Boxed: Boxing Out The Competition with Data Analytics

Since its launch 8 years ago, Boxed has sent out tens of millions of boxes of groceries, and has been valued at over $600M. Big Data played an integral part.

Founded in 2013, Boxed is a digital provider of wholesale products ranging from groceries and household staples to health supplies. Identifying as a technology-first company, Boxed curates unique customer experiences within the burgeoning CPG market; differentiating through a curated product selection for bulk shopping online that includes premium private label products. The main driver of the firm’s success is its brand building and their in-house development of a e-commerce technology stack.

Boxed creates value across three dimensions of their business model: 1) Product Selection, 2) Customer Experience, and 3) Logistics. This is evidenced by their value proposition. William Fong, co-founder and CTO describes it best: “We power two-day or less delivery with our omnichannel ecommerce platform, have a nationwide fulfilment network, and provide last-mile delivery to certain regions. We focus on consistency in our supply chain operations, trust among consumers, and a more personalized buying experience” (i).

Product Selection

The online wholesaler carries a limited assortment of items (in 2018 there were only 1600 unique SKUs) wherein customer purchasing data is utilized to achieve the right balance between everyday items and surprise and delight / discovery items (ii). Customer purchase data also helps Boxed to be an affiliate network for CPG companies and other advertising brands. This is portrayed in more untraditional approaches in addition to programmatic media and display marketing. As a way to reduce costs and benefit its vendors, Boxed began using air pillows for packing for vendor advertising space to introduce new products and encourage trialability for customers. This novel approach to advertising from a retailer led Boxed to establish a new revenue stream by charging a monthly fee to vendors to advertise and provide a free sample to customers. Billed “Box Takeover,” the program drove 10 – 20 cents of incremental revenue for an average order and allowed the company to recoup packaging costs (iii).

Even still – customers can only shop from an availability of items based on the fulfillment center located closest to where they live. Not only does this allow efficiencies in inventory management and holding costs but affords improved working capital (iv). Customers also obtain the benefit of geographically relevant product assortment.

Customer Experience

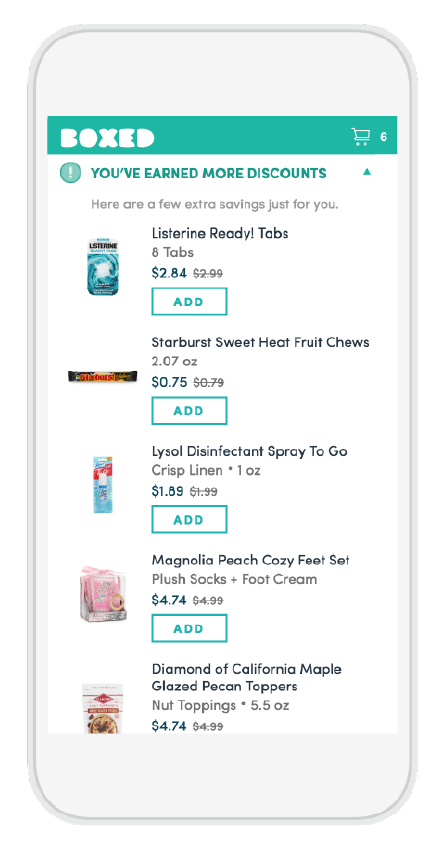

The Boxed shopping experience is contingent upon large ticket sizes. The company maintains over $100 for an average ticket and encourages this through learning about customer behaviors through machine learning, and designing the shopping experience to employ gamification – facilitating browsing versus a keyword search. For example, items are suggested to customers to add to their carts as impulse purchases that typically cost $2 or less, are only suggested when the system knew that there was enough space in a customer’s current box to maximize the packing process.

In light of the COVID-19 pandemic, Boxed saw increased traffic and demand on its platform as Americans scourged for toilet paper. With the large increase in concurrent users on the site, Boxed’s database was mercilessly hit with thousands of read/write operations by the second, specifically for operations like creating new user accounts, adding/removing items to cart, and checking out. These actions require writes to its database, and Boxed had to scale up the resources available to its database to handle this increase in operations per second leveraging Google Cloud (v).

Logistics

Boxed maintains four US fulfillment centers where orders are processed through the management of a backend logistics system. This system assigns each customer to a fulfillment center based on location, and once an order is placed, an algorithm minimized the number of boxes needed to ship the order to the customer (vi). Front-line workers at the fulfillment center pick and pack four boxes at a time, optimizing for a balance of speed and order accuracy.

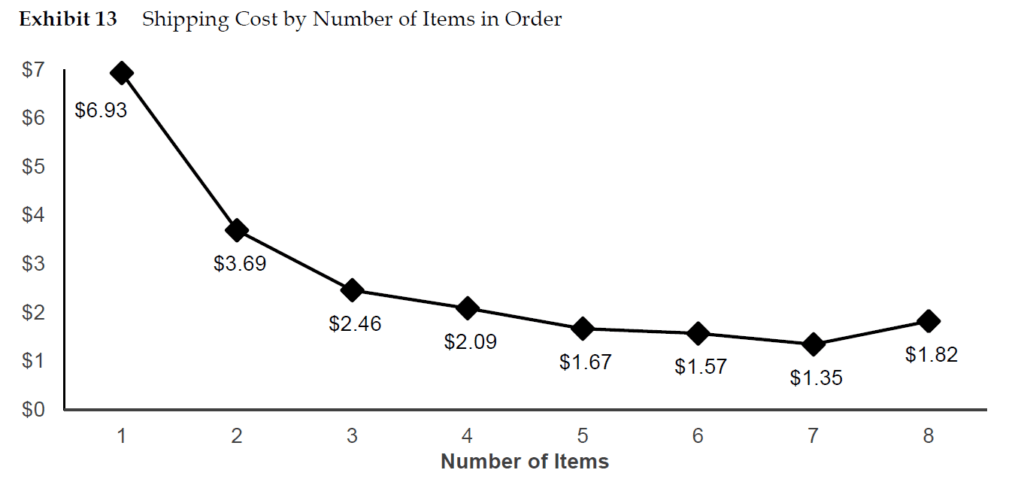

The average Boxed order required 1-2 shipment boxes, weight anywhere between 35 and 50 pounds, at $10 – $12 shipping cost. This only reinforces the need for this business to be focused on driving value given the context of wholesale being a low-margin business. Margins can only rise when more and more products are added to each box in order to spread the shipping cost across more items. Due to the dimensional weight of products outweighing the actual weight for large boxes, filling a box as much as possible allowed the most amount of items to be shipped at the lowest cost. In order to actualize this efficiency at scale, Boxed developed a proprietary algorithm to optimize the size and number of shipment boxes along with suggested impulse items to fill boxes that are not fully at capacity (vii).

Boxed’s investments in a technology stack and proprietary logistics algorithms create outsized value through its offering. Combining this with customer behavior and purchasing data allow for a best-in-class customer experience whereby shipments are quality assured and optimized to drive large volume tickets. Big data further allows Boxed to capture value from its vendors through enhanced product curation and otherwise through advertising spend. Going forward, Boxed will continue to face intense competition from Amazon, Walmart, and Costco wherein two of the three companies have made significant investments in digital. More specific to the retail market, maintaining their differentiation with a limited product assortment will be difficult to do. Boxed’s technology-first approach should be able to reconcile this if they can meet more of their customer needs with better recommendations and vendor partnerships separate from the last minute impulse purchase. The reality is, other offerings in the market offer virtually everything. Boxed will face a crisis in regard to determining the need to expand their product assortment.

Endnotes

(i) https://cloud.google.com/customers/boxed

(ii) Huang, Laura, et al. Boxed. Harvard Business Publishing, 16 Apr. 2019.

(iii)Huang, Laura, et al. Boxed. Harvard Business Publishing, 16 Apr. 2019.

(iv)Huang, Laura, et al. Boxed. Harvard Business Publishing, 16 Apr. 2019.

(v) https://cloud.google.com/customers/boxed

(vi) Huang, Laura, et al. Boxed. Harvard Business Publishing, 16 Apr. 2019.

Huang, Laura, et al. Boxed. Harvard Business Publishing, 16 Apr. 2019.

Great blog post John! I would like to try Boxed but I realized I can’t access the website without signing up (I wonder if that will hinder new customers). Based on the highly competitive retail and supermarket industries do you think that Boxed should continue to focus on competing and growing its business? Or do you think that Boxed should consider a strategy similar to Ocado (the British online supermarket) which has pivoted to licensing its technology to other other retailers? I personally think that with the vertical integration at Boxed they may be able to execute a similar strategy to Ocado’s by exclusively licensing their technology to retailers in non-competing geographic locations or segments. It will be interesting to monitor Boxed as big players such as Costco make more investments in digital capabilities.