Can a 69 billion$ acquisition save CVS against Amazon disruption?

CVS recently announced the acquisition of U.S. health insurer Aetna Inc for $69 billion, with the goal to introduce lower-cost medical services in pharmacies. Will the move stop CVS stock price decline as Amazon threatens to enter the pharmaceutical market?

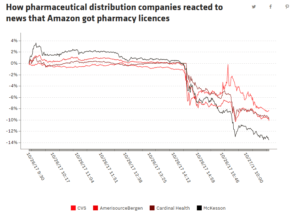

Rumors have been around for years about the possibility of Amazon entering and disrupting the drug prescription business. As Amazon announced at the end of October 2017 to have obtained wholesale pharmacy licenses in 12 states, stock prices plunged for a number of pharmaceutical companies, including CVS. [1]

Source: https://www.recode.net/2017/10/27/16559284/amazon-pharmaceutical-wholesale-stocks-plunging-amzn-cvs

As a response, CVS Health recently announced in December 2017 the acquisition of the U.S. health insurer Aetna Inc for $69 billion. [3]

CVS Health recorded over $180 billion in sales in 2017 and operates over 9,700 stores. It also provides pharmacy benefits manager (PBM) services to self-insured employers and health insurers. Aetna is a leading health insurer with over $60 billion in revenue in 2017 that provides medical, pharmacy, dental, and behavioral health insurance products to 35.7 million members. It also runs a PBM serving more than 14 million members. [4]

According to industry analysts and company reports, CVS plans to use its low-cost clinics to provide medical services to Aetna’s roughly 23 million medical members. Supporters of the mergers argue how a combined insurer and PBM will be better placed to negotiate lower drug prices, and the arrangement could boost sales for CVS’s front-of-store retail business.

The company expects to invest billions of dollars in the coming years to add clinics and services, with the clinics serving as an alternative to more expensive hospital emergency room visits. [5]

The company would have likely to divest investments from other planned activities, and as the stock price continue to decline, investors don’t seem to believe that this move will stop Amazon from disrupting the drug prescription and delivery business.

A recent announcement made the scenario of CVS survival to Amazon entry even more unlikely and put even more downward pressure on the stock price. Indeed, few days ago Jeff Bezos, Jamie Dimon and Warren Buffett – the three influential leaders of giants like Amazon, J.P. Morgan and Berkshire Hathaway – announced a partnership to reduce the costs of their employee health plans while improving customer satisfaction.

Amazon – and even more the partnership between with the two financial institutions – could provide significant pressure on prescription drug pricing, not to mention the impact that same day delivery and free shipping would have among distributors and pharmacies.

In an even more dramatic scenario according to Wells Fargo analyst David Maris in a note to clients [6], “with experience in video streaming, content creation, and the continued emergence and acceptance of telemedicine, Amazon may have eyes on an even larger prize – fully integrated digital healthcare. So maybe Amazon will first conquer the pharmacy, and then conquer the doctor visit.”

A recent nationwide survey from Wells Fargo shows that five in 10 U.S. adults would probably use Amazon Pharmacy and 40% of consumers would feel comfortable in sharing their health data with Amazon.

It is now a foregone conclusion that Amazon will enter the healthcare sector, and it’s just a matter of how. While Amazon announced that it will administer its own health plan internally as its own PBM to its employees – as well as J.P. Morgan and Berkshire Hathaway ones – it may consider in the near future to partner or acquire a small PBM to learn the business model and speed up the roll-out on a national scale. [8]

Will the Aetna $69 billion acquisition help CVS to mitigate Amazon entry in the market and reverse the downward trend in the stock price? It will maybe just help to slow down the decline of what seems to be the next victim of the Seattle tech giant.

Sources:

[1] https://www.recode.net/2017/10/27/16559284/amazon-pharmaceutical-wholesale-stocks-plunging-amzn-cvs

[4] https://www.fool.com/investing/2017/10/28/how-cvs-health-can-beat-amazoncom.aspx