Banking experience powered by humanized chatbot

The Royal Bank of Scotland Group plc is a banking and insurance company, based in Scotland. The group offers personal and private banking, insurance, and corporate finance. This blogpost is focused on RBS’s AI chatbot, Cora, focused on providing an exceptional banking experience.

If we look at the overall banking landscape, the chatbots are gradually inching in as banking organizations reducing various running costs and steadily meeting the need of the increasing populace of tech-savvy consumers. In many instances, chatbots were deployed to facilitate a much better two-way communication, between banks and customers without the use of channels like phone, email or text. For banks, the projection is that chatbots will be responsible for over $8 billion annual cost savings by 2022.

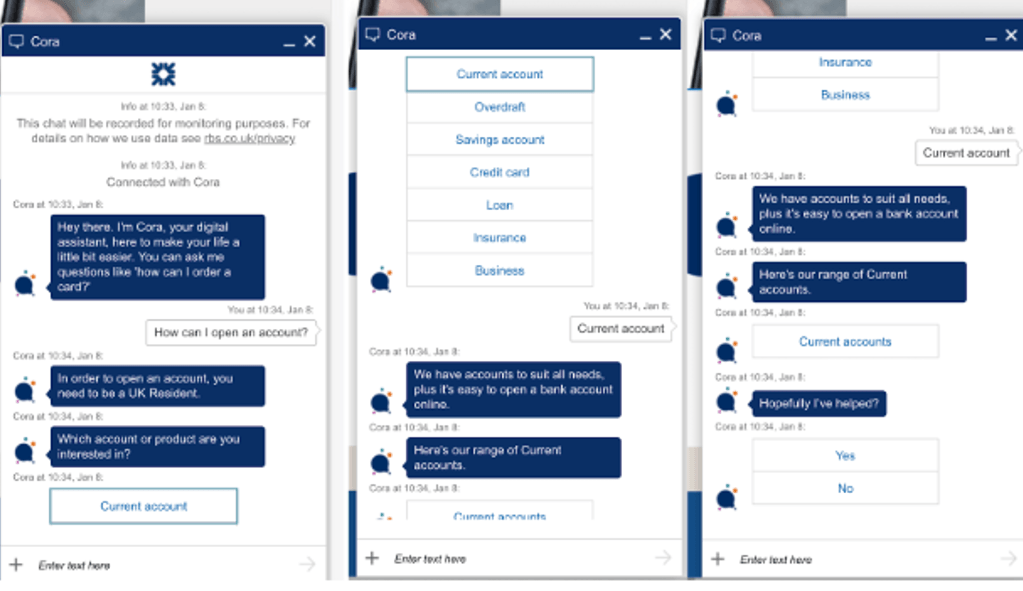

In January 2017, RBS’s team introduced automation into the program, creating the text-based bot Cora, built on IBM Watson. Customers can use Cora on the bank’s online help pages to get answers to 200 basic banking queries either verbally or through texts. Cora speaks to over 40K customers per day and is the front door to all conversations on mobile and secure online pages. It also handles more than 63K weekly messaging conversations, with an efficiency of 1.8 over voice, whilst maintaining a personal connection with every customer. She currently correctly retains and successfully answers on average 27% of conversations and hands-off those customers who need more specialized help than she is currently trained on.

But drawing upon advances in artificial intelligence, the next version of Cora has been built to include a life-like digital human that customers can have a two-way verbal conversation with on a computer screen, tablet or mobile phone. In this version, Cora is able to answer basic verbal questions like “How do I log in to online banking?”, “How do I apply for a mortgage?”. AI technology uses biologically inspired models of the neural networks that can detect human emotion and react verbally and through facial expressions. The technology relies on using audio and visual sensors, which are standard in modern computers and mobile phones. As humans, it is trained when dealing with the new idea and when she learns from its mistakes, making interactions more and more accurate going forward. The biggest constraint that the full roll-out of the second version of Cora is facing is the total available data. Currently, Cora is being trained on 1000 responses for 200 queries, however, this data is not enough for full roll-out. Currently, the innovation team is triaging customer non-trivial queries and assessing patterns to train Cora. The patterns are derived by doing psychoanalysis of the customer’s conversation and trying to understand the ultimate goal of the customer.

The chatbots also increase value for the live agents as their conversation with the customers is lengthy and more value-creating, rather than just answering mundane questions (which are now handled by Cora). In addition, the live agents also get a set of non-mundane questions from the chatbot to better prepare responses. Cora can also find great applications in increasing the financial literacy of customers. For eg., the chatbot can work with the customer as their personal assistance to help them plan budgets and push them towards more savings. Once fully equipped, Cora can find many ancillary applications for usage in the banking world.

Going forward

Artificial intelligence technology is going to shape the future of conversational banking – taking it to the next level where the queries will be answered instantly through real-time conversations, thus enhancing customer satisfaction and loyalty. The banking industry will have to integrate with the tech firms to a certain level of maturity with the chatbot deployment in the next few years. Still, many questions remain unanswered – ‘Can an immediate status update on a cross-border blockchain transaction be provided through Chatbots’ or ‘How can the unbanked vernacular speaking population of India be reached through banking chatbot technology’. The jury is out!

Source: