Changing of the Guard: Is AT&T’s Wireless Business at Risk?

New technologies threaten to significantly change the dynamics for wireless carrier business models. Can they adapt, or are ATT and Verizon destined for obsolescence?

Wireless internet access and cellular connectivity has played a central role in the creation of today’s digital economy and the enabling of many new products and services. AT&T, for its part, has long been one of the leading service providers in the United States[1], and has benefitted tremendously. Therefore, it might seem counter-intuitive that I’ve labeled it as a digital loser. However, I would argue that it is poorly positioned to remain competitive in the mid- to long-term in the wireless business.

How does AT&T create value?

AT&T’s value creation is simple, and eminently relatable for any reader who’s ever used a phone: it operates a telecommunications network that allows users to connect phones, tablets, or other wireless-enabled devices to the internet, as well as providingg voice and text services. Users include both consumer and business accounts. In fewer words, AT&T provides wireless internet and phone service. It is a central element of daily life for many people around the world.

What about value capture?

AT&T charges its customers for access to its network. While accounts can be either pre-paid or post-paid (the more valuable customers), at the end of the day AT&T is billing customers monthly based on their consumption of voice and data services. It’s a fairly simple utility model.[2]

If it’s all so simple, what’s the problem?

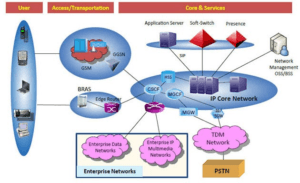

The problem comes down to AT&T’s operating model, and technological shifts in the underlying assets. AT&T’s network consists of a nationwide coverage of cellular radios, networking infrastructure, and data centers that provide coverage for the users and allow the network to function.

The network relies on massive data centers full of bespoke hardware, the networking infrastructure, and a myriad of cellular radios mounted on towers around the country. It also relies on the dedicated spectrum licenses that AT&T holds which permit it to provide services to its users. It’s an asset-heavy business with huge operational leverage, economies of scale, and barriers to entry. Unfortunately for AT&T, many of these traditional network components are changing.

- New cellular radios and standards are allowing seamless transition between the RAN and wi-fi access to wireline networks, making

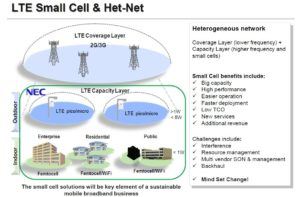

Heterogeneous Network Diagram competitors like Comcast, with its robust network backbone and many wi-fi access points a dangerous competitor.[3] [4]

- Advances in software defined networking and antenna capabilities are making so-called heterogeneous networks, consisting largely of much smaller radios[5], are erasing barriers to entry by lowering the capital required for new entrants, especially in dense urban environments. Additionally, data centers become cheaper to establish and run.[6]

- New spectrum availability and supporting technology will make services on shared spectrum possible, lowering the value of AT&T’s dedicated spectrum licenses and lowering another barrier to entry.[7]

These changes combined will have a negative impact on AT&T’s business. AT&T’s competitive advantages and economies of scale will begin to disappear and new, more flexible business models will begin to emerge. These will put AT&T under significant pressure and potentially pave the way for more nimble competitors or competitors with better infrastructure for the new network architecture (e.g., Comcast).

Additionally troubling is that two potential avenues for continued to success appear risky. First, AT&T’s bid to merge with Time Warner is an attempt to move closer to content and gain a competitive advantage that way, and avoid being just another “dumb pipe.” However, it’s unclear whether AT&T will be able to leverage it effectively, just as Verizon struggled with its Go90 content play, or indeed whether the deal will go through.[8]

Second, carriers look for Internet of Things to drive revenue growth. However, their current value capture models are usage based and unsuitable for Internet of Things applications, many of which will not drive meaningful network volume compared to usage like HD video download/upload to phones and tablets.[9] Combined with lower barriers to entry, it’s unclear that AT&T will be able to win in that market when it emerges.

So you’re saying one of the largest providers of a service critical to the digital economy is a potential loser?

Pretty much! Nothing is certain, and AT&T may prove nimble enough to counter these threats to its business and operating model, and/or successfully leverage content to move up the value chain. However, technological innovation has placed its business model under threat and promises to lower many traditional barriers to entry, making AT&T a digital loser.

Sources:

[1] http://www.fiercewireless.com/wireless/how-verizon-at-t-t-mobile-sprint-and-more-stacked-up-q2-2016-top-7-carriers

[2] https://www.att.com/shop/wireless/data-plans.html

[3] http://www.multichannel.com/news/technology/voice-over-wifi-set-surge/387580

[4] http://www.fiercewireless.com/wireless/moffettnathanson-cable-s-infrastructure-will-ultimately-win-wireless

[5] http://www.3gpp.org/hetnet

[6] http://www.senzafiliconsulting.com/Portals/0/docs/Reports/SenzaFili_SmallCellWiFiTCO.pdf

[7] http://www.rcrwireless.com/20150515/test-and-measurement/isart-2015-google-spectrum-sharing-3-5-ghz-tag6

[8] http://www.androidheadlines.com/2017/02/verizons-go90-service-referred-to-as-pretty-much-dead.html

[9] https://www.fastcompany.com/3056442/startup-report/why-the-internet-of-things-hasnt-gone-cellular-yet

Images:

[1] http://www.huffingtonpost.com/david-katz-md/cell-phones-health_b_4431622.html

[2] http://comstar-global.co.uk/telecom-services/network-design-and-build

[3] NEC, via http://blog.3G4G.co.uk

Hi, Will. This is a great post. I recently wrote a piece on Comcast, and in an interesting twist, Comcast is considerably worried about mobile carriers snatching customers away and diminishing the utility of its fiber network as mobile technology and consumer behavior evolve. Think about the evolution of mobile networks thus far (2G through LTE) and how use cases have changed (simple voice calls to email to watching HD videos). AT&T and Verizon have kept up with those changes remarkably well and have healthy profits to show for it, though I’m not sure how technologically challenging it was then relative to what they face now. Which of the changes you list above are substantially different from the changes the company made as it transitioned from fixed voice all the way through LTE?

Will – love the post. I do think the emergence of a strong fiber network as well as the continued improvements in mobile networks will eventually lead to a showdown, but i can’t help but think that we are a long way off. I feel like mobile consumers have gotten very comfortable with being able to confidently make a call almost anywhere. I find myself, if for any reason i can’t complete a call, becoming infuriated. I wonder just how good the fiber networks would have to get for me to make the choice of less coverage!

Well, AT&T wireless internet services are working fine and there are a large number of AT&T wireless subscribers which are increasing day by day. I am also subscriber of at&t internet plans