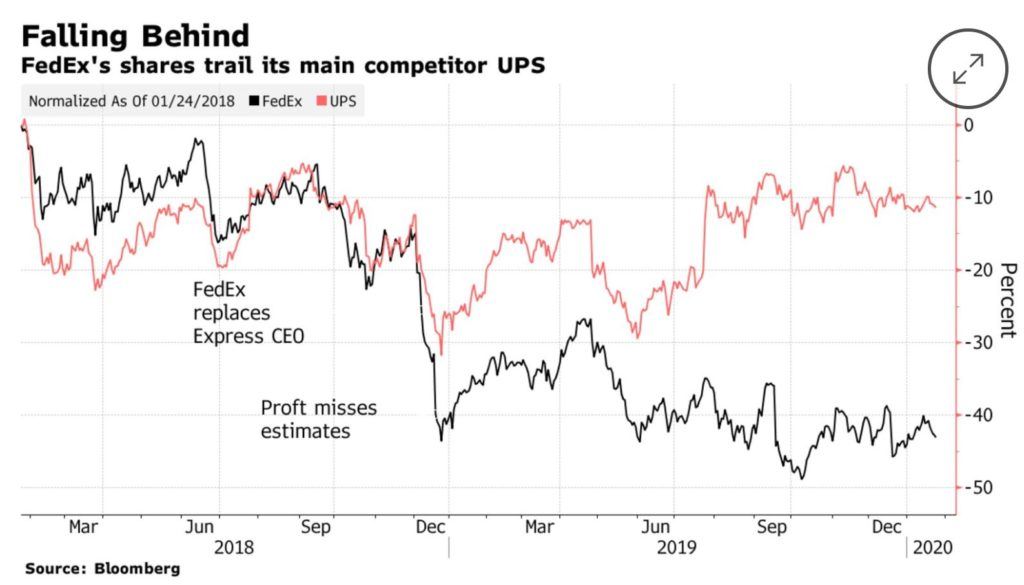

After Fedex’s stock price decreased by 43% over the last two years, lagging UPS by 30 points, the company’s founder doubles down on FedEx’s anti-Amazon alliance strategy, keeps committed to the company’s decision to break up with the tech giant and places high hopes on the years to come, expecting to surpass its rival UPS in size and revenue in the next two to three years. Despite Mr. Smith’s relentless and energetic claims, a closer look at the company’s evolution in the last years in face of the new dynamics of the logistics industry puts FedEx on the losers’ side of this business. The company has failed to anticipate the changes in the e-commerce landscape and has not addressed the architectural innovations in different steps of the supply chain.

Vertical integration in e-commerce logistics is the big driver for customer retention and growth

In 2019, for the first time, Amazon has declared that transportation and logistics companies are among its rivals. This predictable decision is extremely related to a core differentiation element of e-commerce: delivery service levels are one of the main drivers for customer satisfaction and the main barrier that Amazon has in order to prevent its competitors to slow the growth of its business. It is almost mandatory for the tech giant to increase its ownership and control over the end-to-end network of this strategic element of the business.

So, behind FedEx’s decision to break with the tech giant (which composed only 2% of the revenues of FedEx Ground service) there is a more profound dispute between two really different business models: a vertically integrated one and a modular supply chain of logistics companies and retailers with brick-and-mortar and e-commerce operations.

Even though this dispute is yet to be solved, the fact in the last 4 years Walmart increased its e-commerce share from 3 to 4% while Amazon did it from 32 to 38% is an indication of which business model is leading this business, characterized by strong network effects. From an operational point of view, a vertically integrated model is better suited to build a resilient supply chain and ensures the strategic alignment and customer focus of the different players of the chain.

Current political and technological uncertainty together with strong seasonality demand e-commerce supply chains to be as resilient as possible. A fast information sharing and data management structure that can provide broader alternatives for decision-making is crucial to improve the resilience of the network. So, a vertically integrated model, coupled with proper flexible technological solutions (on-demand fleets, for example), clear decision-making structures and strategical alignment, should be more effective than a modular supply chain characterized by players with different objectives. In addition, the strategic alignment of a vertical network allows the company to evaluate its logistics decisions with a pure customer-focused approach, aligning the resources to maximize the profitability of the whole process.

“Uberization” of logistics: an architectural innovation that threats the integrated logistics business models

In recent years, the platform businesses had overcrowded the logistics industry with cost-effective and flexible (on-demand!) solutions for each different step of the supply chain: from food logistics to last-mile delivery solutions. At the same time, in order to react to e-commerce integration, FedEx will keep on focusing on its core competency: providing a one-stop-shop solution for logistics, being able to manage a large scale and diverse set of logistics services.

Even though this claim will still hold true for most of the customers willing to outsource their distribution activities, it questions the need for FedEx to keep its capital heavy business model and its limited flexibility to react to the more frequent variabilities in each step of the supply chain. For example, this is particularly critical for the last-mile delivery market, where on top of the higher flexibility that on-demand options provide, the future combination of packages, food and passenger transportation will allow new players (such as Uber) to extremely increase the utilization of their assets.

Furthermore, if the value-added activities will rely on the selection, integration and end-to-end management of these different specialized solutions, there are no strong barriers for new tech and asset-light players such as Oracle or SAP to provide one-stop-shop information management solutions for each customer so they can easily manage and monitor the 3rd party logistics providers on their own.

Stormy skies ahead

FedEx has chosen to play a defensive strategy by sticking to its current business model and fight Amazon’s e-commerce integrated vision. At the same time, new platform solutions are redefining the role of the end-to-end logistics giants. Facing digital disruptions on both fronts, clear skies are far away during the FedEx journey in the coming years.

Sources

“FedEx CEO Sees Vindication Ahead for His Anti-Amazon Strategy”, Bloomberg (Jan. 28, 2020). https://www.bloomberg.com/news/articles/2020-01-28/fedex-s-smith-promises-2020-rebound-will-prove-him-right-again

“Fred Smith Created FedEx. Now He Has to Reinvent It.” Wall Street Journal (Oct. 17, 2019). https://www.wsj.com/articles/fred-smith-created-fedex-now-he-has-to-reinvent-it-11571324050?ns=prod/accounts-wsj

“FedEx’s double-edged sword: New rivals Amazon and Uber aim to slash its business” CBNC (Jun. 25, 2019). https://www.cnbc.com/2019/06/24/fedexs-threat-rivals-amazon-and-uber-aim-to-slash-its-business.html

“The Delivery War Is Reckless And Vain” Forbes (Jun. 20, 2019). https://www.forbes.com/sites/janetwburns/2019/06/20/the-delivery-war-is-reckless-and-vain/#5f088b086c0a

“From Tracking Food To Last-Mile Delivery, 125+ Startups Disrupting The Supply Chain & Logistics Industry” CBInsights (Aug. 30, 2018).https://www.cbinsights.com/research/digitizing-supply-chain-logistics-market-map/