A Brex of Fresh Air in Corporate Credit Access

Brex is a corporate card company that uses bank information to make real-time data-driven decisions about the credit limits that it should set for start-ups and other small businesses. This helps minimize financial risk while increasing the revenue that the company receives as a card issuer.

Brex is one of the newest Fintech unicorns to emerge from Silicon Valley. For those who frequent SF or New York, you may have seen one of the many Brex billboards scattered around the city. But what exactly is Brex, and how is it applying data to corporate cards?

Brex is a young start-up that is two years old. In June, it closed a $100 million round at a valuation of $2.6 Billion. The company’s primary service is to offer corporate charge cards to other businesses. This has become a hot space in recent years, with companies like American Express, Divvy, Stripe, and Bento for Business all targeting business cards and services for small and medium-sized businesses that have been traditionally underserved.[1]

Using Real Time Data in the Underwriting Process

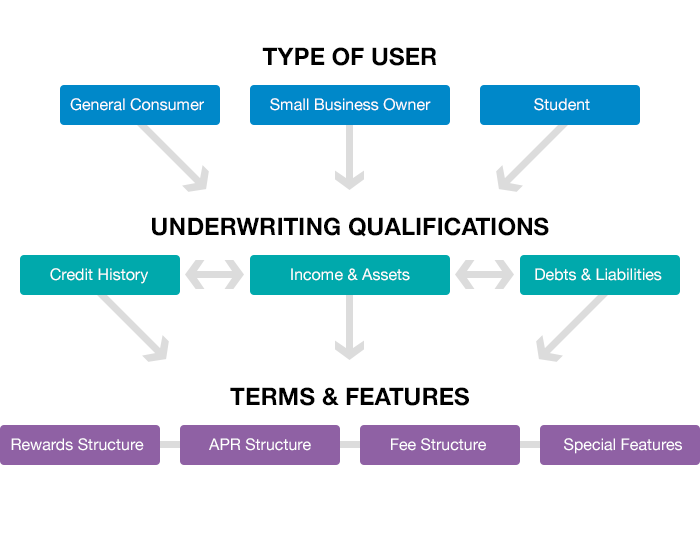

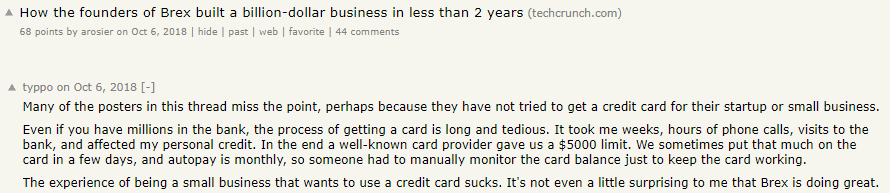

Brex has differentiated itself from its competitors by easing frictions for start-ups and other early stage firms to access credit. One of the keys strengths of Brex is their innovative underwriting. Underwriting is a process that a financial institution uses to predict the reliability of a borrower. This is important when making loans, insurance, or investments because the institution takes on a financial risk in the case that the borrower defaults. Traditionally, banks will look at the financial history of a company and the personal credit history of the owner in determining creditworthiness.For small businesses and start-ups, getting access to these corporate cards can be a challenge due to these constraints. With this backward-looking evaluation process, card issuers like American Express or Chase will tend to be more risk averse, providing less credit and offering corporate cards to only select companies. Furthermore, a common practice in the industry is to require a personal guarantee. That is, it requires an applicant to accept personal liability for a business debt – the creditor has the legal right to go after the founder’s personal assets. For founders or small-business owners, corporate cards may appear to be more risky than a debit card given that it might impact the owner’s credit score or lead to personal liability.

Yet there are benefits of a corporate card that start-ups would like to access. Debit card purchases have limited protection against theft or fraud. Furthermore, a corporate card can make it easier to manage money in the company, by monitoring accounts or setting spend limits. [1]

Brex uses real-time data to underwrite the borrower. It does not require a social security number, a personal guarantee, or access to the founder’s credit score. It does, however, require card holders to link their bank account, and Brex utilizes information about the bank account balance as a primary underwriting input. To do so, it partners with Finicity to integrate with thousands of banks across the United States and to ensure that this information is encrypted and that consumer data is not mis-used. By monitoring information about a start-up’s finances, Brex can dynamically adjust card credit limits to minimize their risk exposure. On the flip side, this also allows Brex to scale the credit limit with the growth of a company. For example, Scale.AI first started using Brex with only 4 people and a seed round and continues to use the card even as it has become a unicorn. [2][3]

This again contrasts with other card issuers, who rely on historical data to set credit limits. According to Brex, this allows them to set credit limits that are 10-20x higher than any competing card. [4]

Business Model and Risk Minimization

Brex primarily generates revenues from transaction fees (interchange fees with merchants). As such, setting higher credit limits and increasing the number of transactions made through their corporate cards helps to increase revenues.

However, doing so also substantially increases Brex’s risk. Without any personal guarantee, it can be extremely challenging for Brex to recover credit from an insolvent firm (which may be especially likely for start-ups). Brex has addressed this in at least two additional ways: first, they minimize risk up-front by having high requirements for card applicants (according to some, a firm needs to have at least $50,000 in the bank account that is linked with Brex). In addition, Brex is a charge card, which minimizes long-term debt. In this way, Brex does not need to be extremely forward-looking in setting the credit limits, and can adjust the credit limit if a cardholder is falling behind on payments. [5] Can Brex succeed in diversifying and offering other types of financial products that might be higher risk, and open up access to credit to smaller businesses?

Going forward, Brex faces challenges in that the data that drives its proprietary underwriting process is held by banks – which can directly compete with the company. It could be very easy for Amex or Chase to copy the Brex process, or to possibly even close access to transaction data. Other fintech companies like Stripe have also started to move in. How can Brex maintain a competitive advantage? Perhaps one stride is to directly own the data that is held in bank accounts, which Brex is now attempting to do with Brex Cash. [6]

References:

[2] https://www.nerdwallet.com/blog/credit-cards/brex-card/

[3] https://news.crunchbase.com/news/brex-launches-new-offering-to-compete-with-traditional-banks/

[4] https://medium.com/@karimcmahon/will-brex-disrupt-your-companies-corporate-cards-93e78eeae8e4

[6] https://brex.com/blog/what-is-a-charge-card-startup-corporate-card-explainer/

[7] https://techcrunch.com/2019/10/02/brex-cash/

Great post, I like the summary of the benefits of Brex. Personally, I tend to be skeptical of over-indexing on the use of data to determine credit limits because correlate until they don’t. With a regime change, perhaps in a overall market down cycle, the financial models used to dynamically adjust credit limits tend to break down. In extreme circumstance, correlations tend to coalesce. Nonetheless, I am all for startups having easier access to credit, especially in markets with inefficient credit markets outside of the US.

Helpful summary. We will see whether or not the Brex data driven approach results in lower default rates. As Keagan suggested it may be subject to the usual pitfalls of SV hype. Especially given its primary customer base being startups, it could be very susceptible to a market downturn.

Great article. Incremental to the comments above, I am also thinking about how the low interest rate environment has contributed to Brex’s openness to take on charge card risk. If we were to transition to higher rates, I am intrigued as to how many of Brex’s current customers would still be Profitable for the company to serve.