100Plus: A New Era of Remote Patient Monitoring

Remote patient monitoring platform 100Plus has experienced significant growth due to the coronavirus pandemic and recent Medicare reimbursement changes. To sustain its growth, it will need to consider the competitive landscape and continue improving the platform.

The Context: An Unmet Need

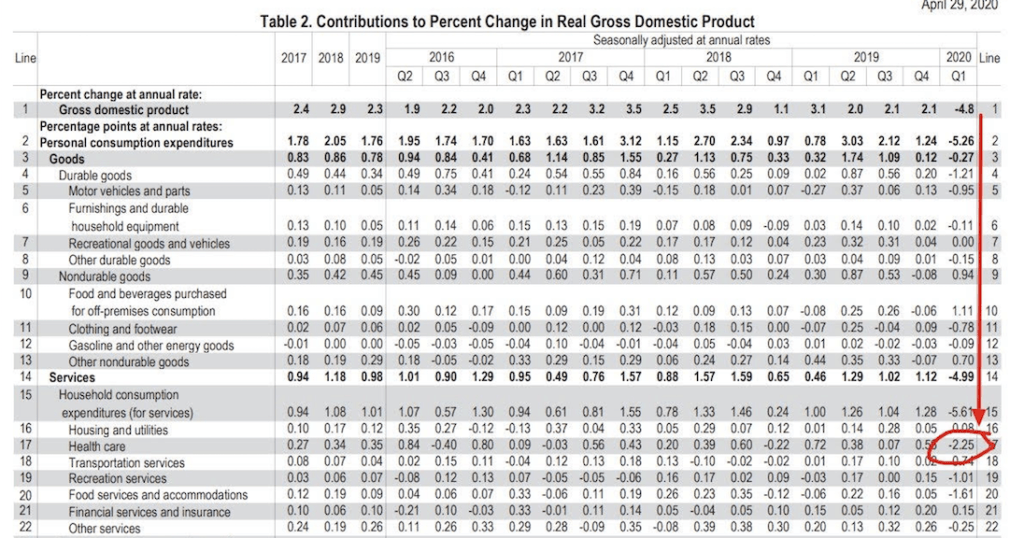

In the midst of the coronavirus pandemic, it might have been intuitive to predict that there would be an increase in health care spending. In reality, health care expenditure in the United States has dropped significantly in 2020 Q1, accounting for nearly half of the overall U.S. GDP decline. Health care spending in Q2 is likely to be even lower as the American Medical Association has recommended that all hospitals and clinics around the country cancel non-urgent appointments and elective surgeries. [1]

However, just because we are in the middle of a pandemic does not mean that other health problems have been adequately addressed. Many physicians around the country are shifting to telehealth visits in order to see their patients. For chronic care management, these visits are most effective when patient data can be collected to remotely monitor a patient’s health. This has created a significant need for devices and platforms that can help doctors manage patient data virtually. Digital health startup 100Plus has stepped in to fill this unmet need.

Value Creation: When Reimbursement Aligns with Health Care Needs

Approximately 80% of older adults in the United States live with at least one chronic disease, accounting for 75% of overall health care expenditure. [2] This segment of the population is also continuing to grow in size. Recognizing the need to incentivize chronic disease management and preventative care, Medicare began reimbursing for remote monitoring devices and services starting last year. [3] Collection of remote patient data by companies like 100Plus is reimbursed at a rate of $60 per patient per month while physicians are paid $70 per patient per month for spending at least 20 minutes looking over this data and documenting their review. These recent changes have created a potential $30B addressable market for companies like 100Plus to enter. [4]

Value Capture: Incentivizing Early Adoption

100Plus has proven to be the fastest growing remote patient monitoring platform for patients and physicians. [5] Since January of this year, the company has onboarded 1,000 physicians and 15,000 patients. It has also raised $15M in venture capital funding. [6] In order to gain early market share, 100Plus has taken on most of the financial risks of remote patient monitoring. Patients enrolled on the platform receive their medical devices in the mail fully configured and free of charge. The company has started with four device offerings: a blood pressure cuff, digital weight scale, blood glucose monitor, and emergency watch.

Source: 100Plus website

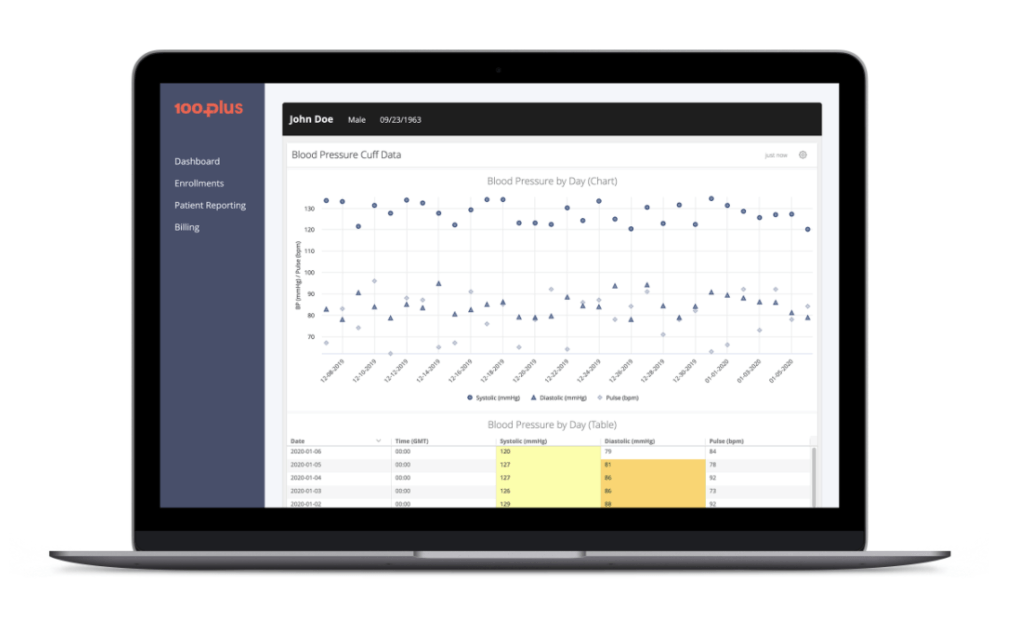

Physicians are paid $55 per patient per month to review their patient’s data on the platform, with 100Plus taking the other $15. For doctors who do not have the staff or bandwidth to review remote patient data monthly, they have the option to contract with a third-party company that uses 100Plus’ platform for a 70/30 revenue split. 100Plus also provides a physician portal that aggregates all patient data for easy tracking, along with automatic notifications when a patient’s data falls outside of a specified range.

Physician Portal (Source: 100Plus website)

Physician Portal (Source: 100Plus website)

Sustaining Growth Post-COVID

Much of the initial growth for 100Plus has come as a result of the coronavirus pandemic. Medical practices have seen a 35% decline in patient volume, and many have looked to alternative ways to take care of patients and generate revenue. [7] For a typical physician who registers 10% of a 400-patient panel onto 100Plus, the additional annual income would be $26,400. In order to continue growing post-COVID, 100Plus would need to demonstrate a more robust value proposition for patients, physicians, and the health care system. Most importantly, it will need to prove that patient outcomes are actually improved through remote monitoring, by allowing physicians to detect uncontrolled blood pressures, blood glucose, and weight earlier. In addition, it will need to quantify the health impacts of early detection and the value generated for the health care system.

In addition, as a new digital platform, 100Plus will need to consider the following competitive dynamics as more companies enter the space:

- Network effects: Cross-side network effects are strong while same-side network effects are weaker. When more patients are registered on the platform and use the digital devices, barrier to implementation becomes lower for physicians. Similarly, if many physicians are signed onto the platform, the number of patients will also increase. However, having many patients on the platform might not necessarily encourage more patients to sign up because patients derive little benefit from having other patients use the service. Because of weaker same-side network effects, 100Plus will need to continuously invest in patient and physician education to raise awareness for remote monitoring.

- Multi-homing: The business model of 100Plus decreases its vulnerability to multi-homing. Because it provides its own digital devices to patients, there is less incentive for patients to buy another device. However, if the quality of the devices or platform start to be superseded by other companies, multi-homing and eventual loss of users will become a bigger issue.

- Disintermediation: Risk of disintermediation is low because of the value-added service 100Plus provides in organizing patient panel data onto a provider portal for easier monitoring. Physicians will have low incentive to bypass the platform and reach out to patients directly for their data to earn an extra $15 per patient per month.

- Network Bridging: One potential way to maximize its early mover advantage would be for 100Plus to bridge with other virtual care platforms. If it is able to integrate with telehealth companies or the predominant electronic health records, it will allow for more convenient use and increased desirability.

- Clustering: Network clustering presents the biggest challenge for 100Plus to achieve scale. Medical care in the United States is very localized to local hospitals and clinics. Achieving high market penetration in one area of the country does not help 100Plus reach critical mass in a different area. Because of this, competitors will likely be able to focus outreach on specific regions to steal market share.

Conclusion

100Plus has experienced significant growth due to the coronavirus pandemic and recent changes to Medicare reimbursements. This growth is likely to continue because the remote patient monitoring industry will continue to grow. However, in order to capture a larger share of the value created, 100Plus needs to look into validating its value to patient outcomes and bridging with existing health care platforms.

References:

- https://www.ama-assn.org/delivering-care/public-health/helping-private-practices-navigate-non-essential-care-during-covid-19

- https://www.ncoa.org/news/resources-for-reporters/get-the-facts/healthy-aging-facts/

- https://www.cms.gov/newsroom/press-releases/cms-takes-action-modernize-medicare-home-health-0

- https://blog.definitivehc.com/remote-patient-monitoring-market-2019

- https://www.100plus.com/

- https://www.bizjournals.com/sanfrancisco/news/2020/04/27/health-tech-startup-says-wearables-for-the-elderly.html

- https://www.kareo.com/newsroom/press/kareo-survey-reveals-coronavirus-pandemic-impact-independent-medical-practices