Caviar – Food delivery’s race to your doorstep

Caviar entered the competitive food delivery space in 2012 positioning itself as the “fancy food” delivery startup. At that time, the market was dominated by two large players, Seamless and Grubhub, with many new players looking to enter. Caviar’s platform architecture allowed it to succeed in difficult circumstances; however, as competition has increased, how should Caviar respond?

Caviar entered the competitive food delivery space in 2012 positioning itself as the “fancy food” delivery startup. At that time, the market was dominated by two large players, Seamless and Grubhub, with many new players looking to enter. Caviar’s platform architecture allowed it to succeed in difficult circumstances; however, as competition has increased significantly, how should Caviar respond?

Value Creation

Caviar’s platform architecture created value by focusing on a niche market that would drive a critical mass of users with only a few restaurants, allow for exclusivity to reduce multi-homing, and provide ancillary services for restaurants to reduce the barriers to entering the delivery business.

Caviar launched with a relatively limited, curated assortment of restaurants that had loyal customer bases among food enthusiasts. With only 30 restaurants, Caviar had a small selection compared to its competitors, offering around one vendor per cuisine. Despite this, Caviar’s value proposition of “hype” restaurants attracted a different customer base that were willing to pay a premium to get delivery from these crave-able restaurants, many of which had never been available before on delivery. In addition, by onboarding restaurants new to delivery onto its platform, Caviar was able to sign exclusivity with many of its partners (see Exhibit 1) to reduce the multi-homing and creating stronger network effects with its users.

Exhibit 1

Finally, Caviar managed the delivery personnel and later on offered restaurants additional services such as data analytics, integration with order management systems, and access to corporate clients. Through this positive cycle, Caviar amassed a large user base, which benefited restaurants by expanding their reach to customers and ultimately add an additional source of revenue through delivery sales. [1]

Finally, Caviar managed the delivery personnel and later on offered restaurants additional services such as data analytics, integration with order management systems, and access to corporate clients. Through this positive cycle, Caviar amassed a large user base, which benefited restaurants by expanding their reach to customers and ultimately add an additional source of revenue through delivery sales. [1]

Value Capture

Caviar’s original business model highly favored restaurants by limiting their downside and enticed delivery workers by passing on the costs to the consumers. It charged a $9.99 delivery fee on all orders, had inflated menu prices on some items and utilized an 18% gratuity for all orders. According to Eater, delivery workers were took the entire $9.99 fee plus a portion of the gratuity and Caviar earned money by keeping a percentage of the gratuity, service fee, and surcharge on food items. For restaurants, once they were able to integrate delivery into their operations, Caviar was a favorable option as they were allowed to opt out any time and could refuse to take orders if they were too busy. [2]

The Present

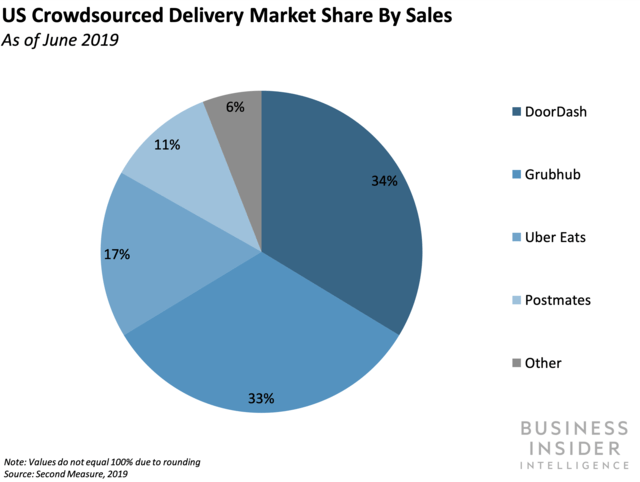

As the food delivery industry evolved, Caviar made some adaptations to protect its territory and remain relevant amongst its deep pocketed competitors. First, there has been major consolidation in the industry in a race to scale operations. Now, 94% of all food delivery is being made by 4 large players (see Exhibit 2).

Exhibit 2 [3]

Scaling operations has significant benefits in lowering operating costs, driving efficiency, and amassing a user base. Caviar was acquired by food delivery platform DoorDash in 2019, and probably would not have survived the “race to space” without securing well-funded partners with extensive operations capabilities along its way.

Caviar has also changed its business model to the commissions model that the rest of the industry employs. It charges up to 30% commissions to restaurants for delivery, and ~12% for pick-up orders. [4] This is likely in response to the rapid platform growth and restaurant penetration – it’s much harder to differentiate and thus the strength of the network effects has changed. While luxury restaurants first attracted consumers, now a large user base is the top priority and exclusive restaurants is helpful, but a secondary differentiator. Furthermore, updated its delivery fee to customers from $0.00-$9.99 reflecting its need to match the range of its competitors despite its premium quality. The industry suffers from customers’ ability to multi-home with little customer loyalty and many players fight for users by offering discounts.

Moving forward, Caviar and DoorDash need to find more defensible positions sustain them over time – user penetration in the US is ~15.9% and is expected to grow to 18.4% by 2024. [5] Ancillary services for restaurants and delivery personnel are now the norm, with some competitors like Uber Eats competing through their ability to network bridge across their complimentary ride-hailing app. One strategy that DoorDash is employing is with DashPass, a subscription service to DoorDash that eliminates delivery fees, and focuses on reducing multi-homing and building customer loyalty. Caviar could look to do something similar or look to create contracted partnerships with corporations to cater lunch to employees. While there has been some brand dilution, Caviar has been able to maintain its premium brand despite the acquisition and should look to protect this unique characteristic of the platform. Finally, Caviar could think beyond the scope of delivery and consider creating unique customer experiences (VR, AI, sustainability/packaging) to differentiate itself from competitors. Ultimately, Caviar and DoorDash’s sustainability does depend on capital and their ability to allocate resources towards the right projects and they continue to scale and maintain the platform.

References:

[1] https://www.trycaviar.com/

[2] https://ny.eater.com/2014/2/10/6282591/inside-caviar-a-new-premium-food-delivery-service

[3] https://www.businessinsider.com/doordash-buys-caviar-food-delivery-consolidation-2019-8

[4] https://getbento.com/blog/online-ordering-grubhub-doordash-postmates-ubereats-caviar-chownow/

[5] https://www.statista.com/outlook/376/109/platform-to-consumer-delivery/united-states

Great article! I am unsure about the sustainability of Caviar’s business model. It seems their limited restaurant options and lack of updated offerings maybe be a hinderance to keeping a user for the long-term. Also, as a multi homer of five different food delivery apps, as of today I believe UberEats provides the best UX and customer stickiness given that it links to my Uber account as well so I can use rewards on both platforms. DashPass may need to look at more innovative ways of keeping customers on their platform.

Thanks for the article! I’m a big Caviar user, as at least in Boston, it does still have exclusivity with a few restaurants I like. I have no idea they were acquired by Doordash (I’m also a user of Doordash), and I wonder why they haven’t tried to unify the experience given that it seems, based on the article, that Caviar is less worried about having exclusivity or “hip” restaurants. The competition in this market is really high and with the lack of differentiation of the market, I think the bigger pockets and best UX is going to win. Also, as Anuj said, the synergies between Uber drivers and UberEats delivery needs creates opportunities to reduce logistic costs that Caviar may not be able to match in the long-term.