Comcast: A Winner in the Media Long Game

Lots of buzz on Google, Netflix and other OTT players as innovators in the media space, but traditional cable players like Comcast are paving the way.

Having worked in television prior to coming to business school, I am naturally drawn to the media space to address this topic. I will not be in the least surprised to see my classmates writing about Netflix, YouTube, Amazon, and other over-the-top (OTT) providers, as media disrupters and winners. While it is difficult to write a paper around media disruption in the television industry without acknowledging these players, I’d like to argue that traditional cable, and Comcast specifically, is still winning and will continue to win.

Currently Comcast is the largest cable provider with over 27mm customer relationships, $68.8bn in revenue, and $14.9bn in EBITDA.[1] Even amidst OTT competition Comcast has consistently leveraged its existing assets to create new opportunities, continued to be a digital innovator, and re-focused its business on its most profitable customers.

Starting as early as the 1940s, innovators began creating the infrastructure to deliver cable services.[2] Those wires in the ground have continued to be cable’s greatest asset, and the way in which the industry as a whole creates value. Comcast has led the industry in major initiatives to further leverage these assets. One example is in home security. In 2010 Comcast debuted Xfinity Home, its push for a cut at the $13bn home security and automation market.[3] This sticky product has increased subscribers and further solidified Comcast’s position as a smart player inside the home. Comcast continues to innovate in this category, forming partnerships with additional players in the space such as Leeo and SkyBell, as well as releasing an SDK certification program to make it easier to partner with the company.[4] In class we’ve been talking a lot about Google, Apple, and others trying to find an entry point into the home, but I believe no player is better positioned to take advantage of the smart home than cable, and as the largest provider, Comcast is uniquely positioned to lead the charge.

Even with regards to video, Comcast’s has done a phenomenal job transitioning into the digital age. In the face of OTT players it has created Xfinity TV. Its sleek UI both for the traditional TV product and its digital Xfinity app, provide its customers with a seamless and easy to use experience. Furthermore, through its NBCU acquisition it inherited a 32% equity stake in Hulu.[5] Comcast is well poised to take advantage of the transition of content to OTT through these two services.

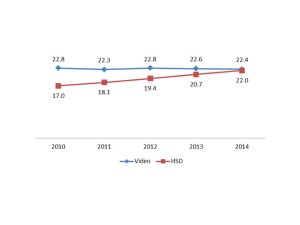

A common misconception around Comcast relates to their changing subscriber base. People see Comcast losing video subscribers, and companies like Netflix gaining subscribers, and think it’s the death of cable. However, as programmers raise price on cable providers, video subscribers are increasingly unprofitable for cable providers. In fact, I think within the next 5-10 years if cable providers hang on to their video business it will actually be a completely unprofitable business line. However, as shown in the graph below, while Comcast is losing video subscribers, they are actually capturing more value through gaining profitable high speed data subscribers. This will position Comcast to continue to be a leader in the space, and to leverage its infrastructure to build new more profitable businesses. Furthermore, in thinking about OTT services, it is important to remember how those services are delivered to the consumer – cable providers. Everything still has to pass through the pipe. Seeing that it would cost nearly $80bn to overbuild the entire US, cable will continue to be a major player for many years to come.[6]

Comcast Subscribers (mm)[7]

[1] CMCSA 2014 10K

[2] https://www.ncta.com/who-we-are/our-story

[3] http://www.fiercecable.com/special-reports/comcast-leads-cables-push-cut-13b-home-security-and-automation-market-0

[4] http://corporate.comcast.com/news-information/news-feed/comcast-expands-xfinity-home-business

[5] http://articles.latimes.com/2013/may/31/entertainment/la-et-ct-comcast-hulu-sale-20130531

[6] http://techcrunch.com/2013/04/08/google-fiber-cost-estimate/

[7] CMCSA 2014 10K

From this post, it seems that you believe infrastructure will allow Comcast to sustain its market position. You also mentioned competitors like YouTube or Amazon. However, I would argue that the latter companies are driven and differentiated by content, not infrastructure. So longer term, does this imply that infrastructure is more important than content? As more companies, like HBO, begin offering their product/service as a stand-alone outside of the core cable packages, will Comcast’s pipes be enough? Or, is Comcast a “loser” in content, but a “winner” based on its ability to differentiate its value capture across new industries, such as home security and high speed internet?

It is interesting to hear a view from someone who has worked in television about the future of players like Comcast, especially when the talk is focused on OTT players like you mentioned in your post. As I read your post, I agreed with most of your observations. I think you are right when you say that Comcast has been slowly moving into other areas outside video broadcasting through areas like home automation, OTT and increased focus on broadband. I also agree with your view that the video subscriber is likely going to be unprofitable one for Comcast to serve and their steps are in the right direction.

However, I am a bit skeptical in calling them a winner yet. The reason for that is two-fold. Firstly, on the new segments they are focused on, they are not the first movers and playing catch up with other players in the OTP or to an extent even home automation. This has not been their traditional strength and I would like to watch how these businesses play out before calling them a winner in those segments. Second, on the broadband/internet business, the business has strong barriers to entry and it is unlikely that any new business will be able to compete directly with Comcast. However, I have some concern around wireless data providers who can deliver broadband at cheaper prices. While this has not yet happened because the technology seems to have issues in delivering the customer experience as wired broadband, it will be interesting to see if wireless data providers can deliver broadband at speeds similar to wired broadband players and what that will mean to the economics. (For reference: In India, Reliance Jio, a company with 4G license is planning to launch wireless broadband services nationally and a big concern for broadband players is the impact that it will likely have on their economics)

I agree that Comcast’s video subscription business is a a dire prospect and that it knows it needs to go digital to lead the way; Comcast has been trying to avoid the trap by increasing its customer base (hence the attempted Time Warner Cable merger, the purchase of content through NBC Universal, and investments in digital news media). I think Comcast will do well as an ISP and a content creator for some time. Unfortunately, I do not believe it is “winning” the video streaming race, at least not yet. Xfinity TV is designed more as a way to make sure people keep using cable as opposed to a proper OTT option. OTT specifically excludes services that require a multiple-service operator such as Comcast’s cable services or Time Warner Cable’s services, and Xfinity in particular is not available to anyone outside of Comcast’s cable customer base. I would contest that its user experience also leaves plenty to be desired (such as its tendency to run the same ad relentlessly throughout the same show) and it shares Hulu’s problem of inconsistent offerings (Hulu has some shows available and it is not clear to the consumer why it has 7th Heaven and CSI but not Big Bang Theory since they are all CBS shows). Admittedly it is difficult to measure Xfinity TV’s success due to regional differentiation and varied competition around the country, but it is not a proper OTT service until Comcast separates it from cable, which will require new contracts.

It is more likely that Comcast is going the HBO option, with Xfinity for cable subscribers and “Stream” for cordcutting and cord-never customers. Until it releases Stream and the reviews come out (will it be locked to areas with Comcast service? Will it have its audience’s favorite shows? Will it have ads for an audience that consistently rejected Hulu because they could not imagine a non-cable premium service with ads?), I have reservations about Comcast’s digital distribution offerings.

As for cable providers in general: Time Warner Cable is doing okay, if not compared to NFLX. Cablevision on the other hand lost half its stock value in ten years or so. We will see.